Altcoins and DeFi tokens have been on a tear for the last two weeks and as the end of August approaches many projects are seeing their tokens reach for new all-time highs.

Data shows that a majority of the top-10 DeFi tokens gained more than 20% in the past 30-days, with projects like Bancor (BNT) and THORChain (RUNE) seeing gains in excess of 115%.

Here’s a look at some of the factors behind the current boost to DeFi tokens and the projects that are leading the way in terms of protocol upgrades and cross-chain interoperability.

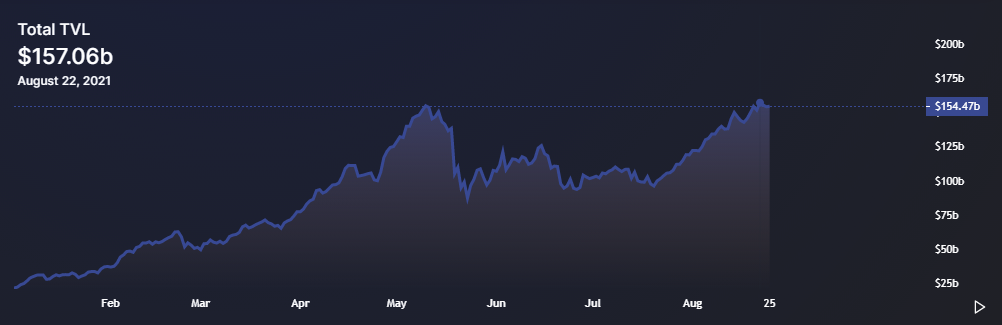

Total value locked reaches a new all-time high

Data from DeFi Llama shows that the total value locked (TVL) in all DeFi protocols reached a new all-time high at $157.06 billion on Aug. 22 and many analysts believe TVL is one of the best measures of sentiment within the DeFi ecosystem.

During the previous run-up, the TVL reaching an all-time high coincided with the surging prices of Bitcoin and Ether (ETH), which both reached their all-time highs around the same time.

This time around, Bitcoin and Ether are more than 24% below their all-time highs yet the total value locked in DeFi has surpassed its previous record.

This suggests that popular DeFi-related tokens with multi-faceted utility within the crypto and DeFi ecosystem have attracted investors' attention. Typically, Uniswap (UNI) and SushiSwap (SUSHI) lead among DeFi tokens but a few other strong gainers this week include a 22% increase for Convex Finance and a 17.84% increase from PancakeSwap.

Related: This time it’s different: When DeFi meets NFTs

New protocols attract attention

The past 3 months have also seen the arrival of popular new DeFi protocols like DinoSwap and the rise of Ethereum-network competitors like Avalanche (AVAX) that have brought fresh energy and funds to the DeFi ecosystem.

$500M In TVL!

— DinoSwap (@DinoSwapHQ) July 31, 2021

We are very grateful to the @0xPolygon community and all of our partners for helping us achieve this huge milestone so quickly. The @DinoSwapHQ team is working hard everyday to continue expanding and providing the best farming experience. Onwards! pic.twitter.com/4h4hrSPKN4

DinoSwap and Avalanche have benefited from users fleeing high fees on the Ethereum network because both off reduced transaction costs and faster processing times through their cross-chain bridges.

Avalanche launched its ‘Avalanche Rush’ DeFi incentive program on Aug. 18 which has brought a flurry of activity to the protocols involved, including Aave, Curve and SushiSwap. This liquidity mining event has proven quite popular and helped to lift its native AVAX token back above $50 for the first time since February.

In the first half of the year, DeFi tokens rallied early and were followed by a surge in the price of NFTs and NFT-related assets. As summer draws to a close and NFTs notch new eye-watering record sales and volumes each day, it's possible that a sector rotation could occur soon and the DeFi sector may be warming up for a run of its own.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: DeFi TVL hits a record $157B as Ethereum competitors attract investors

Sourced From: cointelegraph.com/news/defi-tvl-hits-a-record-157b-as-ethereum-competitors-attract-investors

Published Date: Wed, 25 Aug 2021 23:35:00 +0100