The Fed's Financial Setback

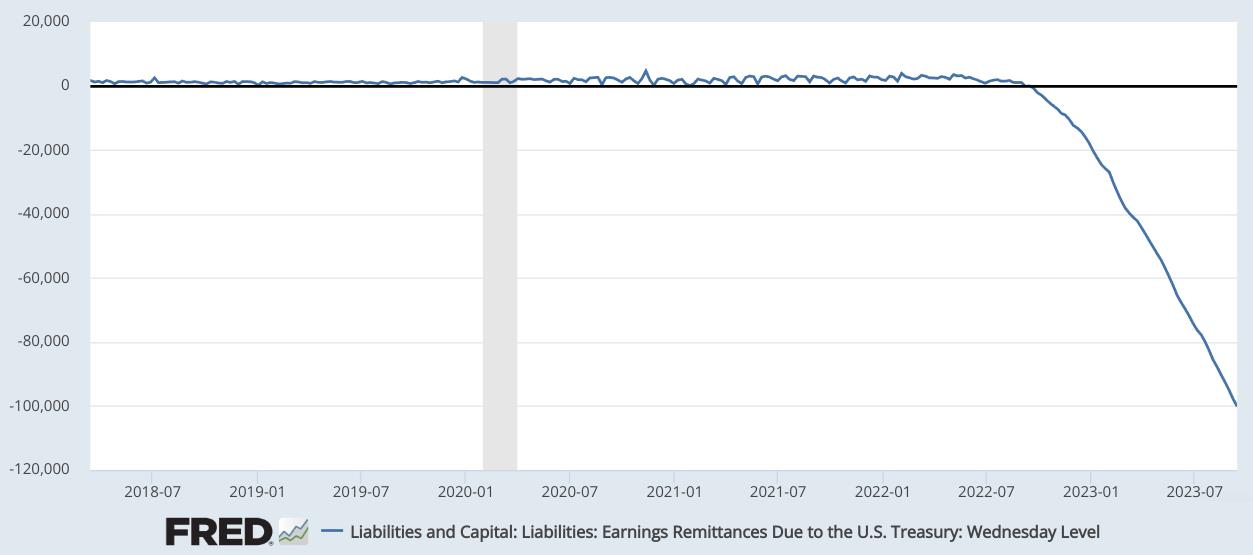

The U.S. Federal Reserve recently announced significant losses of $100 billion in 2023, with experts predicting the situation to worsen. However, this news has actually provided a silver lining for investors in risk assets like Bitcoin (BTC).

Why the Loss?

The primary reason for the Fed's financial setback is that the interest payments on its debt have exceeded its earnings from holdings and provided services to the financial sector.

Implications for BTC

Investors are now eager to understand how the Fed's losses will affect interest rates and the demand for provably scarce assets like BTC.

Projected Losses

Some analysts believe that the Fed's losses, which began a year ago, could double by 2024. The central bank classifies these losses as "deferred assets" and argues that there is no immediate need to cover them.

Historical Profitability of the Fed

In the past, the Federal Reserve has been a profitable institution. However, the absence of profits does not hinder the central bank's ability to conduct monetary policy and achieve its objectives.

Reasons for Losses

The Fed's balance sheet has suffered losses due to significant interest rate hikes in recent years. Even if interest rates remain unchanged, experts anticipate ongoing losses resulting from measures taken during the pandemic to prevent a recession.

Implications for the Economy

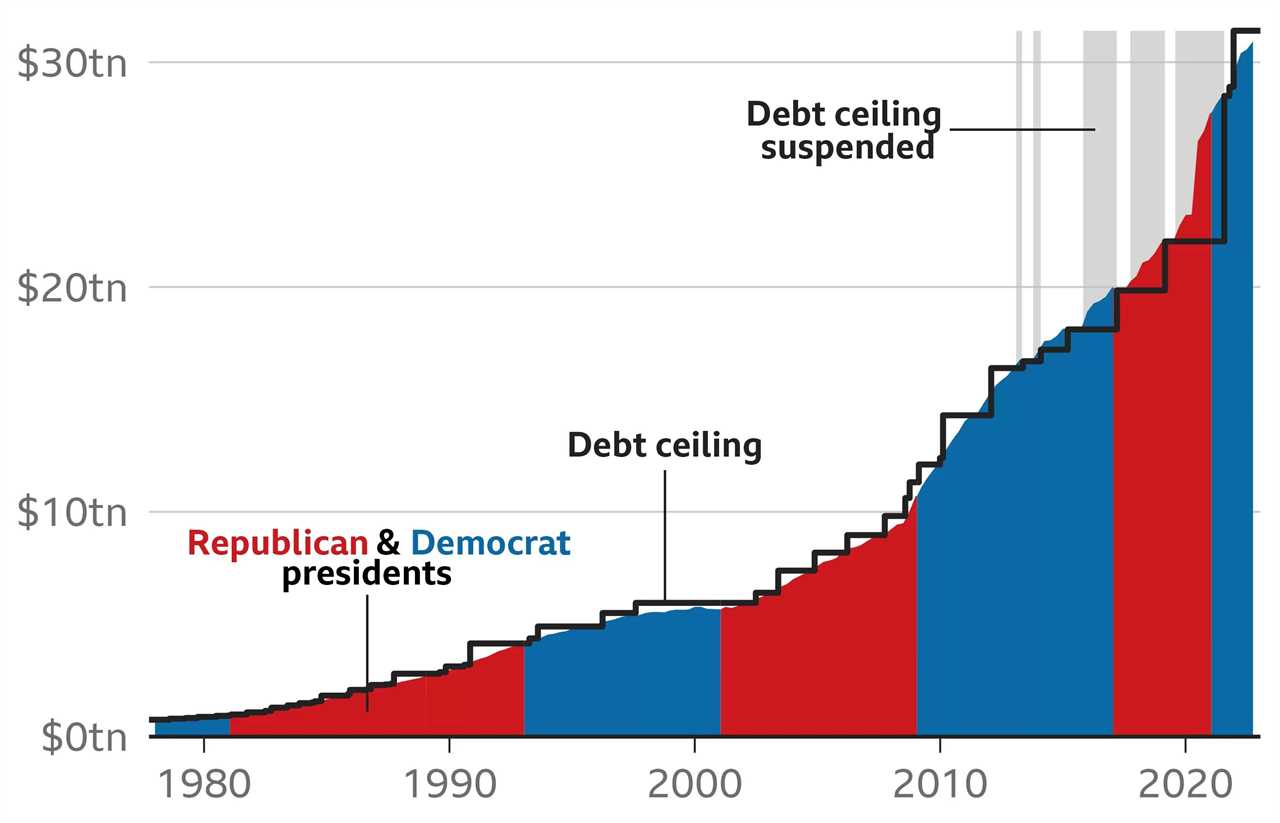

This situation is unsustainable, especially with the U.S. debt reaching $33 trillion. While some may blame the Fed for raising interest rates, it's crucial to recognize that these measures were necessary to combat inflation and economic pressure.

Risk for Investors

Investors face potential dilution when the Fed injects liquidity into the market, posing a risk to assets like stocks and real estate. With a fixed-income yield, inflation could outpace returns, and the government may be forced to issue additional Treasuries.

Seeking a Secure Investment

With uncertainties in sectors like real estate and stocks, investors are searching for alternative assets to hedge against inflation. While Bitcoin and cryptocurrencies may not initially seem like a reliable option, their appeal may grow as investors realize the boundless nature of the U.S. government's debt ceiling.

Preserving the Moment

Collecting this article as an NFT allows you to preserve this significant moment in history and show support for independent journalism in the crypto space.

This article is for general information purposes and should not be taken as legal or investment advice. The author's views do not necessarily reflect those of Cointelegraph.