Bitcoin's Price Consolidates Around $34,700

Bitcoin (BTC) has been trading within a narrow 4.5% range over the past two weeks, indicating a level of consolidation around the $34,700 mark. Despite the stagnant prices, the 24.2% gains since Oct. 7 instill confidence, driven by the impending effects of the 2024 halving and the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the United States.

Macro Data Supports Bearish Outlook

Bears expect further macroeconomic data supporting a global economic contraction as the U.S. Federal Reserve holds their interest rate above 5.25% in order to curb inflation. For instance, on Nov. 6, China exports shrank 6.4% from a year earlier in October. Furthermore, Germany reported October industrial production down 1.4% versus prior month on Nov. 7.

Flight to Quality Amidst Weakening Global Economic Activity

The weaker global economic activity has led to WTI oil prices dipping below $78 for the first time since late July, despite the potential for supply cuts from major oil producers. "Remarks" by U.S. Federal Reserve Bank of Minneapolis President Neel Kashkari on Nov. 6 has set a bearish tone, prompting a 'flight-to-quality' response.

Bullish Sentiment in Stock Market Contradicts Expectations

Curiously, the S&P 500 stock market index has reached 4,383 points, its highest level in nearly seven weeks, defying expectations during a global economic slowdown. This phenomenon can be attributed to the fact that the firms within the S&P 500 collectively hold $2.6 trillion in cash and equivalents, offering some protection as interest rates remain high. Despite increasing exposure to major tech companies, the stock market provides both scarcity and dividend yield, aligning with investor preferences during times of uncertainty.

Bitcoin Futures Open Interest Reaches Milestone

Meanwhile, Bitcoin's futures open interest has reached its highest level since April 2022, standing at $16.3 billion. This milestone gains even more significance as the Chicago Mercantile Exchange (CME) solidifies its position as the second-largest market for BTC derivatives.

Bullish Catalysts Drive Demand for Bitcoin Futures and Options

Recent use of Bitcoin futures and options have made media headlines. The demand for leverage is likely fueled by what investors believe are the two most bullish catalyst for 2024: the potential for a spot BTC ETF and the Bitcoin halving.

Market Health Indicators Point to Bullish Outlook

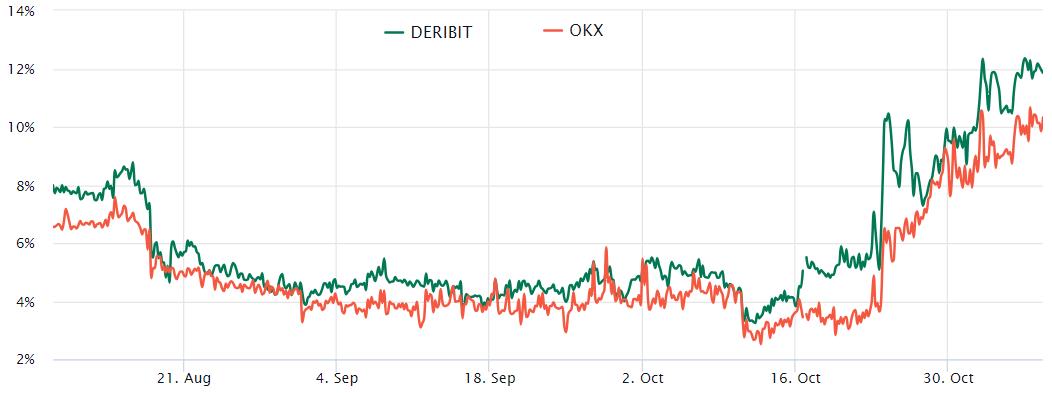

One way to gauge market health is by examining the Bitcoin futures premium, which measures the difference between two-month futures contracts and the current spot price. In a robust market, the annualized premium, also known as the basis rate, should typically fall within the 5% to 10% range. Notice how this indicator has reached its highest level in over a year, at 11%. This indicates a strong demand for Bitcoin futures primarily driven by leveraged long positions.

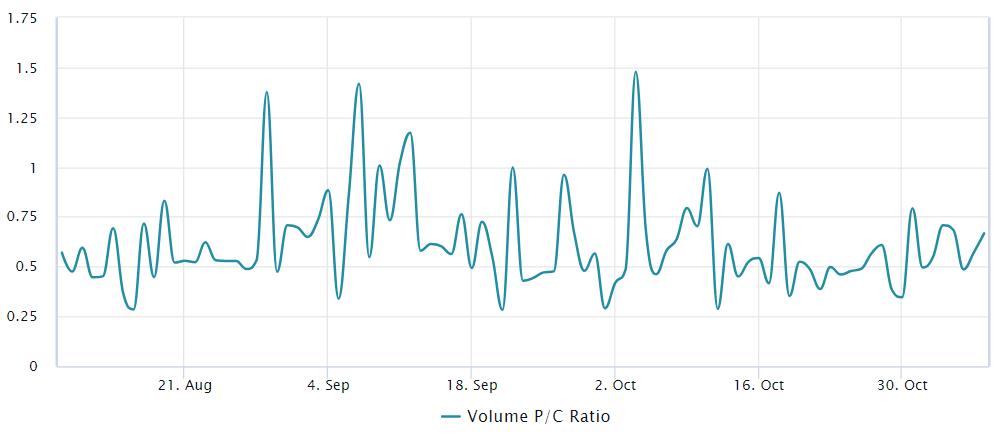

Another piece of evidence can be derived from the Bitcoin options markets, comparing the demand between call (buy) and put (sell) options. Over the past week, this indicator has averaged 0.60, reflecting a 40% bias favoring call (buy) options. Interestingly, Bitcoin options open interest has seen a 51% increase over the past 30 days, reaching $15.6 billion, and this growth has also been driven by bullish instruments.

Bullish Outlook Remains, Targeting $40,000 by Year-End

As Bitcoin's price reaches its highest level in 18 months, some degree of skepticism and hedging might be expected. However, the current conditions in the derivatives market reveal healthy growth with no signs of excessive optimism, aligning with the bullish outlook targeting $40,000 and higher prices by year-end.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoins-supply-held-by-longterm-holders-hits-alltime-high