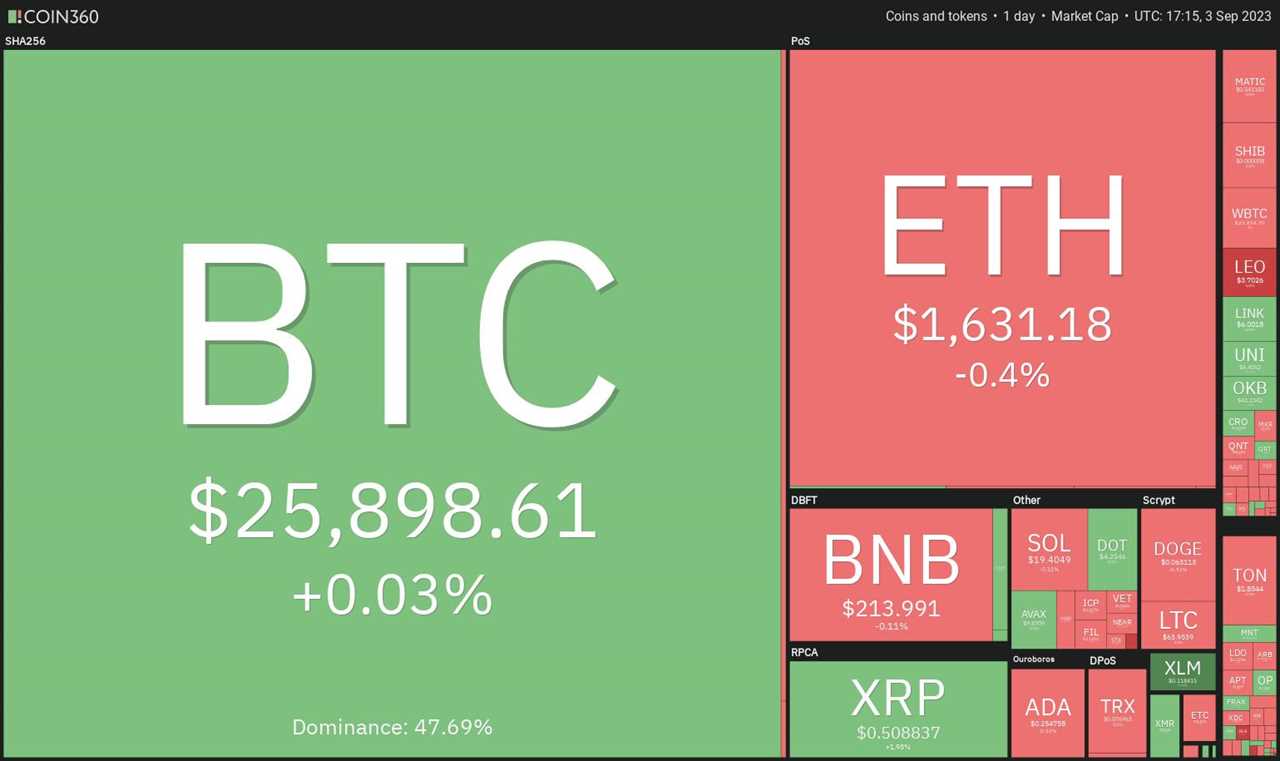

Bitcoin (BTC) has once again retreated back inside its established trading range after failing to break out last week. Currently trading near the $26,000 level, the price action of the past few days has left traders uncertain about the next move.

SEC Approval Provides Hope for Bulls

Despite the uncertainty, there is optimism that the United States Securities and Exchange Commission (SEC) will eventually approve a spot Bitcoin exchange-traded fund (ETF), which could limit the downside for Bitcoin. Former commission chair Jay Clayton even expressed confidence in a recent interview, stating that approval is "inevitable."

However, in the short term, there is no clear catalyst that could push Bitcoin out of its range and as a result, major altcoins are under pressure.

Top 5 Cryptocurrencies to Watch

While most altcoins have struggled, there are a few showing signs of strength. Let's take a closer look at the charts of the top five cryptocurrencies that may start a rally if they break above their resistance levels.

Bitcoin Price Analysis

Bitcoin is currently back within the $24,800 to $26,833 range. Although the downsloping moving averages suggest bearish sentiment, the recovering relative strength index (RSI) indicates that bearish momentum may be weakening. A break above the range at $26,833 would be the first sign of strength and could lead to a retest of the August 29 high of $28,142.

On the downside, bears would need to sustain the price below $24,800 to seize control. However, the bulls are expected to defend this level fiercely. If the bears are successful, the price could potentially plummet to $20,000.

The immediate support at $25,300 is currently holding firm against bearish pressure. Buyers will aim to drive the price above the 20-exponential moving average to signal a stronger recovery. Although the 50-day simple moving average may act as a roadblock, it is likely to be overcome, potentially leading to a rally towards the overhead resistance at $26,833.

Sellers May Have Other Plans

Despite the hopes of bulls, sellers may have different intentions for Bitcoin's future. It remains to be seen how the market will evolve in the coming weeks.