THE closure of Nigel Farage’s bank account was yesterday branded sinister by the Home Secretary.

Suella Braverman hit out at posh Coutts — as MPs said its operating licence should be at risk.

Nigel Farage’s bank account closure was branded sinister by the Home Secretary Suella Braverman yesterday

Meanwhile MPs said Coutts’ operating licence should be at risk

Parent bank NatWest is in talks with the Financial Conduct Authority, who said customers must be treated fairly.

And a Treasury-led industry crackdown on banks who discriminate against customers based on their political beliefs is expected within days.

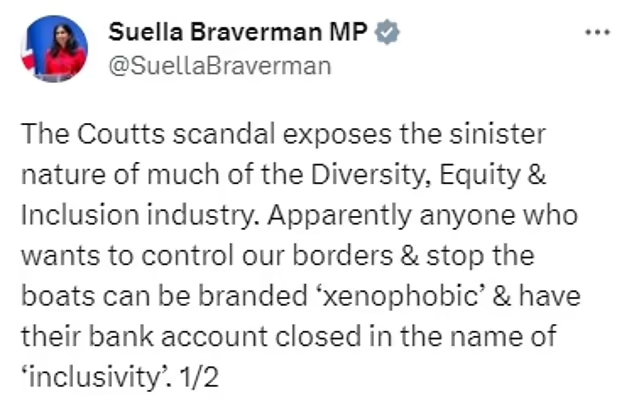

Ms Braverman wrote: “The scandal exposes the sinister nature of much of the Diversity, Equity and Inclusion industry.

“Apparently anyone who wants to control our borders & stop the boats can be branded ‘xenophobic’ & have their bank account closed in the name of ‘inclusivity’.”

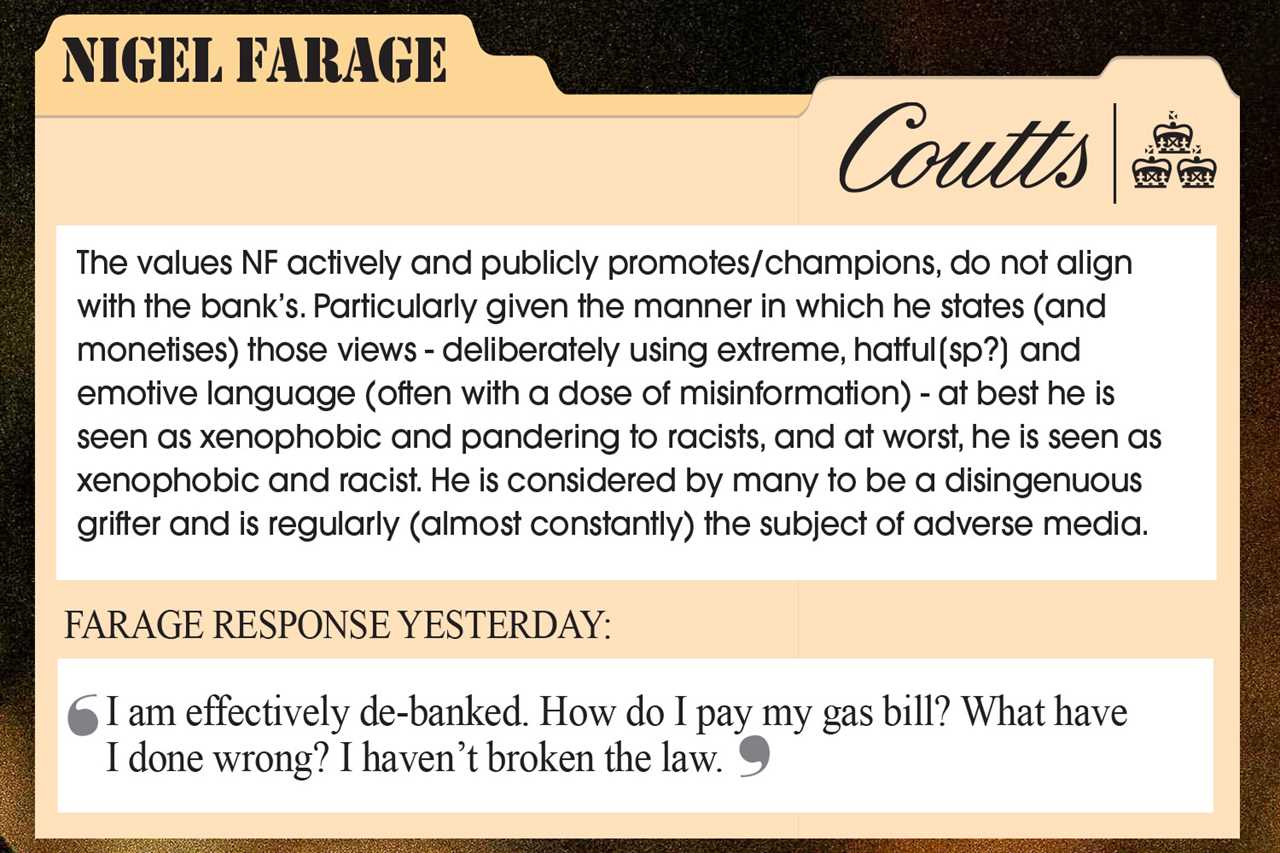

A memo to Coutts’ reputational risk committee has said Mr Farage was considered by many to be a “disingenuous grifter” with “xenophobic, chauvinistic and racist views”.

Yesterday, he raged: “I am effectively de-banked.

“How do I pay my gas bill? What have I done wrong? I haven’t broken the law. The whole thing is deplorable.”

He said UK banks were heading to a Chinese-style social credit system where only those with acceptable views could participate in society.

A Treasury source said Chancellor Jeremy Hunt was unaware banks had set up committees to police customers’ political views.

The source said: “It is a serious concern if the banks are denying access to anyone for exercising their lawful right to free speech.”

A change in law is expected where banks will have to give three months’ notice and give a reason to close an account.

PM Rishi Sunak said: “This is wrong. Free speech is the cornerstone of our democracy.”

Ex-Business Secretary Sir Jacob Rees-Mogg called for an inquiry.

Coutts said: “Decisions to close accounts are not taken lightly and take into account a number of factors including commercial viability, reputational considerations and legal and regulatory requirements.

“As the client has previously confirmed, alternative banking arrangements have been offered in the wider group.”

Farage’s response to Coutts bank

Suella Braverman tweeted her outrage at the Coutts bank scandal