Black researchers made up about 1.5 percent of the Federal Reserve system's 945-person staff of doctorate-level economists at the end of 2021, a number that highlights the central bank’s ongoing struggle to improve racial and ethnic diversity in its ranks.

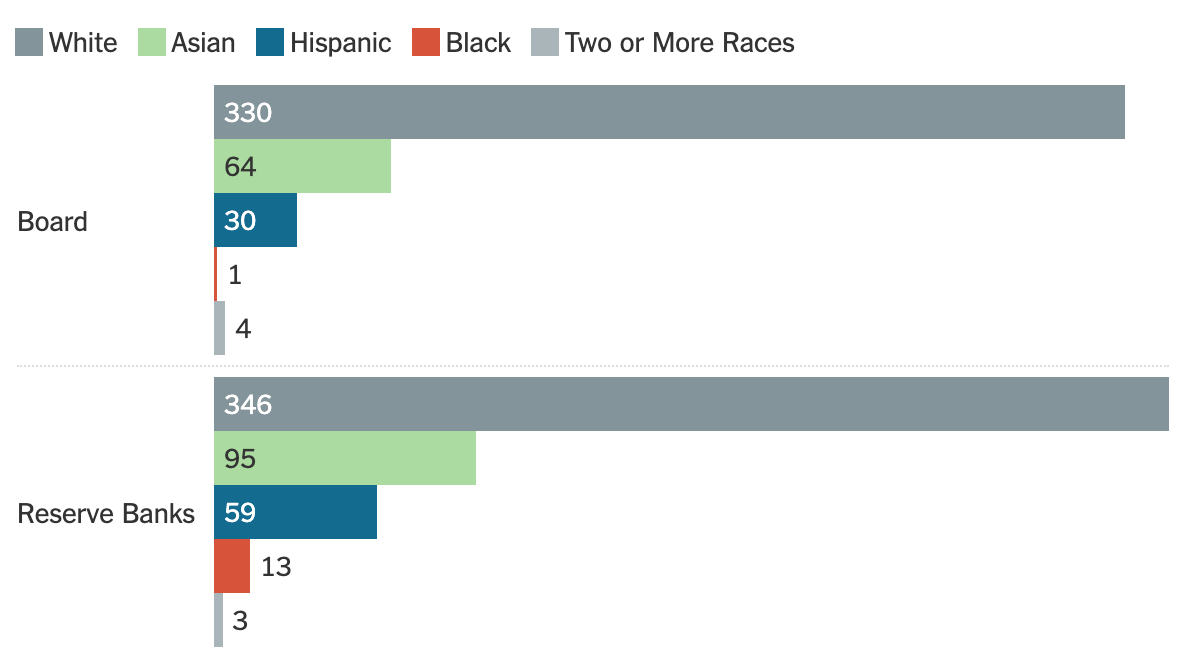

Data that the Fed on Thursday published publicly for the first time showed that 72 percent of the system's Ph.D.-level economists are white, 17 percent are Asian, and 9.4 percent identify as Hispanic or Latino. A small share report identifying with two or more races.

The new diversity figures follow reporting by The New York Times last year, in which data provided by the Fed showed that just 1.3 percent of economists across its system identified as Black alone around the end of 2020. The 2021 data are roughly, but not exactly comparable, because the central bank made methodological improvements in collecting the figures this year.

Economics is a heavily white and Asian profession — just under 5 percent of U.S. citizens or residents who earned doctorates in the field in the 2020 school year were Black — but the Fed tends to be even less racially diverse than the profession as a whole. The release underlined that America’s central bank is making slow progress when it comes to hiring and retaining a more racially varied staff of experts.

Across the Fed’s 12-bank system and Board of Governors in Washington, 14 Ph.D.-level economists identify as Black alone. The board employs 429 economists, but no Black women and just one Black man.

There appears to be some progress toward greater diversity at the entry level, however. When it comes to the Fed’s 393 research assistants, who usually have bachelor’s degrees and are often aiming to pursue doctoral degrees in economics down the road, the new data showed that 19 people, or about 5 percent of the assistants, were Black.

That is a slight improvement from 3.7 percent the prior year, and it roughly reflects the share of economics graduates who identify as Black.

The Fed’s more entry-level staff was also more diverse by gender: 42 percent of research assistants were women, compared to about 25 percent of its doctorate-level economists.

Lawmakers and think tanks have for years pushed the Fed to increase diversity within its ranks, arguing that having a set of economists and researchers at the central bank who more closely reflect the public — the people the Fed ultimately serves — would lead to a wider range of viewpoints around the policy table and more rounded economic discussions.

The Fed sets the nation’s monetary policy, raising or lowering the cost of borrowing money in order to slow down or speed up the economy. Its actions help to determine how strong the labor market is in any given moment, help to control inflation, and can influence financial stability.

“The risk with underrepresentation, from a substantive standpoint, is that you are underrepresenting perspectives that are important for policymaking,” said Skanda Amarnath, executive director at Employ America, which pushes the Fed to focus more intently on the job market.

That could mean that a range of ideas and experiences “don’t get fully understood, or captured, to the same degree,” he said.

The Fed is about to see greater racial diversity at its highest ranks: Lisa D. Cook and Philip N. Jefferson, who are both Black, were confirmed as Fed governors just this week. Susan M. Collins will become the first Black woman ever to lead a regional Fed bank when she becomes president of the Boston Fed this summer, and Raphael Bostic, the first Black man to ever lead a regional bank, is currently president of the Atlanta Fed.

The Fed’s leadership team has also become more gender diverse in recent years. Assuming Mr. Biden’s nominees are all confirmed, three of the central bank’s seven governors will be women. Once new presidents take office in Boston and Dallas this summer, five of its 12 regional bank leaders will be women.

Fed officials have in recent years talked publicly about aiming for a broader array of views within their own workplaces.

“The Atlanta Fed is committed to modeling economic inclusion, and that starts with our own organization,” Mr. Bostic from Atlanta said in a 2020 opinion piece, published after George Floyd, a Black man, died at the hands of the police in Minneapolis. “We embrace diversity and inclusion as essential to who we are.”