Federal Reserve hints at higher rates, triggering sell-off

The Federal Reserve's decision not to hike interest rates in its recent meeting but hint at the possibility of higher rates in the future has sent shockwaves through the US equities and cryptocurrency markets. This comes as risk assets struggle in a high-interest-rate environment.

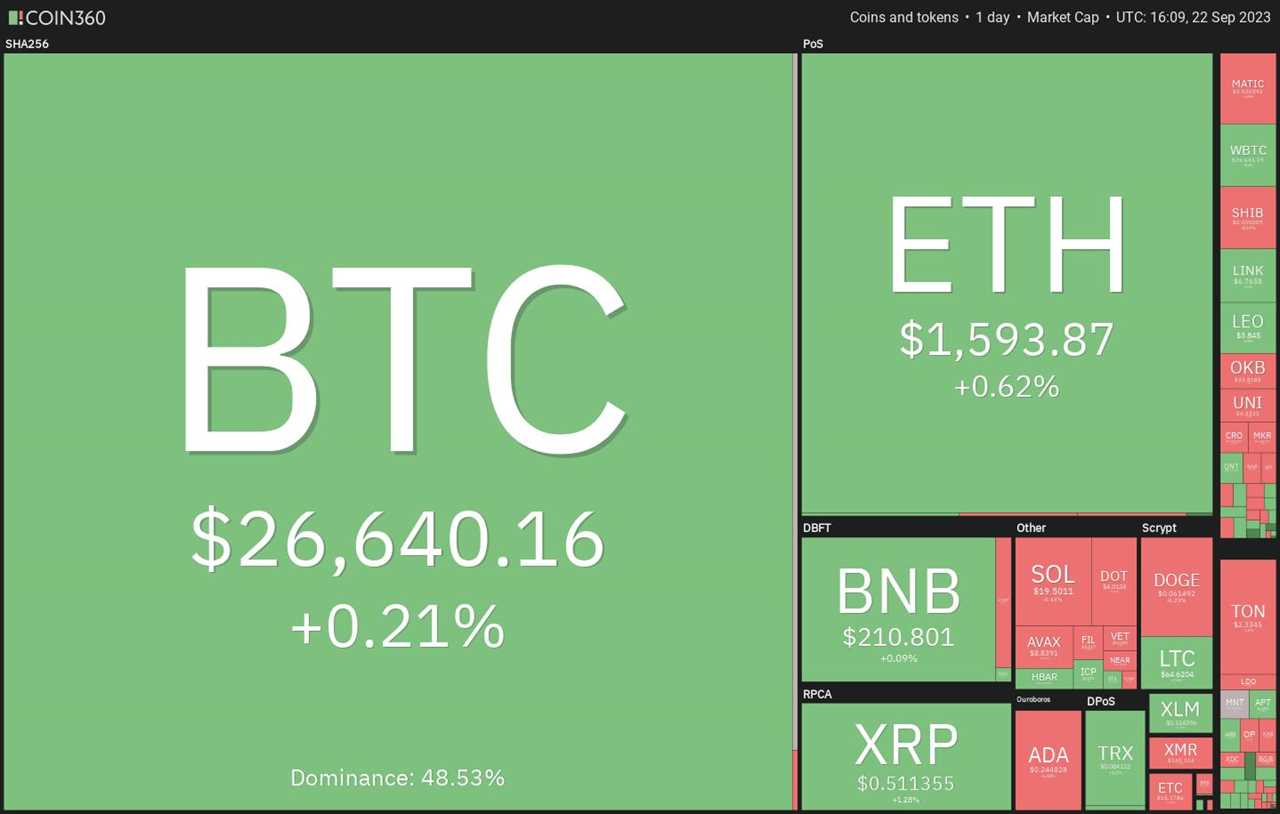

Bitcoin stays flat as altcoins struggle

While the S&P 500 and Nasdaq recorded losses this week, Bitcoin managed to maintain its position without any significant movement. Altcoins, on the other hand, have been experiencing volatility and have struggled to hold on to their gains, greatly impacted by a risk-off sentiment.

Critical price battle awaits Bitcoin and major altcoins

The next few days will be crucial for Bitcoin and major altcoins as the market witnesses a tough battle between the bears and the bulls. The price action during this period will determine whether the bears seize the initiative and drag prices lower or if buyers regroup and push prices higher.

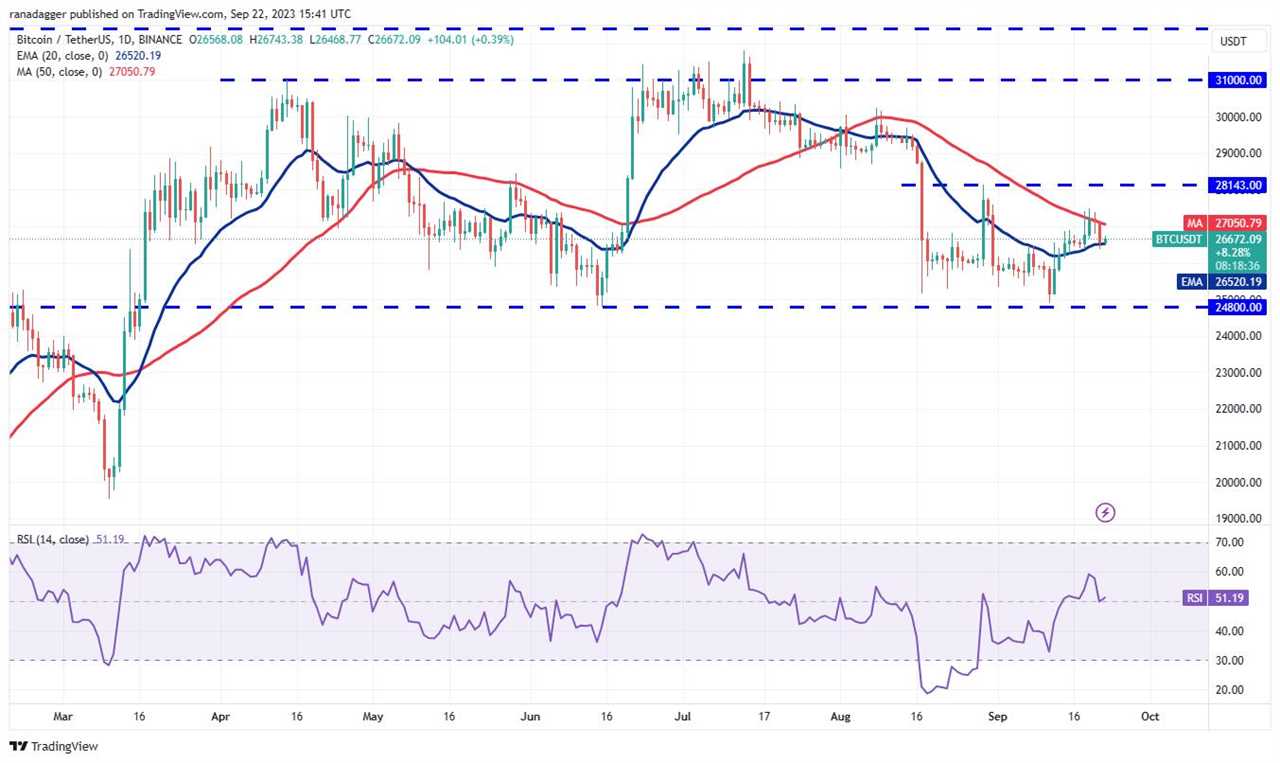

Bitcoin price analysis

Bitcoin has been trading within a tight range, indicating indecision among market participants. If buyers are successful in keeping the price above key moving averages, the bulls will attempt to break through resistance levels and push the price higher. However, if the price drops below certain support levels, it could signal a bearish trend.

Ether price analysis

Ether turned down from a key moving average, signaling continued selling pressure. The price will need to turn up from current levels to attract buyers and potentially rally to higher resistance levels. However, a drop below vital support levels could indicate a bearish trend.

BNB price analysis

BNB's price movement suggests a consolidation phase as it trades within a specific range. The price will need to hold above certain moving averages to demonstrate bullish strength. Breaking through resistance levels is necessary for the bulls to regain control of the market.

XRP price analysis

XRP's recovery has been short-lived, and the price is struggling to sustain positive momentum. The current support level is crucial, as a break below it could invalidate the bullish pattern. The bulls will aim to push the price above key resistance levels to indicate a change in sentiment.

Cardano price analysis

Cardano's price action has formed a descending triangle pattern, which suggests a potential bearish trend. However, a bullish divergence indicator provides some hope for buyers. Breaking above the downtrend line is crucial to prevent a breakdown and pave the way for a relief rally.

Dogecoin price analysis

Dogecoin's price is struggling to break above a key moving average, indicating defensive selling by bears. However, the price has held above an important support level, with bulls buying on dips. The price needs to break above the moving average to signal a sustained recovery.

Solana price analysis

The price of Solana has faced resistance at key moving averages, highlighting bearish activity at higher levels. The battle between the bulls and the bears at certain moving averages will determine the price direction. Breaking above resistance levels will signal a potential retest of higher levels.

Toncoin price analysis

Toncoin's failure to rise above a certain level suggests profit-booking from short-term traders. The price must hold above certain support levels to maintain positive sentiment. A strong rebound could lead to a break above resistance levels and a potential rally.

Polkadot price analysis

Polkadot's price is struggling to break below a critical level, indicating selling pressure from bears. However, a positive divergence indicator suggests a possible reduction in selling pressure. Breaking above certain resistance levels is necessary for the bulls to regain control.

Polygon price analysis

Polygon's price has faced resistance at key moving averages, indicating lack of demand at higher levels. The bears will attempt to break below strong support levels and resume a downtrend. However, a rebound from support could indicate buying interest. Breaking above key levels is necessary for a stronger recovery.

Note: This article does not contain investment advice or recommendations. Readers should conduct their own research before making any investment decisions.