Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded.

In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted the BTC price bottom could now be due.

BTC price bottom "typically" follows miner capitulation

Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed.

The dip to $17,600 — 70% below November’s all-time highs for BTC/USD, has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges.

This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent.

“Our data demonstrate a miner capitulation event that has occurred, which has typically preceded market bottoms in previous cycles,” Moreno summarized.

Miner sales have been keenly tracked this month, with the @Bitcoin Twitter account even describing the situation as miners “being drained of their coins.”

The #Bitcoin miners are being drained of their coins. pic.twitter.com/O0i9Lx0wQF

— Bitcoin (@Bitcoin) June 18, 2022

“For miners, it's time to decide to stay or leave,” CryptoQuant CEO, Ki Young Ju, added in a Twitter thread last week.

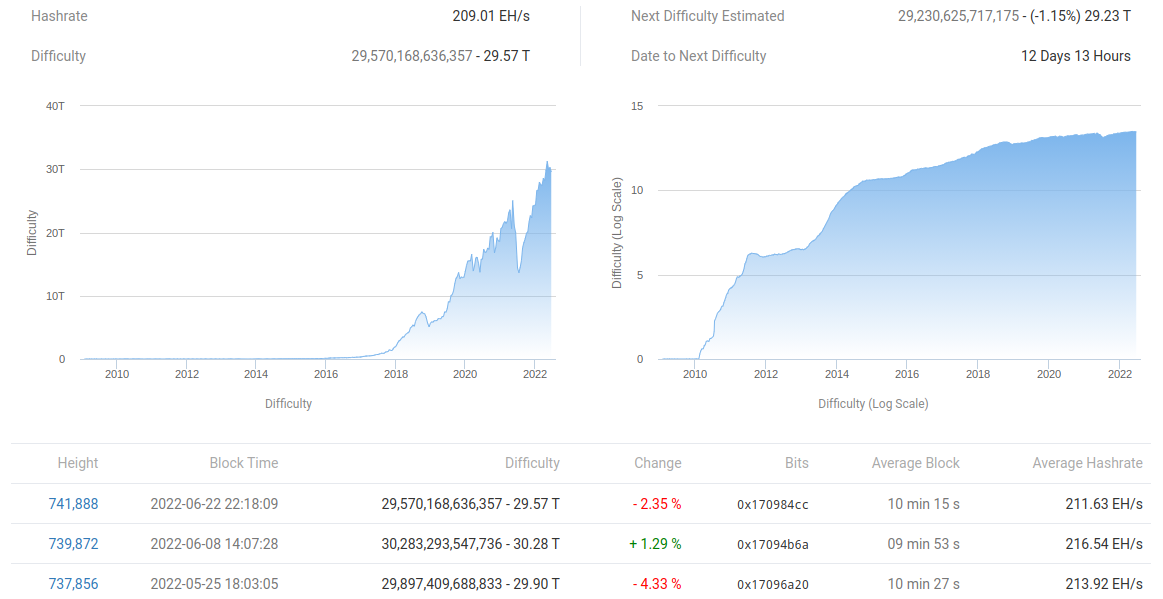

The situation is tenuous, but the majority of miners remain active, as witnessed by network fundamentals dropping only slightly from all-time highs of over 30 trillion.

Mixed signals over buyer interest

When it comes to other large BTC holders, however, the picture appears less clear.

Related: 'Foolish' to deny Bitcoin price can go under $10K — Analysis

After whales bought up liquidity near $19,000, CryptoQuant’s Ki this week heralded the arrival of “new” large-volume entities.

Outflows from major United States exchange Coinbase, he noted, reached their highest since 2013.

Time to welcome new #Bitcoin whales.

— Ki Young Ju (@ki_young_ju) June 23, 2022

Average $BTC outflows from @Coinbase hit a 9-year high. Average inflows are high as well.

There are lots of exchange in/outflows from whales lately, but actually, nothing changed on BTC reserve across all exchanges.https://t.co/Ptw2mg9YuR pic.twitter.com/s697lSvw27

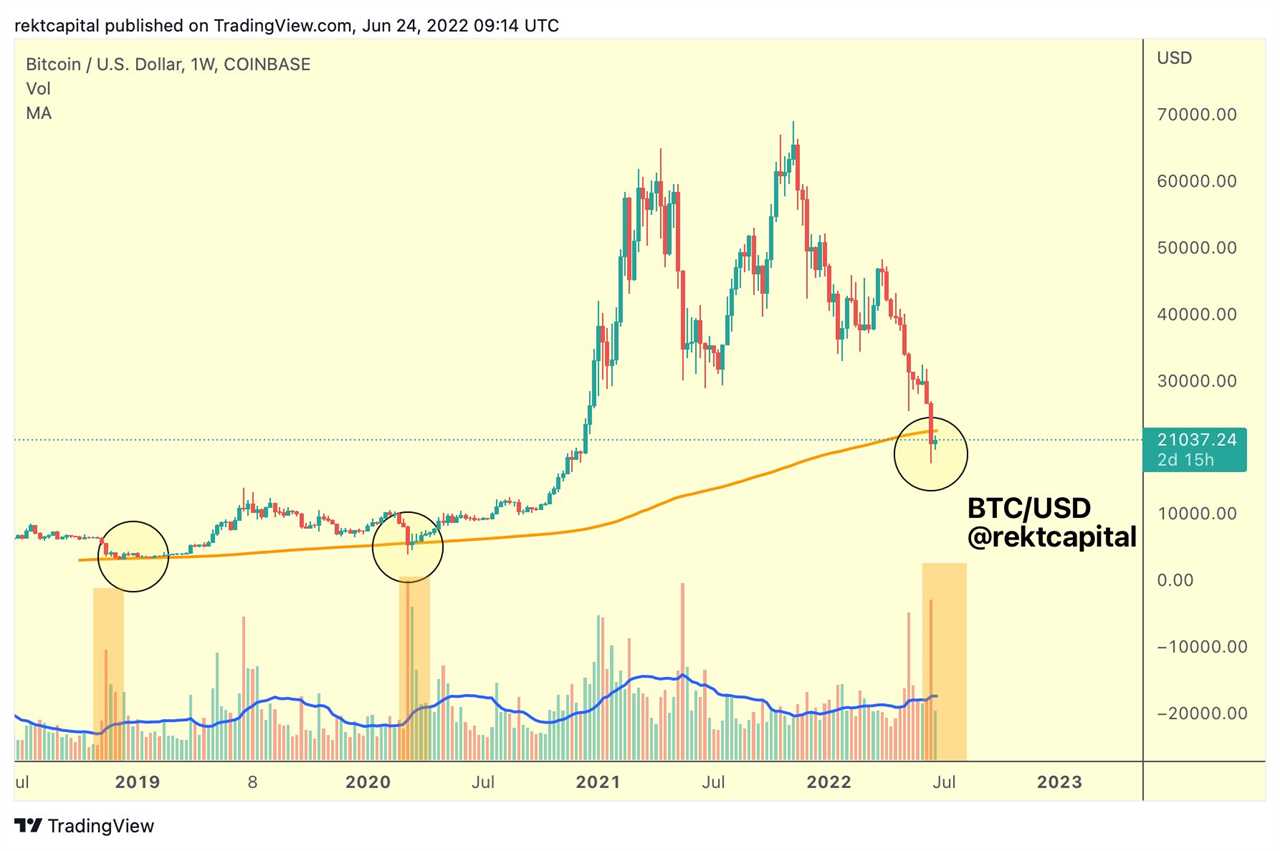

Trader and analyst Rekt Capital nonetheless reiterated doubts about the strength of overall buyer volume, arguing that sellers were conversely still directing market movements.

Bitcoin’s 200-week moving average (MA), a key support level during previous bear markets, has yet to see significant interest from buyers despite spot price being around $2,000 below it.

“Current BTC buy-side volume following the extreme sell volume spike is still lower than the 2018 Bear Market buyer follow-through volume levels at the 200-week MA. Let alone March 2020 buy-side follow-through,” he told Twitter followers.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin miner 'capitulation event' may have already happened — research

Sourced From: cointelegraph.com/news/bitcoin-miner-capitulation-event-may-have-already-happened-research

Published Date: Fri, 24 Jun 2022 11:23:04 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/solana-smartphone-saga-triggers-mixed-reactions-from-crypto-community