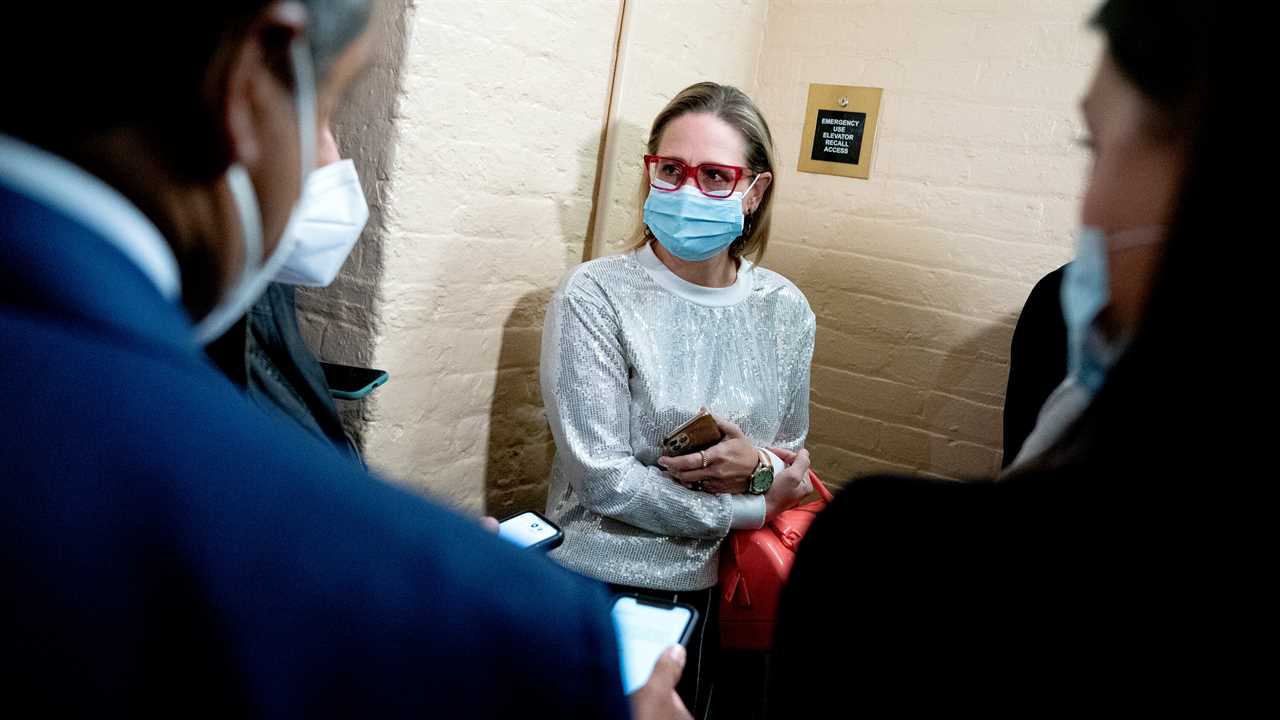

WASHINGTON — Senator Kyrsten Sinema, Democrat of Arizona and one of her party’s only holdouts on President Biden’s sprawling budget bill, has cultivated a profile in Congress as a business-minded centrist.

But her intransigence on raising tax rates on high earners and major corporations to pay for Mr. Biden’s plan is having the ironic effect of pushing Democrats toward wealth taxation and other measures once embraced only by the party’s left flank.

The frenzied search for new paths around Ms. Sinema’s tax-rate blockade has cheered liberals but raised serious qualms among more moderate Democrats, who now openly say they hope that Ms. Sinema’s business allies will pressure her to relent once they — and she — see the details of the alternatives that she is forcing on her colleagues to pay for around $2 trillion in spending on social programs and anti-climate change initiatives.

“The irony is, with some of these alternatives that are coming out there, it may be the very business community that’s rushing to the barricades, saying, ‘Please, give us rates,’” Senator Mark Warner, Democrat of Virginia and a moderate on the Finance Committee, which is charged with drafting the tax plans.

Democrats had hoped to pay for much of their social policy and climate spending with the relatively modest proposal to raise low capital gains tax rates for those earning at least $400,000, lift the top personal income tax rate back to 39.6 percent from the 37 percent level that President Donald Trump secured in 2017, and increase the corporate income tax rate from 22 percent to 25 percent or 26 percent. That corporate rate would still be far less than the 35 percent rate that Mr. Trump slashed, while the top personal rate would be back to where it was for most of the past 25 years.

But in the 50-50 Senate where all Republicans are opposed, they cannot afford to lose even one Democratic vote on the legislation, giving Ms. Sinema effective veto power over its contents.

To get around her resistance, they are looking to a proposal by Senator Ron Wyden of Oregon, the Finance Committee chairman, that would raise hundreds of billions of dollars from just 600 to 700 people — America’s billionaires. Mr. Wyden said his “billionaires’ tax” is a political winner, a way to finally tax the richest of the rich, who in some years have escaped income taxation all together.

“It clearly connects in some of the most challenging political communities in the country — it makes Build Back Better enormously more popular,” he said, using Mr. Biden’s name for the bill, and adding: “I’d like to see elected officials stand up and say, ‘Hey, I don’t think billionaires ought to pay any taxes.’”

Until now, such wealth taxes were almost exclusively the domain of the most ardent liberals in the Senate, Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont.

“This is a good way to make sure that billionaires are paying their fair share for running this country,” Ms. Warren said. “I’m all in favor of it.”

Under the proposal, people with $1 billion in assets or $100 million in income for three consecutive years would be brought into an entirely new tax system. Initially, they would have to assess the current value of their tradable assets — like cash, stocks and bonds — and their value when they were purchased, then pay a one-time levy on them. For someone like Mark Zuckerberg, whose billions of dollars in Facebook stock were initially worth zero, that initial gain would be huge.

Then each year, those billionaires would have to assess the annual increase or loss in the value of those assets — what is known as marking them to market value — and pay capital gains taxes on an increase or take a deduction for losses, whether they sell any or not. To keep billionaires from selling off stocks and bonds for less liquid assets like real estate, the plan would impose an annual interest fee on the value gains of such assets, which would be paid all at once at the time of sale.

Although Ms. Sinema has not explicitly embraced the billionaires’ tax, Finance Committee aides said none of the 50 senators who caucus with the Democrats has expressed opposition.

But some business-minded Democrats have deep qualms about the direction Ms. Sinema has forced them in, and are hoping she will reconsider. Moderate Democrats and Republicans say the affluent and corporations that would be hit by tax rate increases may scream loudest at the alternatives.

“When you introduce dramatic new concepts, you’ve got to make sure they get fully vetted,” said Mr. Warner, one of the Senate’s richest members.

Senator Mitt Romney, Republican of Utah an another one of the chamber’s wealthiest, said the billionaires’ levy was a “very bad idea,” because it would distort the behavior of the super wealthy, who would flee stocks, bonds and other liquid assets to hide their money in real estate, diamonds, paintings and other items harder to value.

“People are rational beings,” he said. “They’d move away from tradable assets, and then go to untradeable assets. And that means that you’re going to have a depression on things like venture capital, private equity, in the stock market and people’s 401(k)s.”

The new direction that Democrats are heading goes beyond wealth taxation. To cobble together $2 trillion in revenue over 10 years without rate increases, Democrats are looking at other dramatic changes. They would tighten the rules around business partnerships that have allowed rich companies and executives to shield profits and income from taxation. They would limit access to low tax rates created by the 2017 Trump tax cut for so-called pass-through businesses that pay taxes through the personal income tax system, not the corporate tax code.

Where the Budget Bill Stands in Congress

Democrats are scaling back the ambitious bill. After weeks of bickering and negotiations, the party is hoping to reach a compromise between its moderate and progressive wings by substantially shrinking President Biden’s initial $3.5 trillion domestic policy plan to an overall price tag of about $2 trillion.

And they would tax the value of stocks that companies buy back from the market to raise their share prices, a proposal championed by Senator Sherrod Brown, Democrat of Ohio and the Senate’s biggest union champion.

None of those measures were approved by the House Ways and Means Committee or included in the House’s version of the social policy bill. The tax-writing committee’s chairman, Richard E. Neal of Massachusetts, only drafted — or “marked up” — more conventional measures that would hit high earners but leave the wealth of the richest Americans untouched.

“We decided that the most efficient way to accomplish our policy goals was to address the issue of rate increases, because they were not only clear, but they weren’t punitive,” Mr. Neal said, echoing criticism of some of the Senate measures voiced by another reluctant Democrat, Senator Joe Manchin III of West Virginia.

Mr. Neal said Thursday he was “not necessarily philosophically against” Mr. Wyden’s wealth tax, “but it hasn’t been marked up, and there’s been no vetting of it, and I think that it’s a bit of a challenge. That’s for sure.”

He said had talked to Ms. Sinema on Thursday and had his staff meet hers to discuss both rate increases, which he said he has not given up on, and the alternative.

“We’re working hard at it,” he said.

Ms. Sinema has been silent in public on all tax questions, but she has told senators and White House officials her position on tax rate increases for more than a month. Frustration is starting to show.

Mr. Biden said Thursday night on a CNN town-hall broadcast, that Ms. Sinema “will not raise a single penny of taxes on the corporate side and or on wealthy people — period. That’s where it sort of breaks down.”

A White House official later clarified that Mr. Biden was referring only to her opposition to a corporate tax rate increase. In a sign that the pressure is starting to get to her, a person familiar with her thinking said Thursday that Ms. Sinema had agreed to enough revenue provisions to fully finance what is expected to be about $2 trillion in spending over 10 years.

And she has said she would accept tax measures in each of the broad categories of revenue that Mr. Biden has proposed to help pay for the plan: international business taxation, domestic corporate taxation, affluent individuals, and tax code enforcement.

Mr. Wyden said the billionaires’ tax had been in the works for years. Finance Committee experts have consulted with economists, tax experts and even high-end accountants versed in tax avoidance to ensure it would not distort behavior. And polling shows overwhelmingly popular support for taxing the richest of the rich, whom Americans widely see as escaping the tax system.

Emily Cochrane contributed reporting.