Bitcoin Accumulation and Rise of Long-Term Holders

New data from Glassnode suggests that Bitcoin (BTC) is currently in an accumulation pattern, with its available supply reaching a new historical low. The report highlights that Bitcoin's illiquid supply and the rise of long-term holders are contributing to this trend.

Gobbling Up Supply

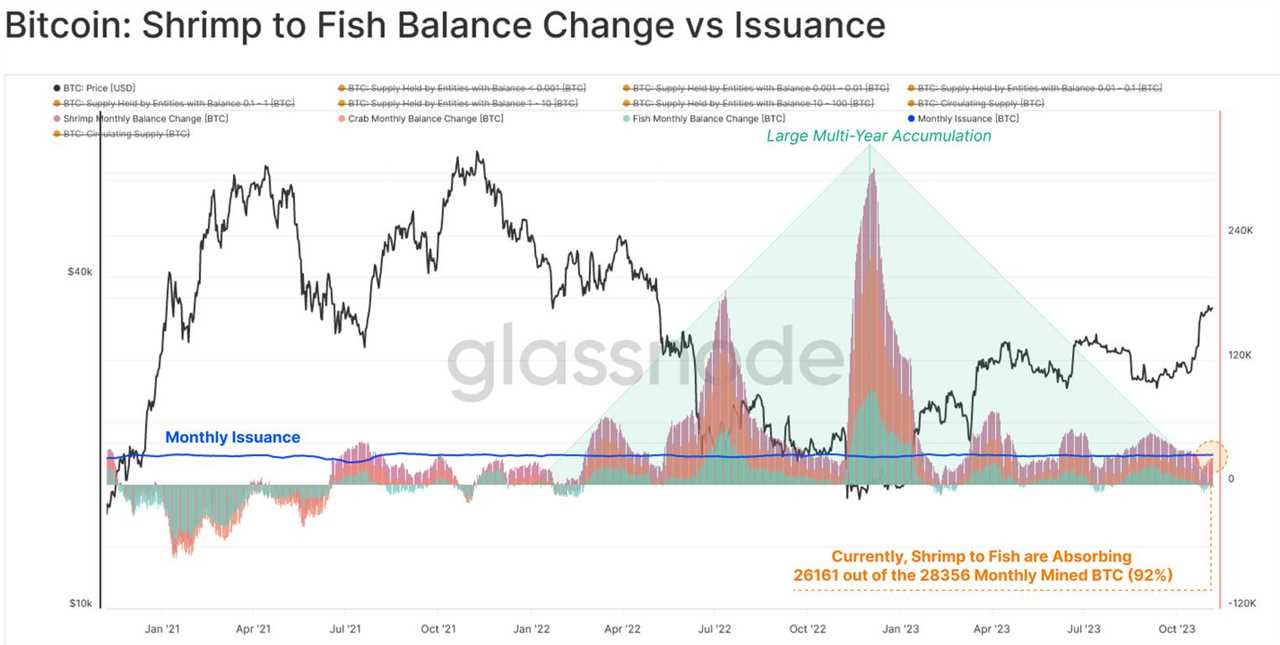

According to Glassnode analysis, a majority of investor cohorts are accumulating Bitcoin, with long-term holders leading the way. In fact, these long-term holders have reportedly been purchasing "92% of the newly mined supply."

Tightening Supply and Support

As smaller entities continue to accumulate Bitcoin, long-term holders have reached new highs compared to short-term holders. This has resulted in a tightening of the available BTC supply for purchase, which may be helping to support Bitcoin's price above $34,000 and provide strong support above $30,000.

Potential Price Breakout

Market strategist Joel Kruger from LMAX Group suggests that a breakout in Bitcoin's price to $40,000 could occur. He notes that Bitcoin's price has been relatively contained compared to other currencies and risk assets, and a break above $36,000 would likely trigger the next wave of bullish momentum.

Bullish Market Indicator

The increasing amount of illiquid coins with Bitcoin's finite supply is typically seen as a bullish market indicator. The illiquid Bitcoin supply continues to see monthly inflows, with a net increase of 71,000 BTC per month.

The growing confidence in Bitcoin, coupled with the tightening supply, is not limited to smaller entities. Various entity cohorts have been increasing their Bitcoin holdings throughout the year.

Please note that this article does not contain investment advice or recommendations. Readers should conduct their own research before making any investment or trading decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/ibm-launches-500m-fund-to-develop-generative-ai-for-enterprise