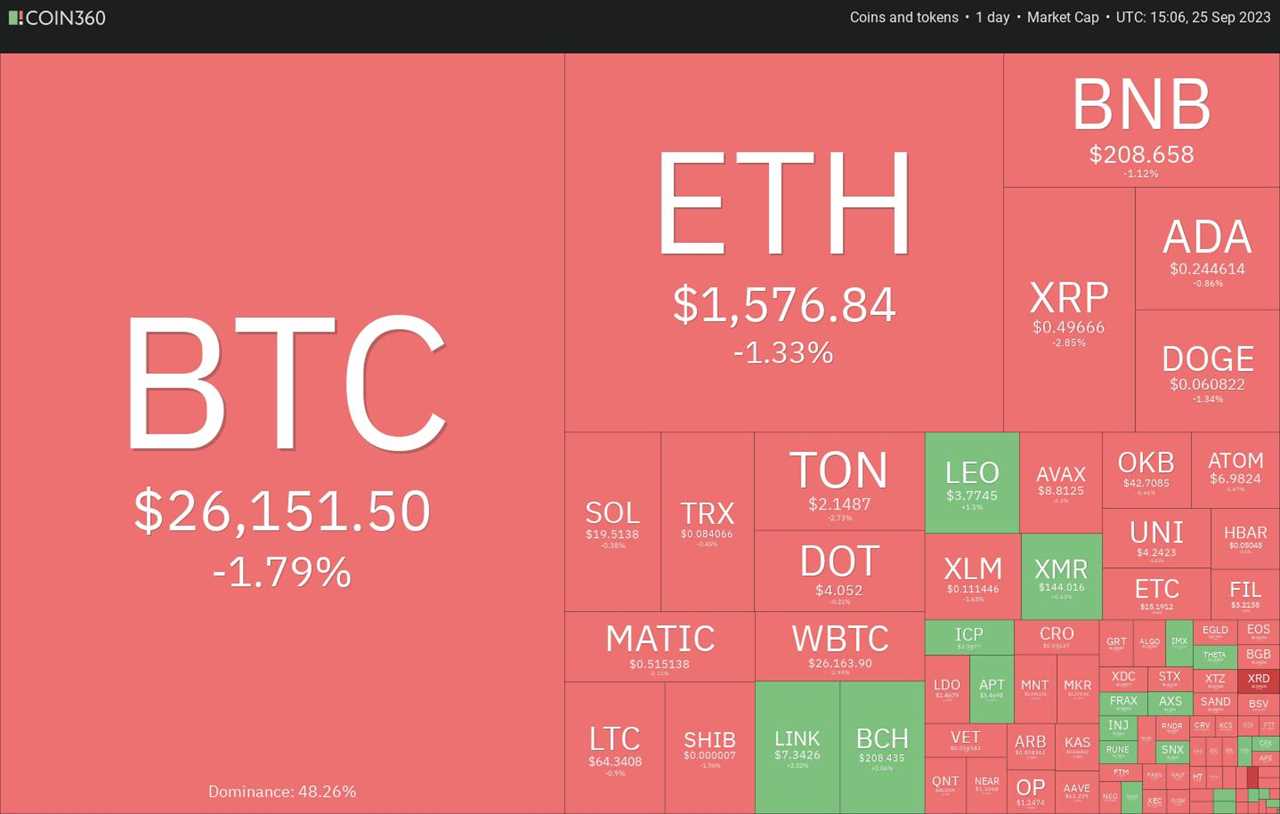

Bitcoin's recent weakness on September 24th indicates that the bears are still in control of the market. Sellers are attempting to bring the price below $26,000, but the bulls are expected to defend this level with determination. Buyers are aiming for a positive monthly close for Bitcoin in September, which has not happened since 2016.

October Could Favor Buyers, Boosting Sentiment

If buyers succeed in achieving a positive monthly close for September, it could serve as a significant sentiment booster. Historically, October has been favorable for buyers, with Bitcoin experiencing a negative monthly close only twice in 2014 and 2018.

Macroeconomic Headwinds Pose a Risk

However, Bitcoin bulls may struggle to maintain momentum if macroeconomic challenges persist. One potential risk to cryptocurrency recovery is the strength of the US dollar, which has seen its longest winning streak since 2014. The US dollar index has also formed a golden cross, indicating the potential for further upside in the near future.

Can Bitcoin Bulls Hold Off Bear Pressure?

The last week of September will be crucial in determining whether the US dollar extends its gains or witnesses a short-term correction. It will also be a test for Bitcoin bulls, who will need to defend against bear pressure. Let's analyze the charts to understand the current market conditions.

S&P 500 Index Facing Bearish Head and Shoulders Pattern

The S&P 500 Index has turned downwards and is approaching a crucial support level at 4,325. If the index remains below this level, it will complete a bearish head and shoulders pattern, with a target of 4,043. However, if bulls can push the price above the 20-day exponential moving average, they may have a chance to retest the local high at 4,607.

US Dollar Index Shows Positive Sentiment, Hits Key Resistance Level

The US dollar index has bounced off the 20-day exponential moving average, indicating positive sentiment. The key level to watch is 106. If the price turns down from this resistance but bounces off the 20-day EMA, it could signal a rally above 106, with the next resistance level at 108.

Bitcoin Continues to Face Bear Pressure

Bitcoin's recent candlestick pattern suggests that bears hold control, with sellers aiming to push the price down to the key support level at $24,800. Bulls will need to prevent a breakdown below this level to avoid a potential downward move to $20,000. To start a meaningful recovery, bulls must push and sustain the price above the moving averages and overcome resistance at $28,143.

Ether Slipping Toward Key Support Level

Ether has been gradually slipping towards the pivotal level at $1,531, indicating a lack of buying support. While downsloping moving averages favor sellers, the RSI shows signs of a bullish divergence, suggesting a reduction in selling pressure. Bulls will need to push the price above the 20-day EMA to signal range-bound action between $1,531 and $1,746, but a sustained break below $1,531 could result in a drop to $1,368.

BNB Swinging in Range, Buyers Defending Key Support

BNB has been trading within a range between $220 and $203. Although moving averages favor bears, the RSI indicates a possible bullish divergence. Buyers are likely to defend the $203 level, and if the price rises or bounces off this level, the range-bound action may continue. However, sellers will need to push the price below $203 to take charge, potentially leading to a drop to $183.

XRP Bears Gain Upper Hand, Support Level in Focus

XRP price has fallen below the 20-day EMA, indicating that bears have gained the upper hand. The cryptocurrency could find support at the uptrend line, and a rebound could lead to an attempt to push above the 20-day EMA. A sustained break above this level may result in a climb to the 50-day SMA. However, a failure to hold the uptrend line could lead to a drop to $0.46 and potentially $0.41.

Cardano Bears Maintain Pressure, Bulls Face Critical Support

Cardano has dropped to a critical support level at $0.24, indicating continued bearish pressure. However, a bullish divergence forming in the RSI offers a minor advantage to bulls. To reduce the risk of a breakdown below $0.24, bulls must quickly push the price above the downtrend line, potentially boosting the price to $0.29. On the other hand, a drop below $0.24 could trigger a bearish move to $0.22 and potentially the pattern target of $0.19.

Dogecoin Trapped in Range, Breakout Direction Uncertain

Dogecoin has been trading in a tight range between $0.06 and the 20-day EMA. The direction of a potential breakout is uncertain, with the range potentially expanding volatility. If the price turns up from the current level, bulls may attempt to clear the overhead hurdle at the 20-day EMA. However, a break below $0.06 could indicate bearish control and a potential drop to $0.055.

Toncoin Bulls Booking Profits, Support at EMA

Toncoin turned down from overhead resistance at $2.59, suggesting bulls are booking profits. The first support level is at the 20-day EMA, and a rebound from this level could suggest positive sentiment and buying on dips. Bulls will then attempt to push the price to $2.59. However, a drop below the 20-day EMA could indicate weakening bullish momentum and potentially lead to a drop to $2 and the 50-day SMA.

Solana Battles Between Bulls and Bears

Solana has been hovering around the 20-day EMA, indicating a tough battle between bulls and bears. The lack of significant movement in the 20-day EMA and the RSI below the midpoint suggests a balance between supply and demand. Bulls must push the price above the 50-day SMA to signal a recovery, while bears may target the important support at $17.33. A break below this level could lead to a collapse to $14.

Please note that this article does not provide investment advice or recommendations, and readers should conduct their own research before making trading decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/tourists-can-now-precharge-digital-yuan-wallets-with-international-cards-in-china