The Need for a Framework

The Stellar Development Foundation has teamed up with PricewaterhouseCoopers (PwC) to create a framework for evaluating the effectiveness of blockchain projects in emerging markets. In a white paper released on September 25th, Stellar and PwC highlight the importance of robust governance and responsible design principles in achieving financial inclusion.

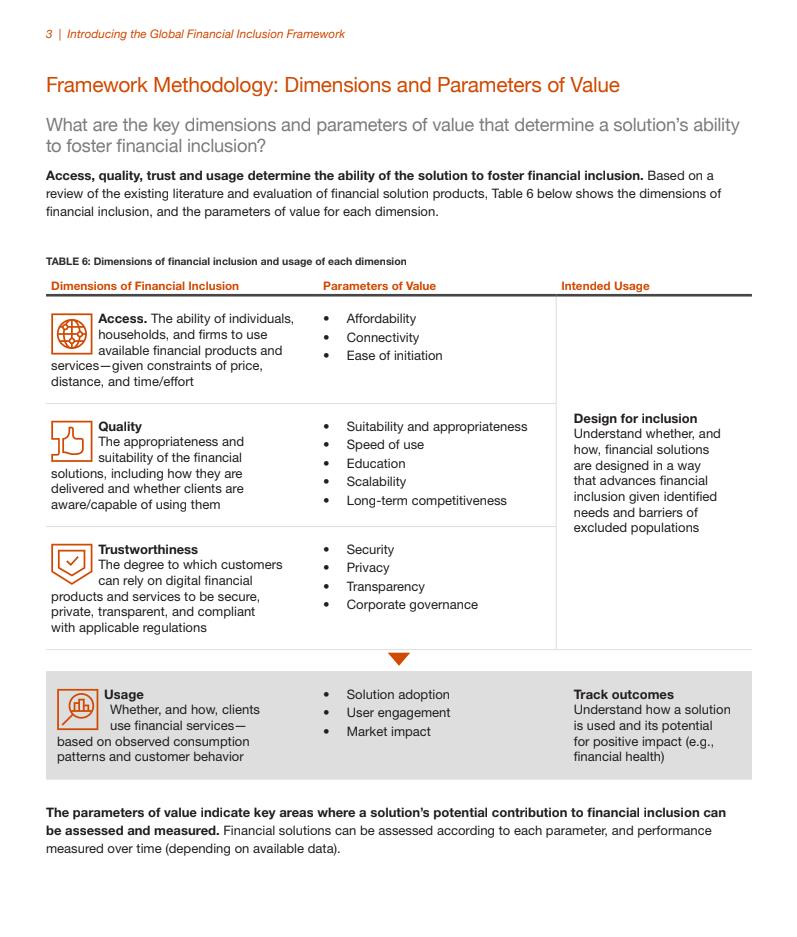

The Four Parameters

To promote financial inclusion, the framework proposes evaluating projects based on four parameters: access, quality, trust, and usage. Each parameter includes sub-parameters that provide a comprehensive evaluation of the project's impact. For example, the sub-parameters for "access" include affordability, connectivity, and ease of initiation. By breaking down these parameters, the framework enables projects to measure their effectiveness scientifically.

A Four-Phase Assessment Process

To address financial inclusion challenges, the framework suggests a four-phase assessment process. Projects are advised to identify a solution, target population, and relevant jurisdiction in the first phase. In the second phase, barriers preventing the target population from accessing financial services should be identified. The third phase involves pinpointing the major obstacles to user onboarding using level charts and guidance. Finally, in the fourth phase, solutions that prioritize key parameters should be implemented to maximize the use of funds.

Proven Solutions

Using this framework, Stellar and PwC identified two blockchain solutions that have successfully enhanced financial inclusion. The first is blockchain-based payments, which reduced fees to 1% or less compared to traditional financial apps charging an average of 2.7-3.5%. This increase in affordability has made electronic payments accessible to an otherwise underserved population. The second solution is a stablecoin application in Argentina that offers an inflation-resistant digital asset, allowing users to preserve their wealth.

Stellar's Efforts

Stellar has been at the forefront of promoting payment inclusion in underserved financial markets. The organization has collaborated with charity organizations to distribute funds to Ukrainian refugees and recently partnered with Moneygram to develop a non-custodial crypto wallet usable in over 180 countries. Despite these efforts, critics argue that cryptocurrency poses financial risks in emerging markets.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/hong-kong-stock-exchange-launches-innovative-settlement-platform-powered-by-smart-contracts