SLRV Ratio Mirrors Previous Bitcoin Crash

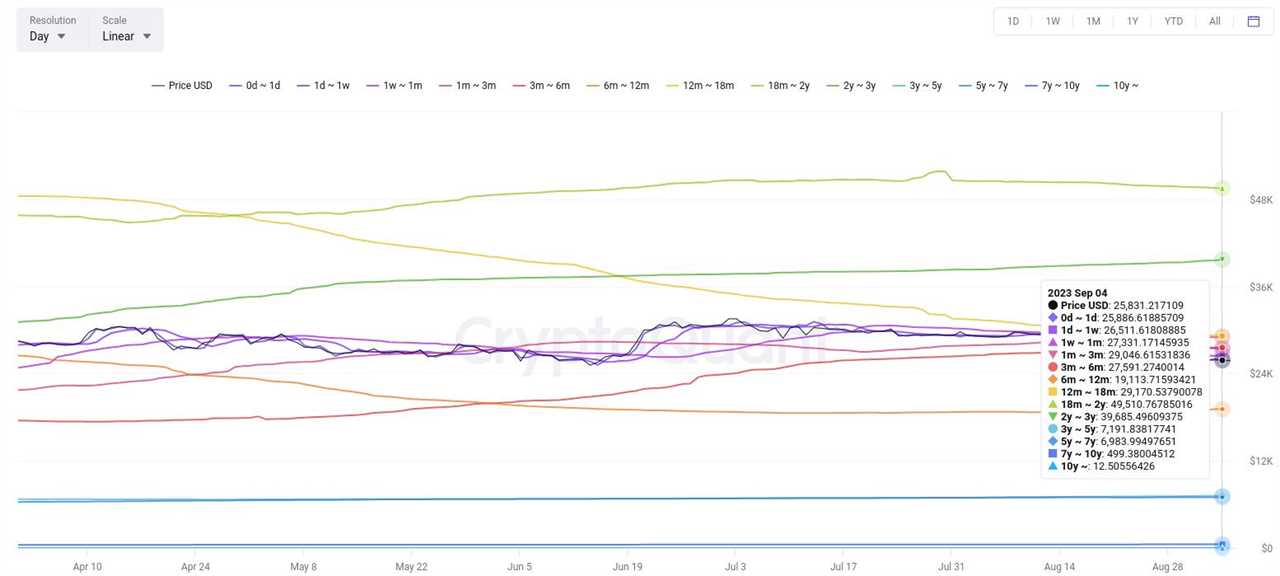

Bitcoin's price could have experienced a significant drop last week, as an on-chain metric, the Short to Long-Term Realized Value (SLRV) Ratio, replicated a move that preceded the FTX crash. The SLRV Ratio "flipped" for the first time since November 2022, suggesting a potential decline in BTC value.

Bitcoin On-chain Velocity Raises Market Concerns

Market observers are on alert for a possible drop in Bitcoin's price to $23,000, following a spike in the sales of older bitcoins in mid-August. The SLRV Ratio, developed by renowned analyst David Puell and ARK Invest, measures Bitcoin's on-chain velocity using the HODL Waves metric. Notably, the metric's crossovers between the 30-day and 150-day moving averages have coincided with significant BTC price events.

Speculators Sell BTC at a Loss

Analysts have closely observed the behavior of short-term Bitcoin holders, known as speculators, compared to long-term hodlers. Traditionally, the short-term holder cost basis has acted as market support. However, recent data shows that speculators have been selling en masse at a loss since late August. This trend suggests a change in market dynamics.

Please note that this article does not provide investment advice. It is important for readers to conduct their own research and assessment before making any investment or trading decisions. Every investment involves risk.