China's recognition of digital currencies on the rise

The recent acknowledgement of digital currencies as unique and non-replicable by a Shanghai Court suggests that Bitcoin's recognition in China is strengthening.

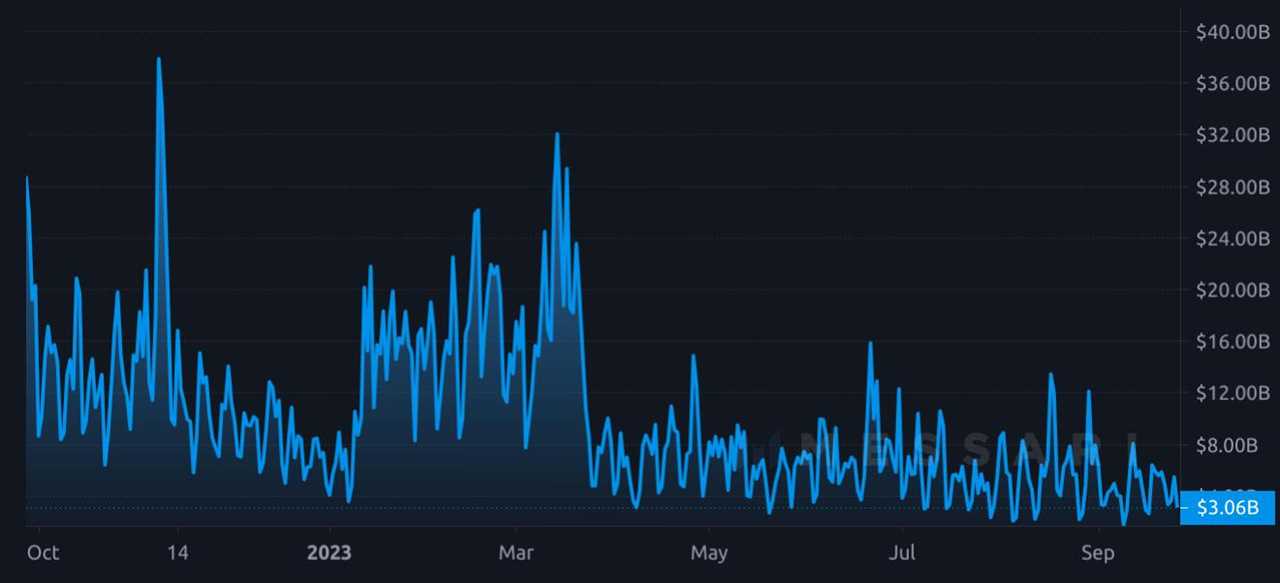

Declining spot exchange trading volumes raise concerns

Bitcoin's spot exchange trading volumes have hit a five-year low, potentially due to growing fears about the global economy.

Risk of unexpected volatility looms

While there has been an increase in long-term holders of Bitcoin, the reduced trading volume poses a risk in terms of unexpected price swings resulting from liquidations in derivative contracts.

Unease among traditional financial institutions

Traditional financial institutions are feeling apprehensive about handling cryptocurrency-related payments.

Dollar Strength Index at 10-month high

The Dollar Strength Index, which measures the dollar's strength against other currencies, reached its highest level in 10 months on Sep. 26. This could make Bitcoin holders feel uneasy, as historically, the index tends to rise when investors seek safety in cash positions.

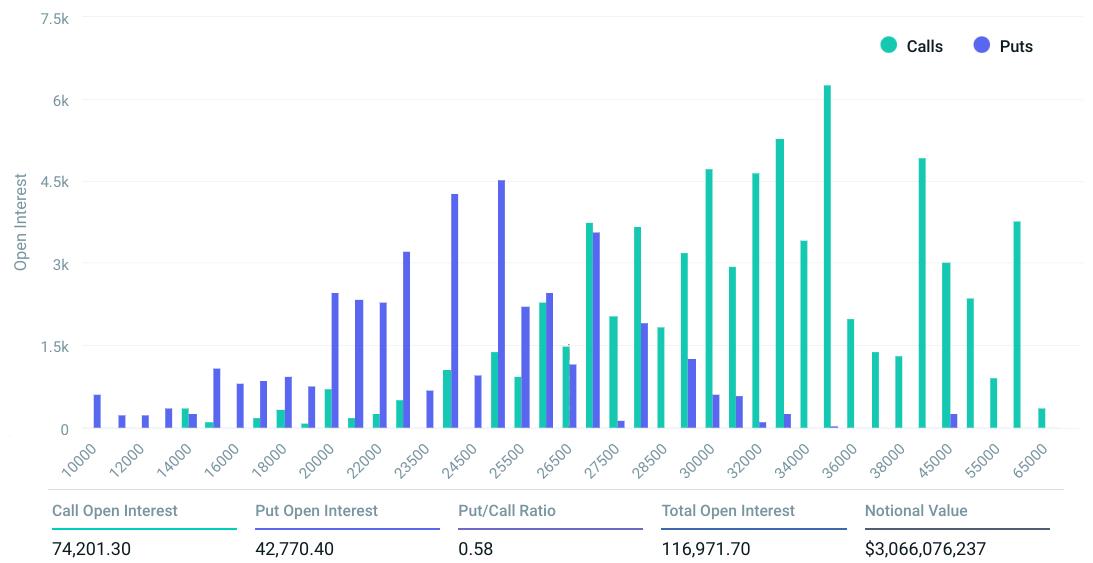

The $3 billion options expiration

The open interest for the Sep. 29 options expiration currently stands at $3 billion. However, bullish expectations of Bitcoin's price reaching $27,000 or higher may lower the final amount.

Imbalance between call and put options

There is an imbalance between the $1.9 billion in call (buy) open interest and the $1.1 billion in put (sell) options. If Bitcoin's price remains near $26,300, only $120 million worth of call options will be available.

Four likely scenarios

Based on the current price action, there are four most likely scenarios for the options expiration.

Potential breach of the $26,000 support level

Given Bitcoin's previous trading below the $26,000 support level, it wouldn't be surprising if it is breached again as the options expiration approaches.

Risk-averse investor sentiment

Investor sentiment is becoming increasingly risk-averse, as shown by the drop in the S&P 500 to its lowest level since June.

Please note that this article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of The Guardian.