Coinbase Advanced Offers Access to Regulated Crypto Futures Contracts

Coinbase, the popular cryptocurrency exchange, has announced the launch of Coinbase Advanced, a platform that allows retail traders in the United States to access regulated crypto futures contracts. This comes four months after Coinbase Financial Markets (CFM) received approval to operate as a Futures Commission Merchant (FCM) entity.

Regulatory Approval from National Futures Association

On August 17, CFM secured regulatory approval from the National Futures Association (NFA) to operate as an FCM and offer crypto futures services to eligible U.S. traders. This approval was granted by the NFA, which is a self-regulatory organization designated by the Commodity Futures Trading Commission.

Trading Nano-Sized Futures Contracts

According to details shared by CFM, Coinbase Advanced customers in the U.S. can trade nano-sized futures contracts. These contracts are sized at 1/100th of 1 Bitcoin (BTC) and 1/10th of 1 Ether (ETH). The CEO of CFM, Andrew Sears, explained that these contracts have lower upfront capital requirements, making them an affordable investment option for a broader range of retail customers.

Access to Educational Content via Coinbase Learn

In addition to offering regulated crypto futures, Coinbase Advanced users will also have access to a library of educational content through Coinbase Learn. This feature aims to provide users with the resources they need to make informed trading decisions.

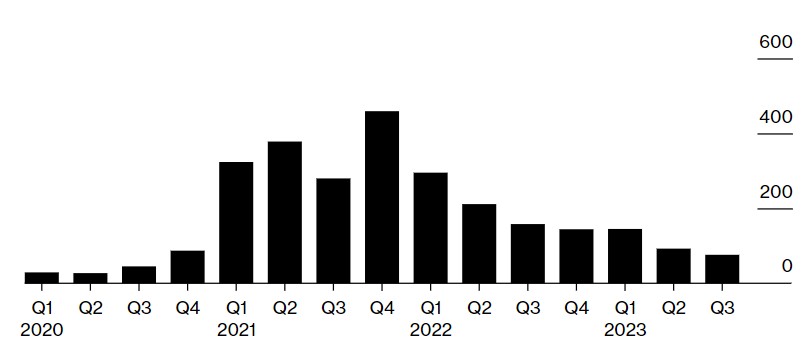

Spot Trading Volume Decline

Coinbase's decision to launch crypto futures services comes as the exchange experienced a decline in spot trading volume this year compared to the previous year. Data from digital asset provider CCData shows that Coinbase registered around $76 billion in spot trading volume for Q3 2023, which is a 52% drop compared to the same period in 2022.

Despite the decline in spot trading volume, Coinbase has gained market share in the last quarter as Binance, another popular crypto exchange, faced increased regulatory scrutiny.