Lackluster Performance of Ethereum ETFs

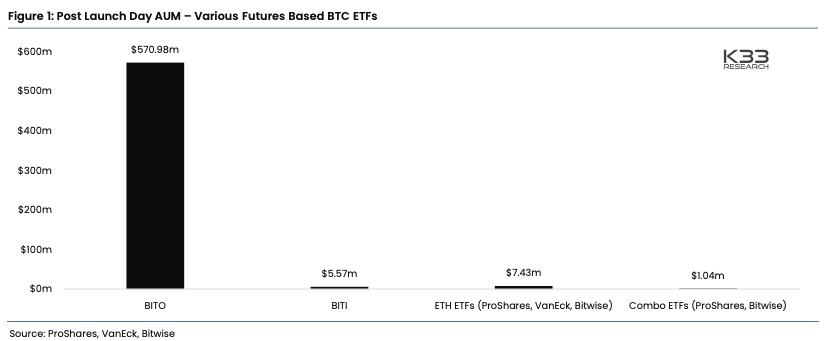

The underwhelming performance of nine new Ethereum futures exchange traded funds (ETFs) has led analysts at K33 Research to recommend a rotation back into Bitcoin (BTC). In a recent market report, analysts Anders Helseth and Vetle Lunde stated that it’s time to "pull the brakes on ETH and rotate back into BTC." The initial trading volume of Ether futures ETFs only accounted for 0.2% of what the ProShares Bitcoin Strategy ETF (BITO) amassed on its first day of trading in October 2021.

Ethereum ETFs Fall Short of Expectations

Although it was not expected for the initial trading volume of Ether futures ETFs to come close to that of Bitcoin futures ETFs, the first-day numbers fell "strongly" short of expectations. On the launch day, trading of ETH futures ETFs accounted for just 0.2% of what BTC futures ETFs accumulated throughout 2021.

Institutional Appetite for Ethereum ETFs Wanes

The lack of institutional appetite for Ether ETFs has caused a change in perspective. Previous advice to increase ETH allocation to capitalize on ETF hype has been walked back, acknowledging that the current market does not exhibit significant unsatiated demand for ETH.

A Sideways Crypto Market

The report suggests that the majority of the crypto market lacks meaningful short-term price catalysts and is likely to continue on a sideways trajectory. However, the landscape appears to be more favorable for Bitcoin, with a potential spot for ETF approval early next year and the upcoming halving event in mid-April.

Experts Remain Cautious

Ben Laidler, global markets strategist at eToro, shares a similar view but with a slightly more bearish sentiment. He highlights current macro trends, such as the influence of the Federal Reserve and oil prices, as potential triggers for a downward movement in the prices of major cryptocurrencies like Bitcoin. Laidler suggests that at this late stage of the rate hike cycle, the market needs further positive news to maintain momentum, but rising oil prices could have a cooling effect on sentiment.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/stellar-and-pwc-publish-framework-to-assess-blockchain-projects-in-emerging-markets