As the Bitcoin (BTC) price edges closer to $59,000, its value relative to gold is approaching new all-time highs, possibly hinting at the emergence of a new preferred store of value.

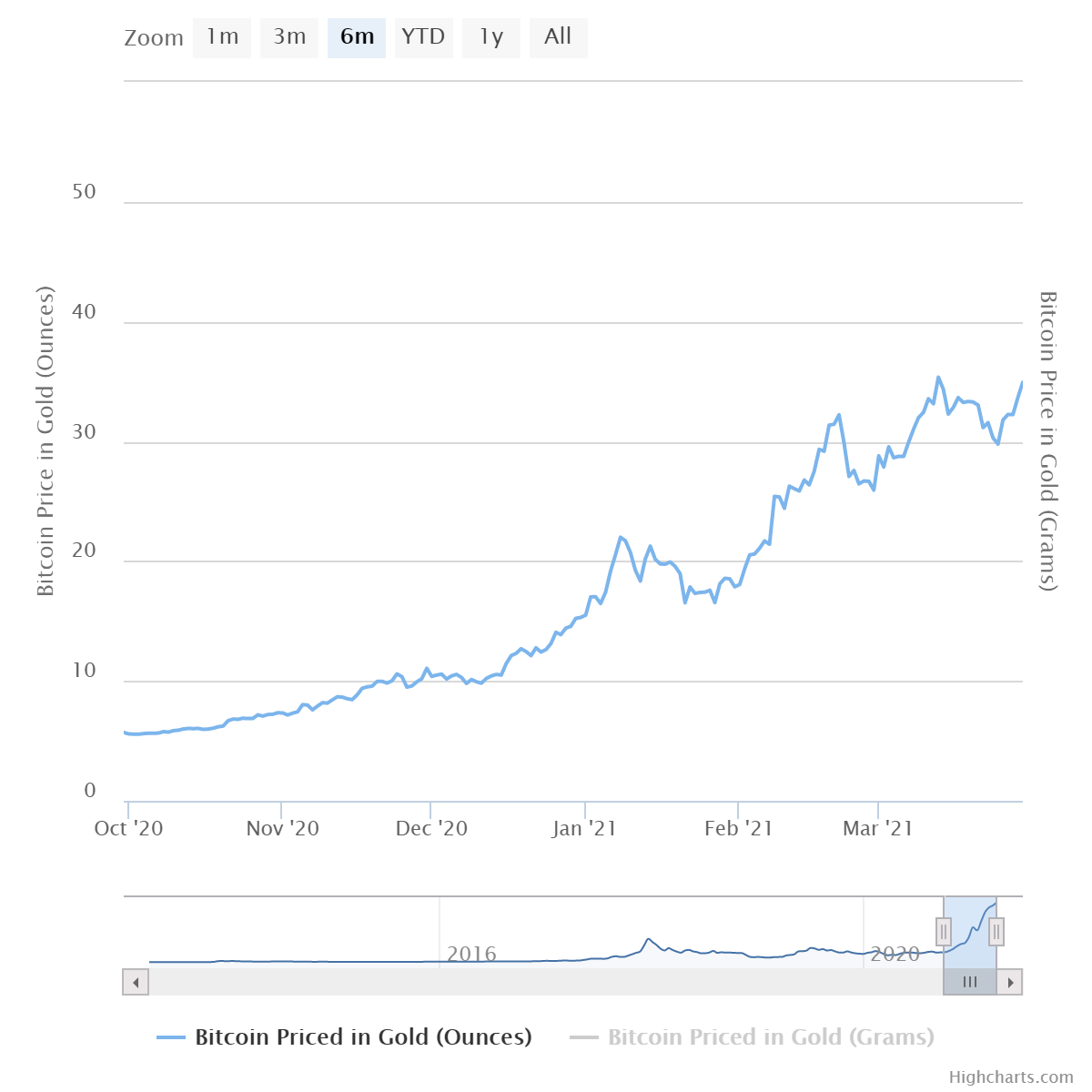

Measured against gold, Bitcoin’s price reached 34.94 ounces on Tuesday. The BTC-gold comparative peaked at 35.35 ounces on March 13 as Bitcoin surged past $61,000.

Bitcoin’s value relative to gold has more than doubled over the past three months and has grown nearly sevenfold since October 2020.

Gold futures, meanwhile, plunged below $1,700 a troy ounce Tuesday on the Comex division of the New York Mercantile Exchange. The price bottomed at $1,676.50, marking a new three-week low. Since peaking above $2,050 a troy ounce in August 2020, bullion has corrected nearly 18%.

2020 was a big year for gold, as the yellow metal set new all-time highs in every major currency before toppling $2,000 per U.S. dollar for the first time. Bullion ended the year with a gain of around 22%. Still, that paled in comparison with Bitcoin’s 265% yearly return.

With the recent $1.9 stimulus package fueling inflation fears, assets like gold and Bitcoin should, in theory, perform well as investors hedge their bets against the declining dollar. However, the recent rise in bond yields may have taken some of the shine away from gold.

Others, even some prominent analysts like Bloomberg’s Mke McGlone, believe gold is losing ground to Bitcoin in the battle of the safe-havens. Earlier this month, McGlone tweeted:

“Gold will always have a place in jewelry and coin collections, but most indicators point to an accelerating pace of Bitcoin replacing the metal as a store of value in investor portfolios.”

Digital #Gold Pushing Aside the Old Guard -

— Mike McGlone (@mikemcglone11) March 8, 2021

Gold will always have a place in jewelry and coin collections, but most indicators point to an accelerating pace of #Bitcoin replacing the metal as a store of value in investor portfolios. pic.twitter.com/RR0CCWmksF

Even JPMorgan, an organization long critical of Bitcoin, has claimed that the digital currency will consume a portion of gold's market share. "The adoption of bitcoin by institutional investors has only begun, while for gold, its adoption by institutional investors is very advanced," JPMorgan strategists led by Nikolas Panigirtzoglou said in a December 2020 report. "If this medium to longer-term thesis proves right, the price of gold would suffer from a structural headwind over the coming years.”

Bitcoin’s digital gold narrative continues to strengthen post-halving. The quadrennial deflationary event, which last occurred in May 2020, reduces the amount of new Bitcoin that enters circulation after each block is mined.

Title: Bitcoin is outshining gold in the battle of the safe havens

Sourced From: cointelegraph.com/news/bitcoin-is-outshining-gold-in-the-battle-of-the-safe-havens

Published Date: Tue, 30 Mar 2021 17:33:40 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/powers-on-why-the-sec-is-not-your-friend-and-how-to-deal-with-that-