Bitcoin support at risk as price remains uncertain

The price of Bitcoin (BTC) hovered around $26,000 at the opening of Wall Street on September 24th, as a significant drop in the weekly close had lasting effects. Data from Cointelegraph Markets Pro and TradingView indicated that the trajectory of BTC price became uncertain after briefly breaking through the $26,000 support level. The weekend's sideways trading took a turn for the worse at the beginning of the week, and the inability for bulls to regain lost ground led to a bleak outlook.

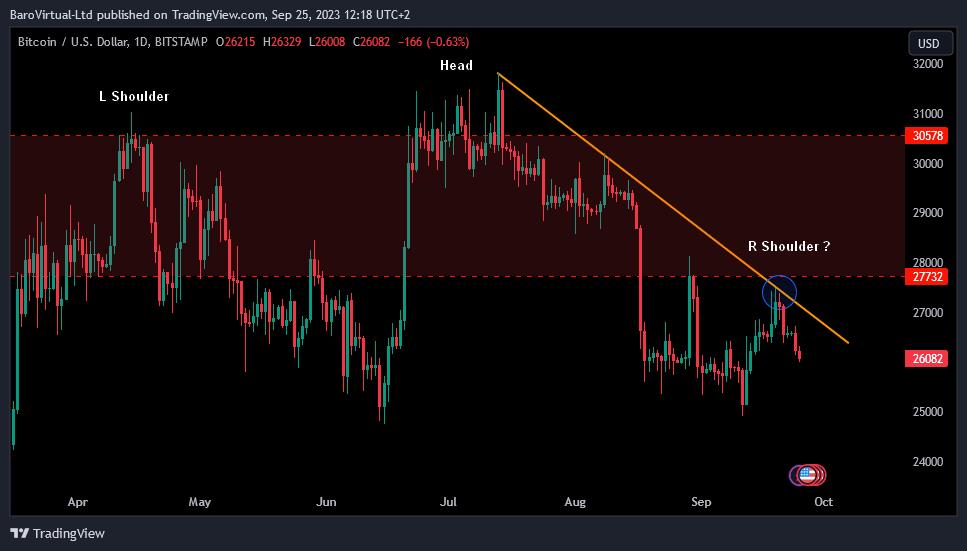

Analyst warns of potential decline in Bitcoin price

Analyst BaroVirtual, an ambassador for on-chain data platform Whalemap, explained that Bitcoin failed to break through local resistance in the form of a descending trend line, and there are concerns that a bearish trend may develop. BaroVirtual shared a daily chart snapshot showing a potential head and shoulders formation, which could lead to Bitcoin falling to the $22,000-$20,000 range. This perspective aligns with others who also anticipate a return to the $20,000 level, which hasn't been seen in BTC price charts for the past six months.

The importance of holding current levels as support

Trader and analyst Rekt Capital, who previously predicted the reoccurrence of the low $20,000s as part of a breakdown from a double top structure, emphasizes the significance of maintaining current levels as support. In fresh analysis, Rekt Capital suggests that Bitcoin could drop to the $25,000-$26,000 range, but cautions that if $26,000 becomes a resistance level, it could lead to further decline in the $22,000-$24,000 region.

Bitcoin faces headwind from surging US dollar

The macro markets experienced another potential challenge for Bitcoin and the crypto industry, as the US dollar continued to strengthen.

The US dollar index (DXY) reached 106.1, its highest point since November 2022. The DXY has risen 6.5% since hitting 15-month lows in July, indicating a strength that has historically impacted the performance of risk assets and the crypto market.

Expert warns of negative impact on Bitcoin and risk assets

Matthew Dixon, CEO of crypto rating platform Evai, commented on the situation, saying, "DXY rocketing higher - to the detriment of BTC Crypto and other risk assets." Dixon had previously anticipated a potential cooling off in the strength of the US dollar, which would have given Bitcoin and altcoins some relief in their price movements.

Note: This article does not provide investment advice or recommendations. It is essential for readers to conduct their own research before making any investment or trading decisions.