WASHINGTON — Shipping traffic in and out of Russia has remained relatively strong in the past few months as companies have raced to fulfill contracts for purchases of energy and other goods before the full force of global sanctions goes into effect.

With the European Union poised to introduce a ban on Russian oil in the coming months, that situation could change significantly. But so far, data show that while commerce with Russia has been reduced in many cases, it has yet to be crippled.

Volumes of crude and oil products shipped out of Russian ports, for example, climbed to 25 million metric tons in April, data from the shipping tracker Refinitiv showed, up from around 24 million metric tons in December, January, February and March, and mostly above the levels of the last two years.

Jim Mitchell, the head of oil research for the Americas at Refinitiv, said that Russia’s outgoing shipments in April had been buoyed by the global economic recovery from the pandemic, and that they did not yet reflect the impact of sanctions and other restrictions on Russia issued after its invasion of Ukraine on Feb. 24.

Crude oil typically trades 45 to 60 days ahead of delivery, he said, meaning that changes to behavior following the Russian invasion were still working their way through the system.

“The volume has been slow to decline, because these were contracts that have already been set,” Mr. Mitchell said. Defaulting on such contracts is “a nightmare for both sides,” he said, adding, “which means that even in the current environment nobody really wants to breach a contract.”

Russia has stopped publishing data on its imports and exports since Western governments united to announce their array of sanctions and other restrictions. Exports of oil or gas that leave Russia through pipelines can also be difficult for outside firms to verify.

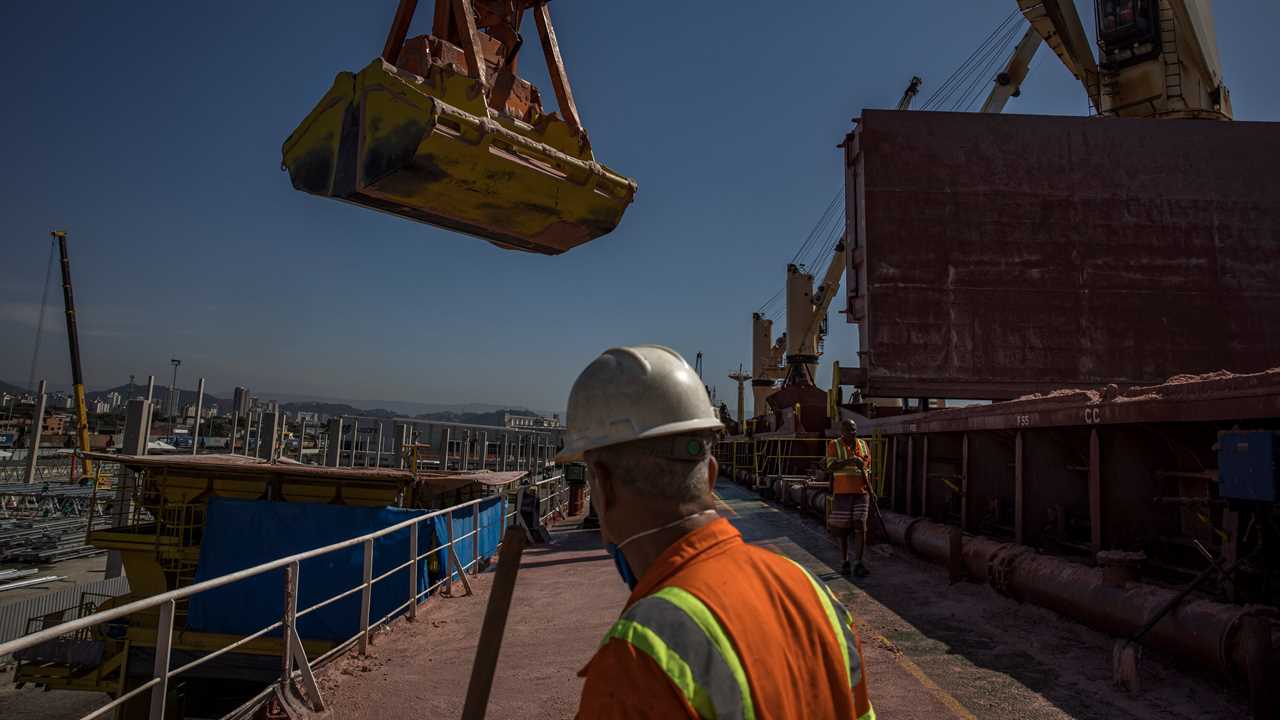

But the global activities of the massive vessels that call on Russian ports to pick up and deliver containers of consumer products or bulk-loads of grain and oil are easier to monitor. Ships are required to transmit their identity, position, course and other information through automatic tracking systems, which are monitored by a variety of firms like Refinitiv, MarineTraffic, Kpler and others.

These firms say that shipping traffic was relatively robust in March and April, despite the extraordinary tensions with Russia since its invasion of Ukraine. That reflects both how long some of the sanctions issued by the West are taking to come into effect and an enduring profit motive for trading with Russia, especially after prices for its energy products and commodities have cratered.

Data from MarineTraffic, for example, a platform that shows the live location of ships around the world using those on-ship tracking systems, indicates that traffic from Russia’s major ports declined after the invasion but did not plummet. The number of container ships, tankers and bulkers — the three main types of vessels that move energy and consumer products — arriving and leaving Russian ports was down about 23 percent in March and April compared with the year earlier.

“The reality is that the sanctions haven’t been so difficult to maneuver around,” said Georgios Hatzimanolis, who analyzes global shipping for MarineTraffic.

Tracking by Lloyd’s List Intelligence, a maritime information service, shows similar trends. The number of bulk carriers, which transport loose cargo like grain, coal and fertilizer, that sailed from Russian ports in the five weeks after the invasion was down only 6 percent from the five-week period before the invasion, according to the service.

In the weeks following the invasion, Russia’s trade with China and Japan was broadly stable, while the number of bulk carriers headed to South Korea, Egypt and Turkey actually increased, their data showed.

“There’s still a lot of traffic back and forth,” said Sebastian Villyn, the head of risk and compliance data at Lloyd’s List Intelligence. “We haven’t really seen a drop.”

Those figures contrast somewhat with statements from global leaders, who have emphasized the crippling nature of the sanctions. Treasury Secretary Janet L. Yellen said on Thursday that the Russian economy was “absolutely reeling,” pointing to estimates that it faces a contraction of 10 percent this year and double-digit inflation.

Earlier this week, Ms. Yellen said that the Treasury Department was continuing to deliberate about whether to extend an exemption in its sanctions that has allowed American financial institutions and investors to keep processing Russian bond payments. Speaking at a Senate hearing, she said that officials were actively working to determine the “consequences and spillovers” of allowing the license to expire on May 25, which would likely lead to Russia’s first default on its foreign debt in more than a century.

Global sanctions on Russia continue to expand in both their scope and their impact, especially as Europe, a major customer of Russian energy, moves to wean itself off the country’s oil and coal. Trade data suggest that shipments into Russia of high-value products like semiconductors and airplane parts — which are crucial for the military’s ability to wage war — have plummeted because of export controls issued by the United States and its allies.

But many sanctions have been targeted at certain strategic goods, or exempted energy products — which are Russia’s major exports — to avoid causing more pain to consumers at a time of rapid price increases, disrupted supply chains and a growing global food crisis.

So far, Western governments have levied an array of financial restrictions, including banning transactions with Russia’s central bank and sovereign wealth fund, freezing the assets of many Russian officials and oligarchs, and cutting off Russian banks from international transactions.

Canada and the United States have already banned imports of Russian energy, and also prohibited Russian ships from calling at their ports, but the countries are not among Russia’s largest energy customers.

The Russia-Ukraine War and the Global Economy

A far-reaching conflict. Russia’s invasion on Ukraine has had a ripple effect across the globe, adding to the stock market’s woes. The conflict has caused dizzying spikes in gas prices and product shortages, and is pushing Europe to reconsider its reliance on Russian energy sources.

The European Union, which is a key destination for Russian energy, plans to begin barring Russian coal later this year and is moving toward a ban on Russian oil by the end of the year, although opposition from Hungary has emerged as a recent stumbling block. Britain has also said it will phase out Russian oil imports by the end of the year.

This weekend, after a meeting of the Group of 7 countries, the Biden administration said it would place additional restrictions on the imports obtained by Russia’s industrial sector and impose sanctions on seven shipping companies, which together own or operate 69 vessels.

The private market has taken its own measures, with many companies, including in the energy sector, saying they would halt operations in Russia.

More changes could be imminent. Mr. Mitchell of Refinitiv said shipping traffic was likely to further decline in the coming months because of a reluctance from insurers in places like Switzerland and Bermuda to insure vessels that call on Russia. European governments are also discussing bans on shipping and insurance.

And last week, President Vladimir V. Putin of Russia signed a decree that would forbid the export of products and raw materials to designated people or entities, the list of which is still being drawn up.

Matt Smith, lead oil analyst for the Americas at Kpler, said Russian crude exports were in fact higher in April, according to their tracking, because sanctions weren’t yet in place to deter the buying of Russian crude.

“Russian crude exports are not dropping as people expected,” he said.

Flows of Russian crude oil into northwest Europe dropped off somewhat in April, but shipments to Italy and other European countries increased, driven by opportunistic purchases and redirected barrels, he said. And countries like India and Turkey that typically don’t import a lot of so-called Urals oil from Russia had “embarked on a spree of bargain hunting and snapped up those barrels at a steep discount,” he added.

“So for all intents and purposes, nothing has really changed,” Mr. Smith said.

Even if Russia’s export volumes drop, rising energy prices could help to offset those losses.

Speaking on Thursday, Ms. Yellen said that a European embargo on Russian energy could have adverse consequences on global energy markets while actually boosting revenues for Russia. Administration officials have had ongoing concerns that embargoes will push up the price of oil globally, allowing Russia to make more money from the places where it continues to sell it. She said that the United States and its allies were examining setting up a “special payments authority” where Russia could get paid for the cost of production on its oil exports while taxes would be redirected for reparations to Ukraine.

In the longer run, as British and European sanctions on Russian energy begin to take effect later this year, Russia is likely to shift its sales to markets outside Europe.

Daniel Yergin, a energy historian and author of “The Prize,” said China and India were increasingly on the receiving end for distressed Russian oil that could no longer find a home in Europe.

“Putin always said Russia’s future was in Asia — this will really accelerate that shift,” he said.

Keith Bradsher and Alan Rappeport contributed reporting.