KWASI Kwarteng has blamed the “incredibly difficult” economy for his sacking as Chancellor by friend and ally Liz Truss.

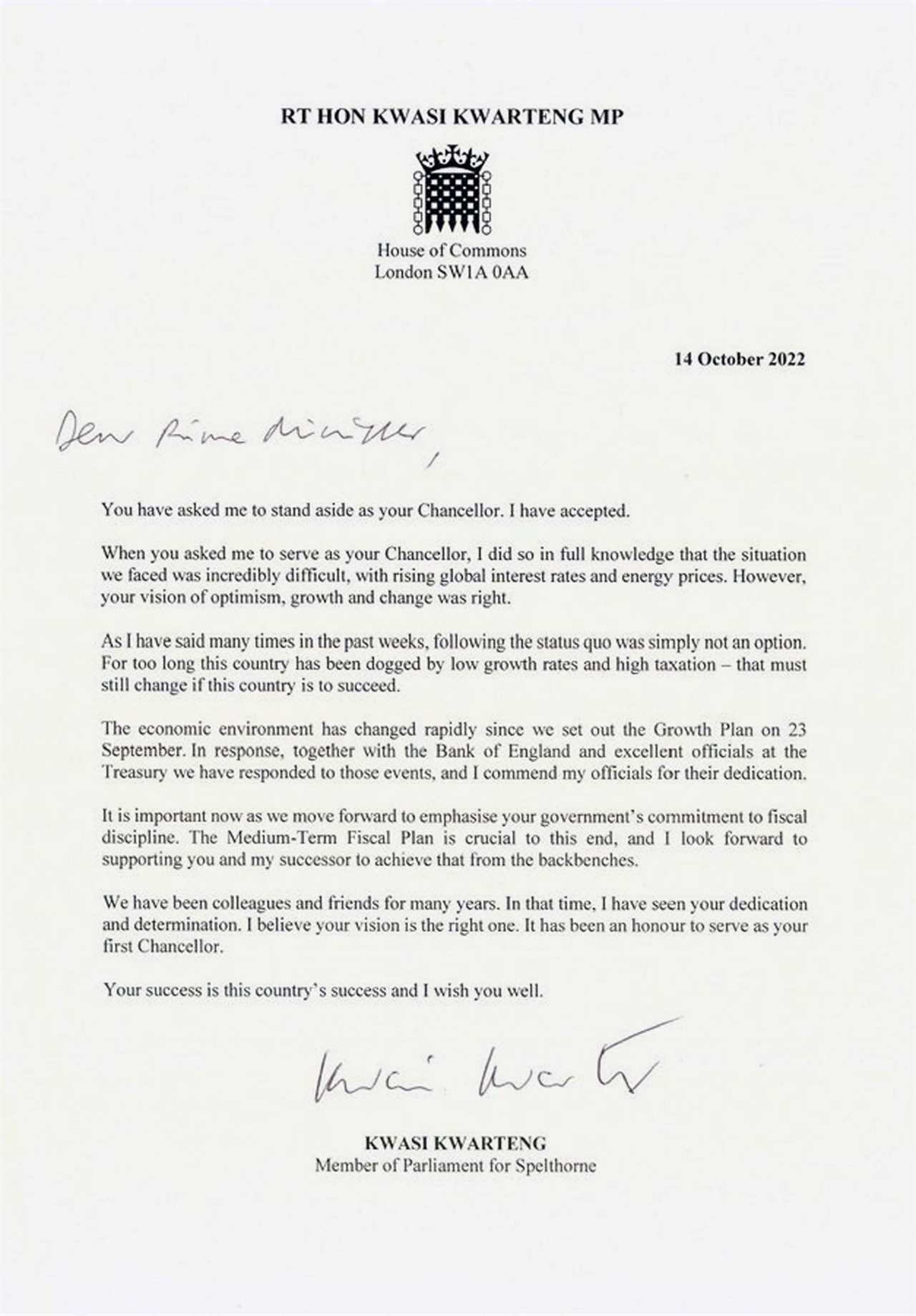

In a letter to the PM confirming his departure, the fired Chancellor said: “You have asked me to stand aside as your Chancellor. I have accepted.”

Kwasi Kwarteng was fired as Chancellor today

Liz Truss asked Kwasi Kwarteng to stand down as Chancellor this afternoon after he landed in London from the US

Kwasi Kwarteng’s resignation letter

Mr Kwarteng said he took on the job in the knowledge that Britain was facing rising interest rates and energy prices.

But the ex-Chancellor added he wanted to work with Ms Truss because he believed her “optimistic” vision to ignite “growth and change was right”.

Mr Kwarteng is expected to be replaced by former health secretary Jeremy Hunt.

The ex-Chancellor said: “It is important now we move forward to emphasise your government’s commitment to fiscal discipline… I look forward to supporting you from the backbenches.

“We have been colleagues and friends for many years. In that time, I have seen your dedication and determination. I believe your vision is the right one.

“It has been an honour to serve as your first Chancellor.”

Ms Truss fired Mr Kwarteng this afternoon, after the ex-Chancellor landed in London having cut a trip to the US short.

The PM made her close pal the government’s fall guy for the economic chaos as she looks to reset her battered premiership just weeks into the job.

Mr Kwarteng this morning arrived at Heathrow Airport after cutting short his trip to Washington for crisis talks in Downing St with Ms Truss.

But he was instead hauled in to No10 to be fired, later confirming he had been ditched in a letter “wishing Ms Truss well”.

Sticking by his tax-cutting vision, he said: “As I have said many times in the past few weeks, following the status quo was not an option.

“For too long this country has been dogged by low growth rates and high taxation – that must change if this country is to succeed.”

The PM will hold a solo press conference this afternoon where she is expected to u-turn on parts of her tax-cutting mini-Budget.

Markets rallied as Mr Kwarteng was sacked.

The FTSE 100 of leading shares was up around 1% on Friday.

The pound is trading over $1.12 against the dollar at the time of writing.

After the mini-Budget last month sterling fell to $1.03, its lowest level against the dollar since decimalisation in 1971.

It had jumped to over $1.13 on Thursday after it was revealed that Mr Kwarteng was for the chop.

The Bank of England was forced to take action after the pound plunged and markets went into turmoil over the Chancellor’s unfunded tax cuts.

It started buying up government bonds, also known as gilts, to stabilise financial markets.

The price of the 30-year gilt has gone up, pushing down the yield to 4.35%. Previously it was 5%.

People pay attention to the yields – the amount of interest on the bonds which is described in % terms – because this shows investors’ confidence in them.

The higher the yield, the cheaper the price, and the riskier investors think they are.

The bond buying is set to end today with the Bank of England earlier insisting that it would not be extended.

Labour’s Shadow Chancellor Rachel Reeves said: “Changing the Chancellor doesn’t undo the damage that’s already been done.

“It was a crisis made in Downing Street. Liz Truss and the Conservatives crashed the economy, causing mortgages to skyrocket, and has undermined Britain’s standing on the world stage.”