ACROSS Britain, Trending In The News on Sunday’s readers are feeling the squeeze.

The extra demand caused by global industry roaring back into life post-Covid, together with Vladimir Putin’s abhorrent invasion of Ukraine, are pushing up prices all around the world.

And every day you can see exactly what all that means for you and millions of others . . .

When you get to the till in the supermarket, when you see the digits spinning ever faster at the petrol pump, and when your latest energy bill lands on the doormat.

We know it’s tough but we want you to know that this government is on your side.

And while it will be tough, we will get through this.

READ MORE ON COST OF LIVING

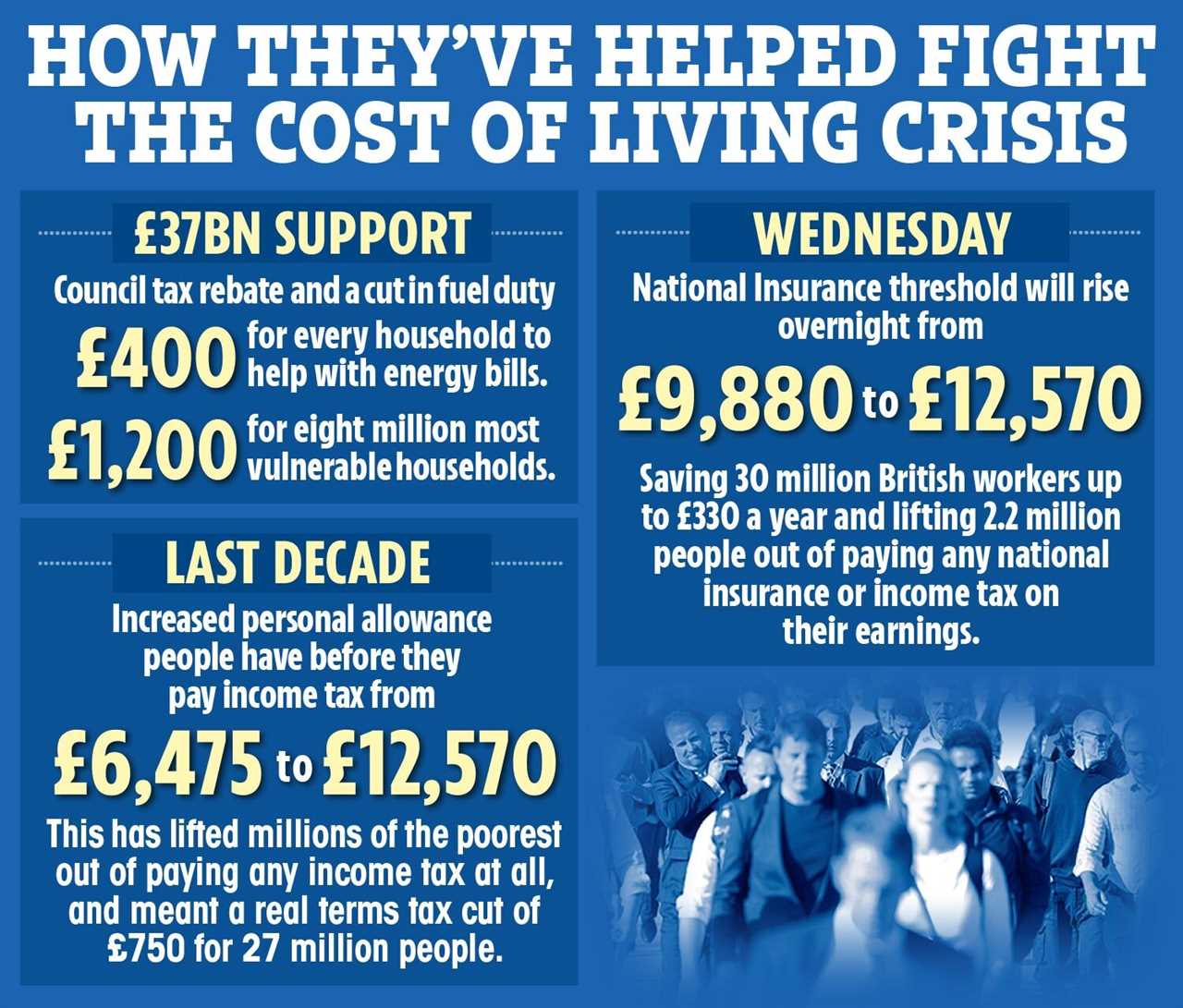

That’s why we are helping households across the country with £37billion of financial support.

It includes a council tax rebate, a cut in fuel duty, at least £400 for every household to help with energy bills and at least £1,200 for the eight million most vulnerable households.

We’re delivering the biggest ever increase in the National Living Wage, worth an extra £1,000 a year for those working full-time.

And we’re helping another million families keep around £1,000 extra a year by cutting the Universal Credit taper rate.

Conservatives in government cut taxes for working families.

Over the last decade we have increased the personal allowance people have before they pay any income tax from £6,475 in 2010 to £12,570 today.

This has lifted millions of the poorest out of paying any income tax at all, and meant a real terms tax cut of £750 for 27million people.

And this Wednesday, the National Insurance threshold will rise overnight from £9,880 to £12,570 — saving 30million British workers up to £330 a year.

It will also lift 2.2million people out of paying any National Insurance or income tax on their earnings at all.

As a result, Sun on Sunday readers will be better off. It’s the single biggest tax cut in a decade, worth £6billion.

It means around 70 per cent of British workers will pay less National Insurance.

And that’s even after accounting for the Health and Social Care Levy that is funding the biggest catch-up programme in NHS history — and putting an end to spiralling social care costs.

So, whether you work in a factory, or are a care worker, a hairdresser or a graphic designer, this week’s tax cut is likely to make you and your family better off.

You can find out exactly what it will mean for you by visiting the Government’s Cost of Living page on gov.uk and using the calculator.

And then check your next payslip to see more of your pay going directly into your pocket.

We’re able to do this because of the extraordinary success of the vaccine roll-out. Together with the furlough scheme that protected millions of jobs, it allowed us to emerge from the pandemic earlier than other nations.

That gave us the fastest growth in the G7 last year and close to the lowest unemployment since 1974 — building up the reserves of fiscal firepower that we are now deploying on your behalf.

But we also need to be sensible and responsible with the national finances.

The support we provided during Covid reached almost £400billion — the equivalent of roughly £5,500 worth of debt for every person in the UK.

It is a price worth paying to save countless lives and livelihoods, but not a bill any of us would want to simply leave to our children and grandchildren.

That is why we have always asked those with the broadest shoulders — and the biggest businesses — to play their part in our collective effort to pay off the nation’s debt.

And there’s another fundamental truth on fighting rising prices — we can’t just spend our way out of the problem.

If we are going to bring down the cost of living, then we need to rebuild and grow the economy and focus our efforts on the underlying problems that hold us back.

MASSIVE AGENDA

So we’re taking forward a massive agenda of reform and improvement to fix the problems in our energy and housing markets, and to get government spending less of your money.

Also, to back private sector-led growth using the benefits of Brexit to bust the bureaucratic burdens on business.

We are making our country more productive by investing in infrastructure, skills and technology. And in levelling up by making it easier for you to get a well-paid job whether you live in central London, the North of Scotland or anywhere in between.

And in the Autumn, we will bring forward business tax cuts and further reforms to encourage them to invest more, train more and innovate more — all of which will lead to higher growth.

Read More on Trending In The News

The coming months will not be easy, and we should not pretend otherwise.

But, together, we will steer our way through these global economic headwinds, rebuilding and growing the economy — with better jobs, higher wages and a brighter future for you and your family.