Bitcoin's bullish momentum fades as liquidity shifts, warns analysis

Bitcoin's (BTC) bullish momentum is losing steam as changes in liquidity signal a potential volatile move, according to a new analysis. Keith Alan, co-founder of Material Indicators, highlighted concerning shifts in the Binance order book, indicating a concentration of bid support around $24,600, a price level not seen since March. While he expects a short-term rally before further downside, he cautioned that neither the bulls nor bears have established real strength, with bullish momentum seemingly fading.

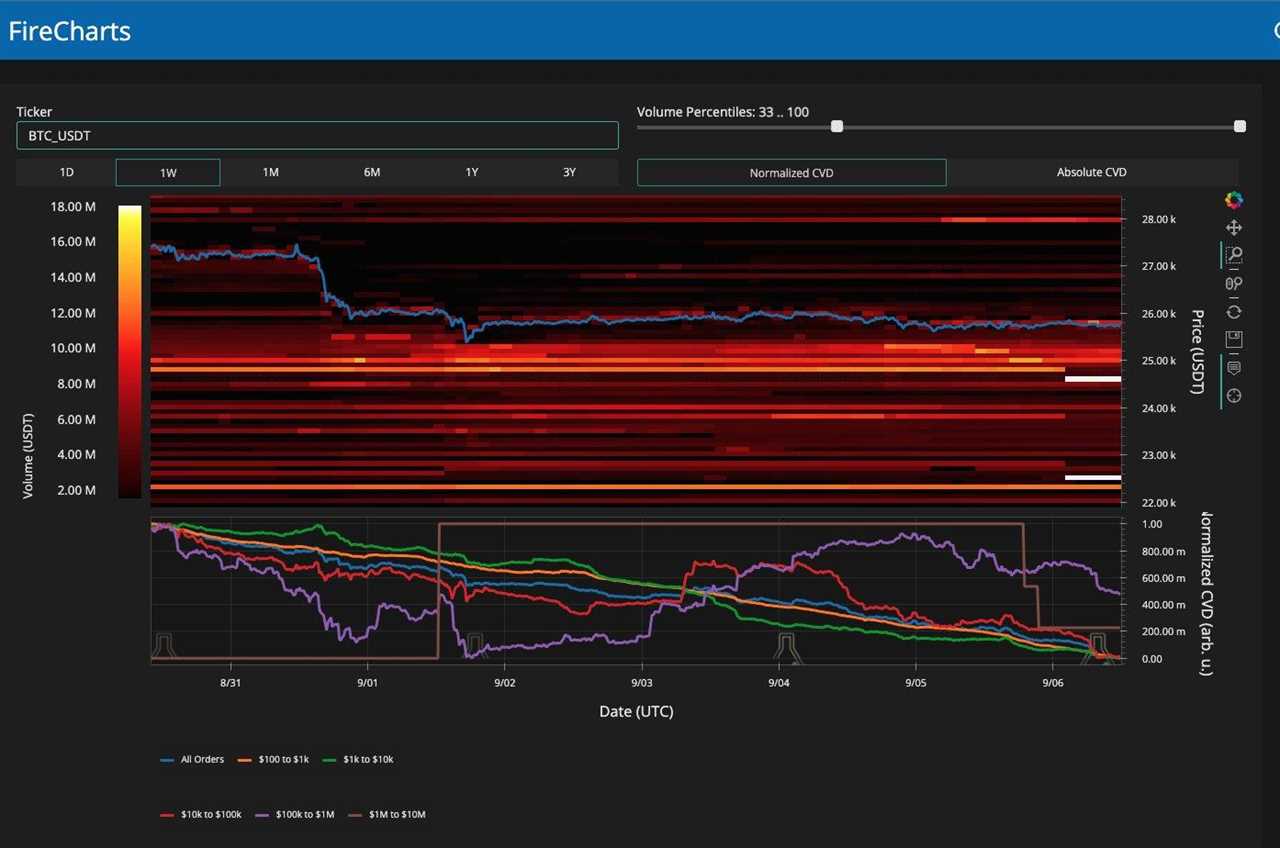

Liquidity shifts raise concerns

The BTC/USD order book on Binance showed concerning changes in liquidity, with the largest concentrations of BTC bid liquidity dropping below the previously established Lower Low. This development, along with the tight trading range over the weekend, suggests a potential shift in the status quo. The bid support moving down to $24,600 is particularly concerning, as it hasn't been seen on spot markets since March.

A potential breakdown looming

While a short-term bounce from current spot levels is anticipated, Alan expects a breakdown in price eventually. He stated, "I do expect to see price breakdown eventually, so the thought of printing a new LL [Lower Low] isn't surprising, but I did expect to see a stronger short term rally from this range before that happens." However, he also emphasized that he does not trust the current buy walls to remain unfilled.

Volatility expected to return

According to popular trader Skew, volatility is likely to make a comeback soon, as indicated by activity in derivatives markets. Skew suggested that the choppy start to the week, overtrading in derivatives markets, increasing perpetual liquidity, and thinning spot liquidity all point towards another big move brewing for Bitcoin.

Optimism for limited downside

Fellow trader Credible Crypto expressed optimism that the downside would be limited to the high $24,000 range. He highlighted the importance of holding the higher timeframe low at $24,800 before a reversal back up to fill the inefficiency above. He believes the local low on major liquid/spot exchanges is at $25.2K.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.