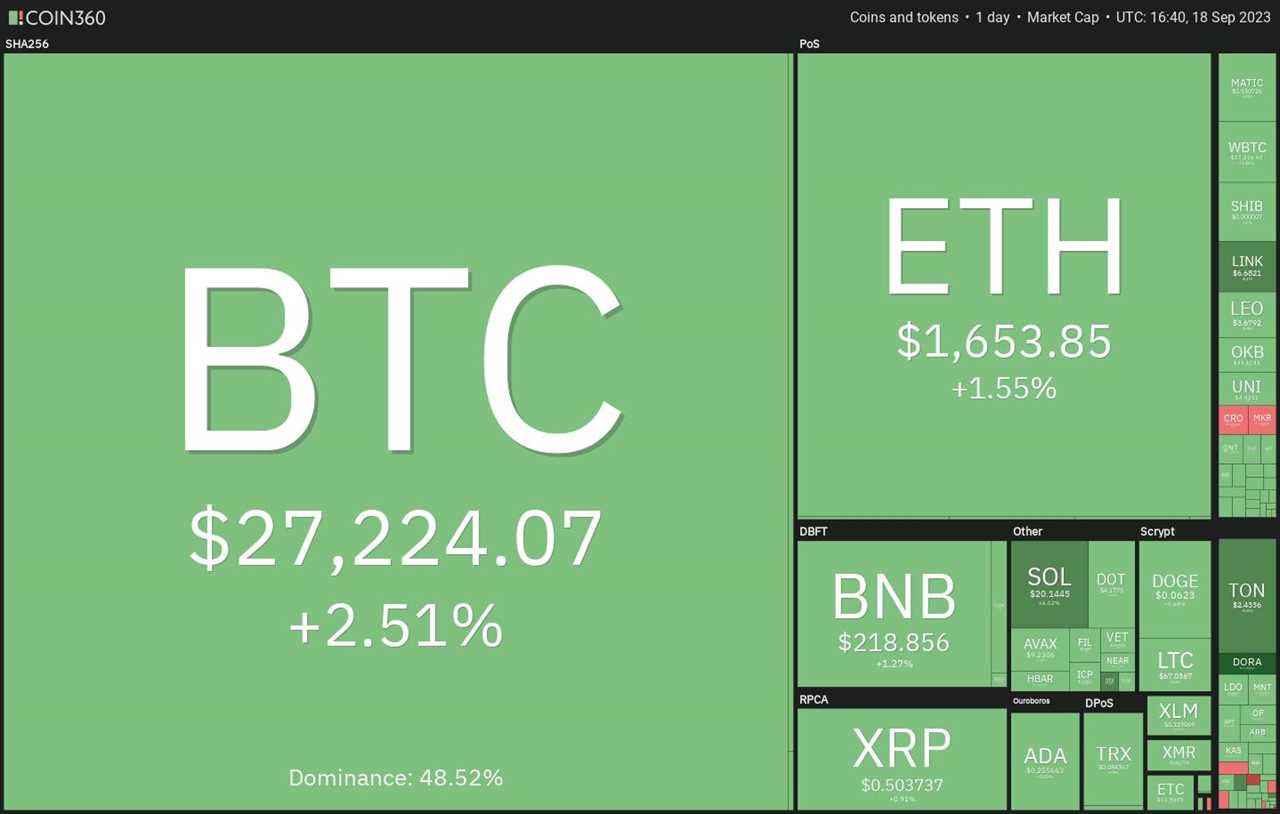

Bullish momentum builds as Bitcoin holds above key support levels

Bitcoin (BTC) and select altcoins are staging a recovery as bullish sentiment builds in the market. The bears' inability to push BTC below the $25,000 mark is fueling buying interest, leading to a positive momentum that has pushed the price above $27,000. Market participants are optimistic that the Federal Reserve will not raise interest rates this year, which is contributing to the strength of Bitcoin despite the United States dollar index (DXY) remaining stable. However, traders should remain cautious as the bears historically have an advantage during the last ten days of September.

S&P 500 Index faces resistance but bulls seek upper hand

The S&P 500 Index has encountered resistance at the downtrend line after breaking above moving averages. Bears are attempting to pull the price below the next support level at 4,030, which could potentially trigger a retest of vital support at 4,325. Bulls could gain the upper hand by pushing the price above the downtrend line, with resistance at 4,542 and a potential sprint towards 4,607.

Bitcoin eyes $30,000 target as bears struggle

Bitcoin has held above the 20-day exponential moving average (EMA) since mid-September, indicating support from buyers. The bulls are now aiming to push the price above the 50-day simple moving average (SMA) at $27,255. However, the bears might mount a strong challenge at the 50-day SMA and the overhead resistance at $28,143. A sharp turn down from this zone could indicate a range-bound market between $24,800 and $28,143. On the other hand, clearing $28,143 would signal targets at $30,000 and $31,000.

Ether sees bullish comeback, sets sights on $1,959

Ether (ETH) has broken above the overhead resistance and is showing signs of a bullish comeback. The flattening 20-day EMA and the RSI near the midpoint indicate the bulls are gaining strength. Sustaining the price above the 20-day EMA could lead to a rise to the 50-day SMA at $1,712 and potentially to $1,750. Breaking above this level would confirm a short-term double bottom pattern with a target of $1,959. However, bears will attempt to push the price below $1,600 and target strong support at $1,531.

BNB's rally faces resistance, consolidation expected

BNB has risen above the 20-day EMA, signaling a weakening bearish momentum. The price could reach the 50-day SMA, but stiff resistance is expected between the 50-day SMA and $235. If the price turns down from this zone, BNB could remain range-bound between $200 and $235. The 20-day EMA and RSI near the midpoint also suggest consolidation in the near term. However, if the bears sink the price below the 20-day EMA, the pair may retest support at $200.

XRP recovery faces hurdle at $0.56

XRP's recovery is encountering resistance at the 20-day EMA, but bulls continue to push the price higher. Breaking above the 20-day EMA could lead to an attempted rally to $0.56, but this level may be difficult to overcome. If the price turns down from the current level, it indicates strong bearish defense at the 20-day EMA. Minor support is at the uptrend line, followed by potential slides to $0.45 and $0.41.

Cardano''s consolidation could lead to breakout

Cardano (ADA) continues to trade within a tight range between the 20-day EMA and support at $0.24. Positive divergence on the RSI suggests selling pressure is easing, which could lead to a breakout. An upside resolution could pave the way for a rally to the overhead resistance at $0.28. However, a downward move below $0.24 would indicate the bears' dominance and potentially start the next leg of the downtrend. The pair may then fall to $0.22.

Dogecoin seeks breakout from tight range

Dogecoin (DOGE) has been trading within a tight range between the 20-day EMA and the support at $0.06. The squeeze in volatility could lead to a range expansion, and a close above the 20-day EMA suggests a potential comeback by the bulls. If the price breaks above the range, the next target is $0.07, with a further rally to $0.08. However, a drop below the $0.06 support could push the price down to the next support level at $0.055, with strong defense expected by the bulls.

TON looks to break resistance at $2.59

Toncoin (TON) has shown profit-taking near resistance at $2.59, with a possible correction or range formation in the near term. The bulls are attempting to push the price above this level, which could lead to a momentum-driven surge to $3. On the downside, an important support level to watch is $2.25, followed by a potential deeper correction to $2.07.

Solana breaks resistance, but bears still in play

Solana (SOL) has broken above the resistance at the 20-day EMA, indicating a potential end to bearish control. The flattening 20-day EMA and the RSI near the midpoint suggest a possible weakening of the bears. Bulls will try to push the price toward the resistance at $22.30, but failing to hold above the 20-day EMA could indicate selling pressure from bears. Initial support is at $18.50, with a deeper correction leading to the next major support level at $17.33.

This article does not provide investment advice. Readers should conduct their own research before making any investment decisions.