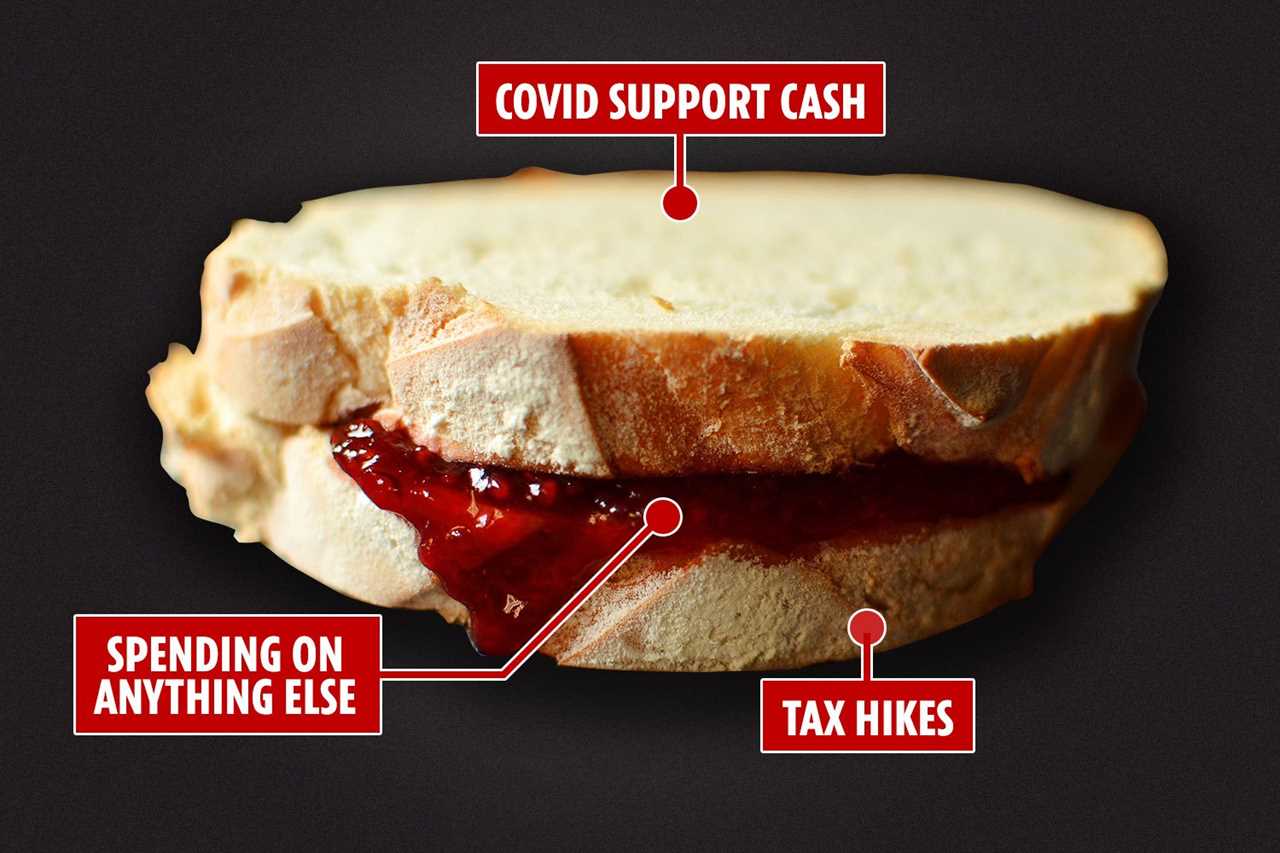

RISHI Sunak’s Budget next week will be an expensive and painful sandwich of giveaways and tax hikes.

Insiders are calling it “two big slices of bread with very thin jam”.

Read our coronavirus live blog for the latest news & updates…

Slice one is a £30billion Covid support bundle that will see furlough, business relief, the Universal Credit uplift and stamp duty holiday all extended to June.

Doing this for three months more, to bring those measures in line with the Government’s programme for coming out of lockdown, leaves “thin jam” — or little to spend elsewhere.

Slice two is a painful package of tax hikes to start raising billions to close the UK’s budget deficit, which will hit £400billion by April.

Experts say that needs reducing by around £30-40billion now to stabilise borrowing and prevent debt from rising as a percentage of national income.

The Institute for Fiscal Studies has said: “Even if the Government was comfortable with stabilising debt at 100 per cent of national income — its highest level since 1960 — it would still need a fiscal tightening worth 2.1 per cent of national income, or £43billion.”

In a bid to prove to the world that Britain’s spending is not out of control, Chancellor Mr Sunak will likely announce a hike in corporation taxes — up to as much as 25 per cent from 19 per cent over a number of years.

Raising capital gains will target the rich, such as second-home owners.

A government source said: “Action needs to be taken now, not in November and not next year, but now.

“The Budget will make a start on that stabilisation. It can’t go the whole way in one fiscal event but it will make a start.”

Covid spending means “thin jam” for other giveaways.

Mr Sunak is under pressure to keep the freeze on fuel duty rises and give a lockdown recovery gift of slashed booze levies plus allocating cash for infrastructure plans in the North.

Labour has insisted: “Now is not the time for tax rises for families or businesses.”