CME Jumps to Second Place

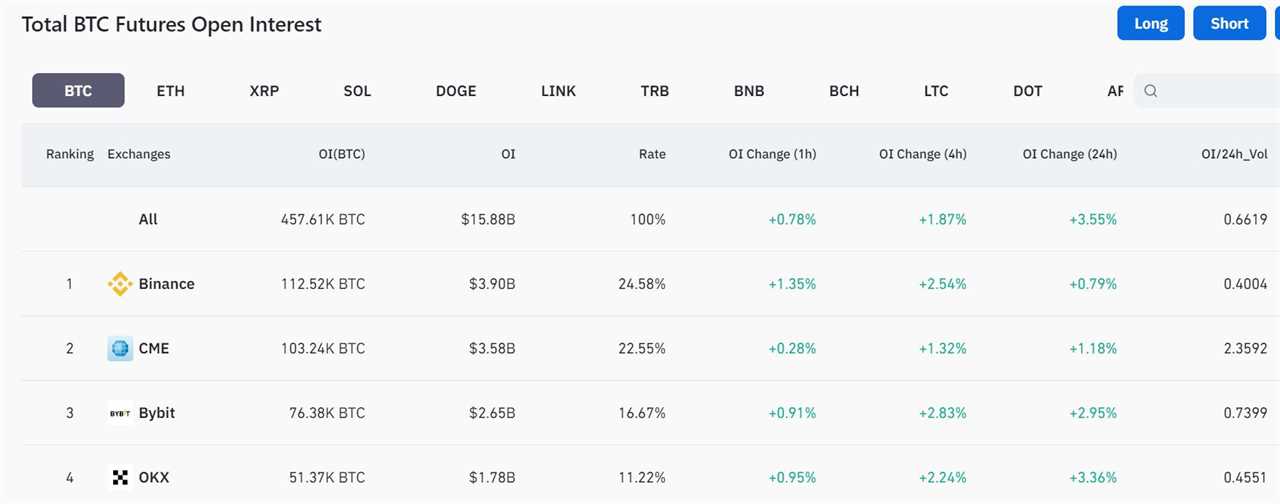

The Chicago Mercantile Exchange (CME), a regulated Bitcoin (BTC) Futures exchange, has surged in open interest (OI) rankings to become the second-largest BTC futures exchange, right behind Binance.

Impressive Open Interest Numbers

CME's OI reached $3.58 billion on October 30, propelling the exchange two positions higher in the rankings. With this surge, CME surpassed Bybit and OKX, who had $2.6 billion and $1.78 billion in OI, respectively. CME is now just a few million dollars away from Binance's OI of $3.9 billion.

Understanding Bitcoin Open Interest

Bitcoin open interest refers to the total number of outstanding Bitcoin futures or options contracts in the market. It is a measure of the amount of money invested in Bitcoin derivatives at any given time. Open interest reflects the capital flowing in and out of the market, with an increase indicating a bullish sentiment and a decline signaling a growing bearish sentiment.

CME's Success and Market Share Growth

CME's rising OI not only helped it climb to the second spot among futures crypto exchanges but also saw its cash-settled futures contracts exceed 100,000 BTC in volume. This surge in interest has propelled CME to capture 25% of the Bitcoin futures market share. The majority of investment into CME futures has come from institutional players, as Bitcoin experienced a significant double-digit surge in October, reaching a new one-year high above $35,000.