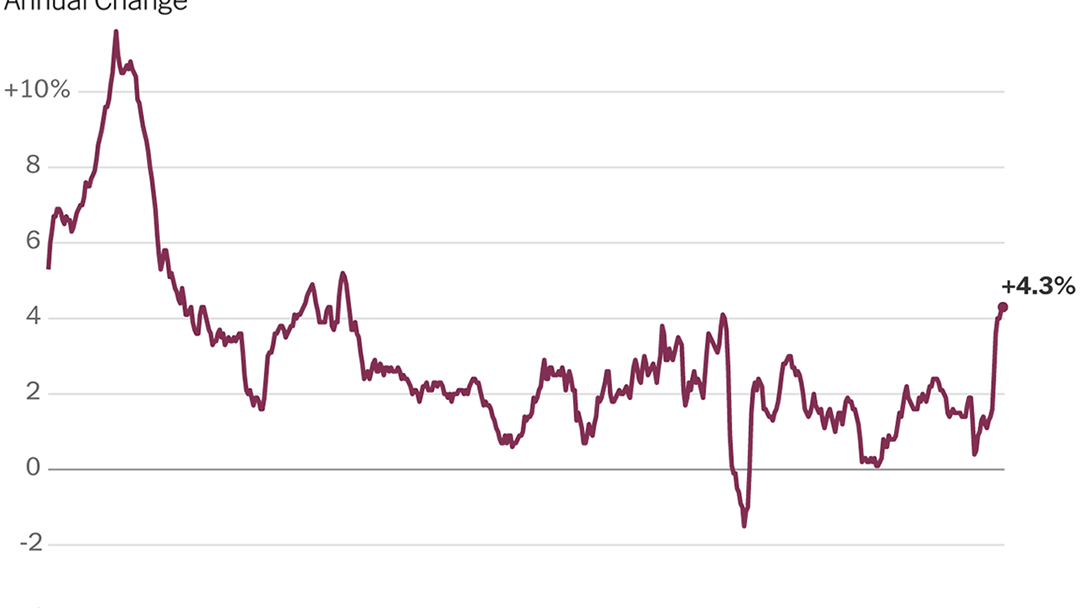

The Federal Reserve’s preferred gauge of inflation climbed in August at the quickest pace in 30 years, data released on Friday showed, keeping policymakers on edge as evidence mounts that rapidly rising prices are poised to last longer than practically any of them had expected earlier this year.

The numbers come at a pivotal moment, as inflationary warning signals abound. Used car prices show signs of picking up again, costs for raw goods like cotton and crude oil are increasing and companies continue to experience pain from persistent supply chain disruptions.

That is stoking fears in Washington and on Wall Street that although rapid price gains will eventually fade, the adjustment could drag on for months. A longer burst of inflation raises the chances that consumers will change their expectations and behavior, paving the way for more permanent price increases.

It is a high-stakes juncture for policymakers. The Fed is preparing to withdraw some of its support for the economy soon, but it would prefer to do so only gradually, given the millions of Americans who remain out of work. The White House is trying to pass two big policy packages at the core of President Biden’s economic agenda, and Republicans have begun wielding every new inflation data point as an argument against more federal spending.

Pandemic-related disruptions have caused the bulk of this year’s pop in prices, which is why economists and White House officials continue to predict they will eventually recede. A spike in demand from stuck-at-home workers and families for furniture, electronics and other products collided with factory shutdowns in Asia and overwhelmed shipping routes.

The inflation measure released on Friday, the Personal Consumption Expenditures index, rose 4.3 percent in the year through August, beating out the previous month’s reading of 4.2 percent. And it is increasingly clear that getting back to normal will not be a quick process. Factory shutdowns continue to ripple through the global supply chain. Shipping snarls may worsen as the holiday season approaches. Rents are rebounding at a breakneck pace after a pandemic swoon, threatening to push housing inflation — an important part of overall price indexes — higher.

“It’s still quite an inflationary environment going into next year, and that isn’t going to be good for growth,” said Laura Rosner-Warburton, an economist at the research firm MacroPolicy Perspectives. “They need to be monitoring things very closely. This is a huge shock.”

Wages are rising, but in many cases not quickly enough to overcome the rapid run-up in prices, Ms. Rosner-Warburton pointed out. A reduction in purchasing power threatens to create a cycle in which consumers buy less while goods and services are becoming more expensive because of supply limits, a situation often called “stagflation.”

That remains a risk — not a baseline expectation — but the possibility of lingering inflation increasingly worries economists, companies and even some policymakers.

It is “frustrating to see the bottlenecks and supply chain problems not getting better — in fact, at the margin, apparently getting a little bit worse,” Jerome H. Powell, the Fed’s chair, said while speaking on a panel on Wednesday. “We see that continuing into next year, probably, and holding inflation up longer than we had thought.”

Phil Levy, the chief economist at the logistics firm Flexport, said his company expected supply chain issues to begin easing next summer at the earliest. But as labor issues bubble up at long-overburdened ports, that could take even longer.

And in the near term, trouble finding shipping space could translate to shortages of toys and trinkets during the holiday season, causing companies to lift prices to make sure their supply lasts, Mr. Levy said.

“Ports are under strain, with ships backed up. We are short on truckers. We have warehouses that are packed full,” he said, later adding: “There was a sense a year ago that this would be a short-lived thing — there would be a craze, a squeeze, and then it would let up. The interpretation of ‘transitory’ has changed.”

While central bankers have long expected price gains to slow down, their guesses at how quickly that moderation will happen have been increasingly glum. In their latest economic projections, Fed officials forecast that the Personal Consumption Expenditures index will average 4.2 percent in the final quarter of 2021 — up from 3.4 percent in their June estimates — before declining to 2.2 percent by the end of next year.

Latest Updates

- Key takeaways from the fourth week of the Elizabeth Holmes trial.

- Disney World’s 50th anniversary celebration begins, with much at stake.

- Debt limit squabbles could cost the United States its AAA rating, Fitch warns.

The Fed aims for 2 percent inflation on average over time, though it is happy to tolerate higher periods as long as they are not expected to last.

Today’s price problem is a surprising one. Central bankers across advanced economies had spent most of the last decade wrestling with too-low, rather than too-high, inflation. That’s one of the reasons officials expect price gains to cool — once the pandemic shock recedes, long-running forces like population aging and technology should dominate.

But for now, officials are watching to make sure the current jump fades, and they are positioning themselves for the possibility that it might not.

The Fed clearly signaled at its latest meeting that it could announce a plan to dial back its big bond-buying program as soon as November, the first step in removing monetary policy support for the economy. Some Fed officials have pointed out that bringing the bond-buying program to a close soon could leave the central bank more nimble, should it find that it needs to raise interest rates — its more powerful tool, currently still near zero — to tamp down demand and wrestle inflation back to its goal.

Inflation and supply issues also pose a headache for President Biden’s White House, as rising costs chip away at voters’ paychecks and as houses and cars prove sharply more expensive and difficult to buy.

Administration officials are focusing on the fact that a “core” price index, which strips out volatile food and fuel prices, has been slowing somewhat on a monthly basis, a senior White House official said on Friday. That measure climbed 0.3 percent in August from July, roughly the same as the previous month and down from a peak of 0.6 percent earlier this year.

But the headline-grabbing annual numbers are giving Republicans political fodder, with many blaming the jump in prices on government spending and using it to argue against additional outlays.

“Regardless of what the White House press team says, I think people are really seeing the impact of higher prices, day in, day out,” Representative Bryan Steil, a Republican from Wisconsin, while questioning Treasury Secretary Janet L. Yellen and Mr. Powell during a hearing on Thursday. He later suggested that “runaway spending” in Washington would increase consumer inflation expectations.

The White House argues that stimulus from Mr. Biden’s infrastructure and social spending legislation would trickle out over time and could improve economic capacity, relieving supply chain pressures over the longer run.

But the administration and Fed alike are watching closely to make sure that consumers do not come to expect ever-higher prices amid today’s burst in inflation.

“The real question is, when your boss says, ‘Hey, I’m giving you a 4 percent raise this year,’ are you happy or upset?” Mr. Levy, the Flexport economist, said. “Once that stuff gets built in, it can be very painful to change.”

Encouragingly, consumer and financial market expectations of where inflation will settle over the longer term — typically five years — seem to have leveled off after climbing slightly earlier in 2021.

Still, companies are planning for the possibility that supply chain disruptions and rising costs will persist for some time.

“We’re not expecting supply chain pressures to ease,” Mark J. Tritton, chief executive officer at Bed Bath & Beyond, said during an earnings call on Friday. He noted that the company was trying to adjust how it operated to deal with the issues, including by trying to carefully manage inventory.

General Motors and Honda both reported significant declines from a year earlier in sales during the three months that ended in September as chip shortages forced them to idle plants, leaving dealers with few vehicles to offer customers. And as used cars remain in short supply, their prices — a major driver of inflation this year — could rise again.

The pain is being felt across many advanced economies: Inflation in the eurozone climbed to 3.4 percent in September from a year earlier, the highest in 13 years, according to an estimate by the region’s statistical agency released on Friday.

Omair Sharif, founder of the research firm Inflation Insights, said he still expected U.S. price increases to fade to more normal levels by the middle of next year — but acknowledged that it was going to take longer to resolve supply problems than he would have expected even three months ago.

“We just had blinders on with the global supply chain,” he said.

Neal E. Boudette and Eshe Nelson contributed reporting.