The price of Bitcoin (BTC) is showing signs of a newfound rally as it breaks the $40,000 resistance area. There is a combination of optimistic on-chain data points and a favorable market structure that is leading analysts and traders to anticipate an impending Bitcoin breakout to a new all-time high.

In the short term, the $38,000 and $40,000 levels remain the biggest hurdles for Bitcoin. The longer BTC took to break out of $40,000, the higher the probability of a potential correction was imminent. Thus, it’s critical for Bitcoin to surpass the $40,000 level and stay above it in the foreseeable future. Bitcoin has already spent nearly three weeks under $38,000, causing its short-term price cycle to stagnate and lose momentum. On Feb. 6, Bitcoin finally broke out of the $38,000 level, establishing it as a support level.

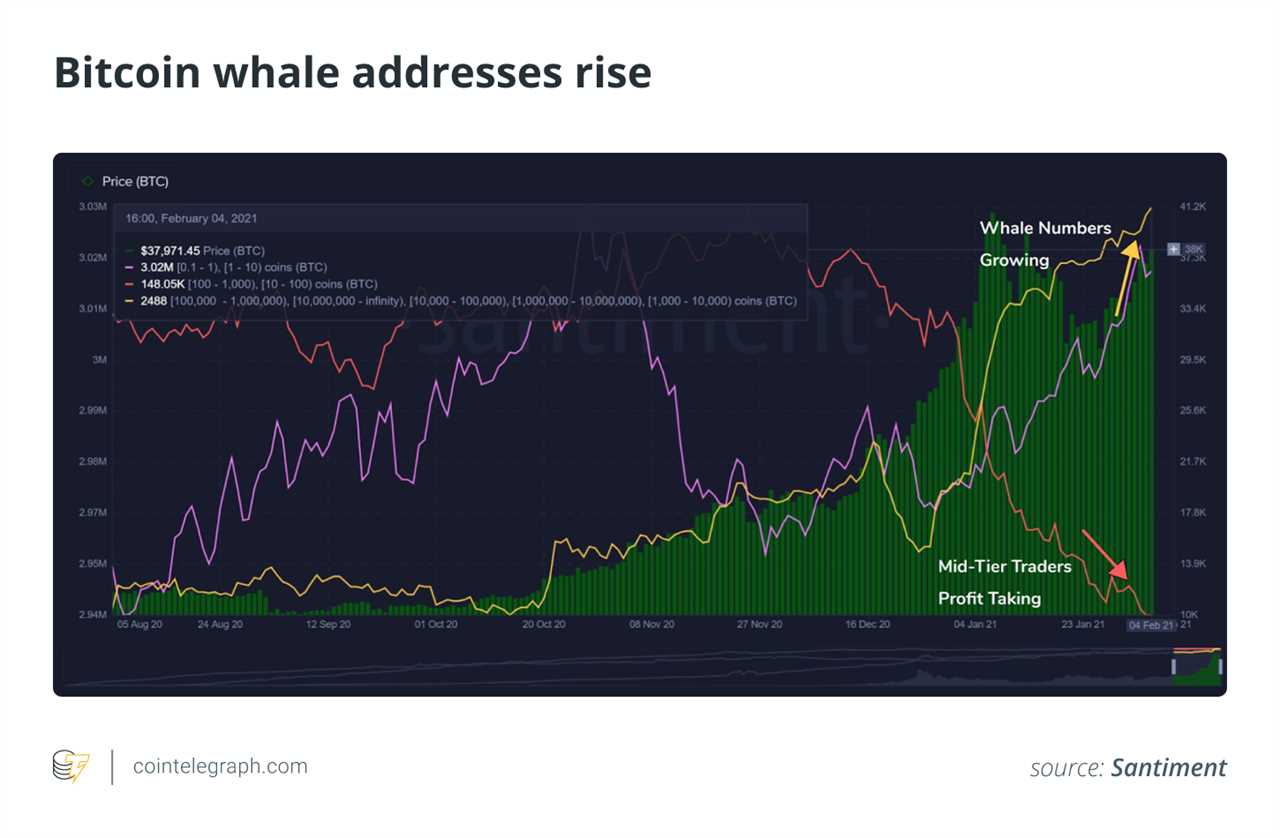

One positive on-chain data point that raises the chances of a Bitcoin breakout is the increase of whale addresses. Analysts at Santiment said that Bitcoin whales have continued to accumulate despite the increase in the price of the asset: “The whales of #Bitcoin (1,000+ $BTC addresses) haven’t stopped accumulating, while the mid-tier traders (10-1,000 $BTC) haven’t stopped taking profit as its price hovers around $38,000. Meanwhile, the small addresses have been #FOMO’ing back in rapidly!”

The accumulation of Bitcoin by whales coincides with large outflows from Coinbase, which typically indicates that high-net-worth investors are purchasing Bitcoin. A pseudonymous trader on Twitter known as Johnny stated: “There is coincidence that we have been seeing huge amounts of $BTC being withdrawn from coinbase. The first market correction of the 2021 bull market is now finished.”

Scott Melker, a cryptocurrency trader, noted that atop the optimistic on-chain data and fundamentals, Bitcoin is demonstrating a favorable technical market structure. He explained that Bitcoin is seeing a “massive bull flag” structure, which, when played out, could lead BTC to hit $63,000 in the foreseeable future: “$BTC is potentially breaking out of a massive bull flag that would technically send price to $63,000,” expressing optimism toward Bitcoin’s short-term price cycle.

What of Bitcoin in the near term?

Speaking to Cointelegraph, Guy Hirsch, managing director for the U.S. at eToro social trading platform, said that there is capital rotation ongoing from Bitcoin to decentralized finance and other altcoins. The market has become full risk-on, as DeFi-related tokens rally by 30%–100% on a single day. The appetite for altcoins, which are seen as higher-risk higher-return bets, has caused the momentum of Bitcoin to slow down.

Hirsch noted, however, that the long-term sentiment for Bitcoin is still bullish. He explained that Bitcoin was range-bound for a while, which means that it was trading in a tight range. This would change if Bitcoin price secures at over $40,000, Hirsch said, as it would cause the interest in Bitcoin to spike in a short period. Based on the options market data, Hirsch said there is a lot of open interest at $52,000 and $56,000, which Bitcoin could be headed to next. He added:

“I would be surprised if Bitcoin does not go past $40,000 in the coming months. There aren’t really any support levels established at that price because it’s only traded there very briefly. However, options positioning could be a good place to look when trying to find some insights into where professional traders see the markets moving.”

Bitcoin stagnated throughout the past week as the decentralized finance market outperformed major cryptocurrencies, including Bitcoin and Ether (ETH). Hirsch said that many investors, including institutions, saw opportunities for higher-gain plays in the DeFi market. Consequently, he said that profits from Bitcoin rotated into altcoins, prompting an “alt season.” However, in the long term, Hirsch thinks that the profits would likely cycle back into Bitcoin, explaining:

“This rotation of capital, often called ‘alt season,’ is common in the wake of Bitcoin hitting new highs and is often followed by a sell-off in these assets back to BTC. Short-term, sentiment is neutral, and that can be seen in Bitcoin’s mostly range-bound trading as of late; but long-term sentiment is still bullish, as evidenced by PayPal’s admission during this week’s earnings call that they were surprised by the amount of crypto-asset transactions on their platform.“

Strategists predict a clean break of $40,000

Investors, researchers and strategists at Bequant, Lmax Digital and CrossTower told Cointelegraph that they expect Bitcoin will likely successfully rally above $40,000 just like the explosive increase in demand in December 2020. They believe that the recent consolidation of Bitcoin does not show weakness in its price trend.

Denis Vinokourov, head of research at Bequant crypto trading and brokerage platform, said that BTC staying below $38,000 for a long period showed “efficient price discovery,” which in the past led to a “sharp reversal due to lack of price information." He further added that once the $40,000 level breaks, what happens next will be hard to predict:

“There is little information to go on since the previous highs are the natural go-to level. But, after that, anything goes, and the next move is anyone’s guess.”

Chad Steinglass, head of trading at CrossTower crypto investment platform, said that after Bitcoin surpasses $40,000, it will see an explosive upward movement. Bitcoin saw a similar scenario play out in December 2020, when it struggled to break out of $30,000. As soon as it did, it saw a rather quick move to its $42,000 all-time high. According to him:

“If new investment demand can eat through this wall of sell interest, and Bitcoin does breakthrough 40K again, and especially if it notches new all-time highs, I expect that the volume of these risk-reduction sellers will evaporate quickly, and that could pave the way for another leg higher.”

Joel Kruger, a cryptocurrency strategist at institutional crypto exchange Lmax Digital, believes that Bitcoin could rally to the $40,000 level, which would present a more “meaningful” resistance area. He noted that the “current price action is indicative of consolidation in the aftermath of a significant rally,” emphasizing that the consolidation has been healthy for Bitcoin.

However, he was more cautious in predicting the continuation of an upward movement of Bitcoin after breaking the $40,000 mark, saying that “we don’t believe the market should be expecting a meaningful bullish continuation beyond $40,000 just yet.” According to him, the “weekly and monthly technical studies are still tracking in severe overbought territory,” which would suggest that BTC is entering risky territory.

Title: Bitcoin price breaks $40K: Here’s where BTC may go next

Sourced From: cointelegraph.com/news/bitcoin-price-breaks-40k-here-s-where-btc-may-go-next

Published Date: Sat, 06 Feb 2021 11:22:17 +0000