The recent decline in cryptocurrency market

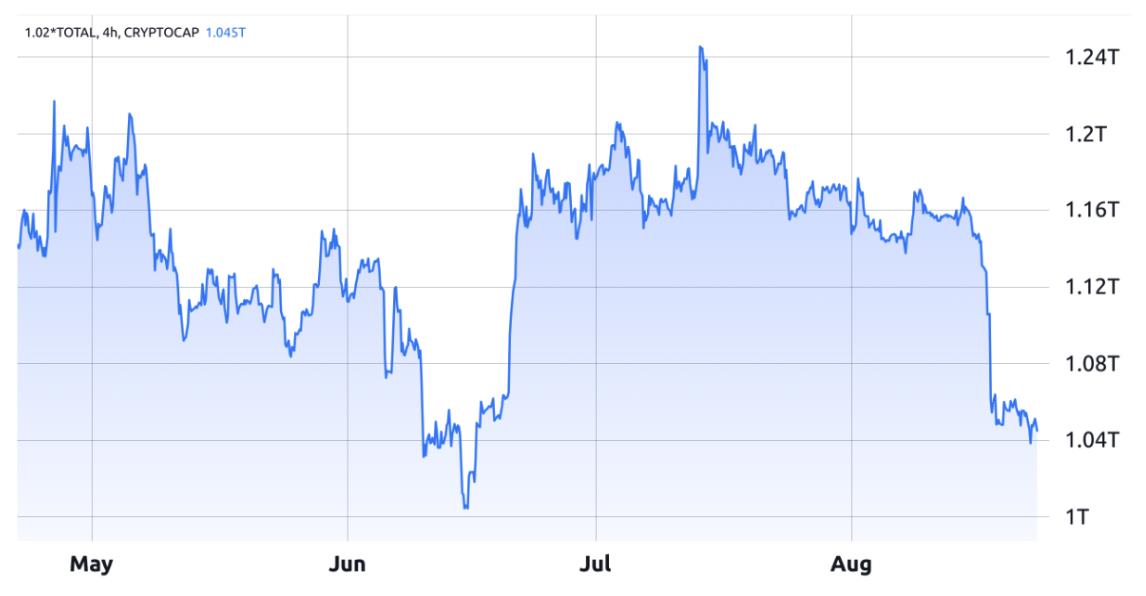

The cryptocurrency market has experienced a significant downturn, with the total market capitalization falling by 10% between August 14 and August 23. This drop resulted in the market reaching its lowest point in over two months, with a valuation of $1.04 trillion. This downward movement has triggered a wave of liquidations on futures contracts, the largest since the FTX collapse in 2022.

Economic factors contributing to the decline

Several economic factors have contributed to this decline. With interest rates surpassing 5% and inflation remaining above the targeted 2%, finance costs for families and businesses have risen. This situation puts pressure on consumer spending and economic expansion, leaving less money available for savings and potentially forcing individuals to liquidate their investments to cover monthly bills.

The Federal Reserve's (Fed) inflation expectations for 2024 stand at 3.6%, and average hourly earnings have increased by 5.5% year-over-year. These factors indicate that the Fed is likely to maintain or raise interest rates in the coming months. A high-interest-rate scenario favors fixed-income investments, which is detrimental for cryptocurrencies.

Inflation has decreased from its peak of 9% to the current 3%. Meanwhile, the S&P 500 index is only 9% below its all-time high. This could suggest a "soft landing" orchestrated by the Federal Reserve, indicating that the likelihood of an extended and profound recession is diminishing. This temporary situation undermines Bitcoin's investment thesis as a hedge.

Factors emerging from the cryptocurrency industry

Investor expectations for the approval of a spot Bitcoin exchange-traded fund (ETF) were high, especially with endorsements from companies like BlackRock and Fidelity. However, these hopes were dashed as the U.S. Securities and Exchange Commission (SEC) continued to delay its decision, citing concerns over insufficient safeguards against manipulation. Additionally, a substantial volume of trading continues to occur on non-regulated offshore exchanges, raising questions about the authenticity of market activity.

The Digital Currency Group (DCG) also faces financial difficulties. One of its subsidiaries owes over $1.2 billion to the Gemini exchange, and Genesis Global Trading recently declared bankruptcy due to losses stemming from the collapses of Terra and FTX. If DCG fails to meet its obligations, this situation could lead to forced selling positions in the Grayscale GBTC funds.

Regulatory tightening is further compounding the market's woes. The SEC has leveled charges against Binance exchange and its CEO Changpeng "CZ" Zhao, alleging misleading practices and the operation of an unregistered exchange. Coinbase is also facing regulatory scrutiny and a lawsuit regarding the classification of certain cryptocurrencies as securities, highlighting the ambiguity in U.S. securities policy.

U.S. Dollar strengthening amidst global economic slowdown

Signs of trouble stemming from lower growth in China have emerged. Economists have revised down their growth forecasts for the country, with both imports and exports declining in recent months. Foreign investment into China dropped by over 80% in the second quarter compared to the previous year. Additionally, unpaid bills from private Chinese developers amount to a staggering $390 billion, posing a significant threat to the economy.

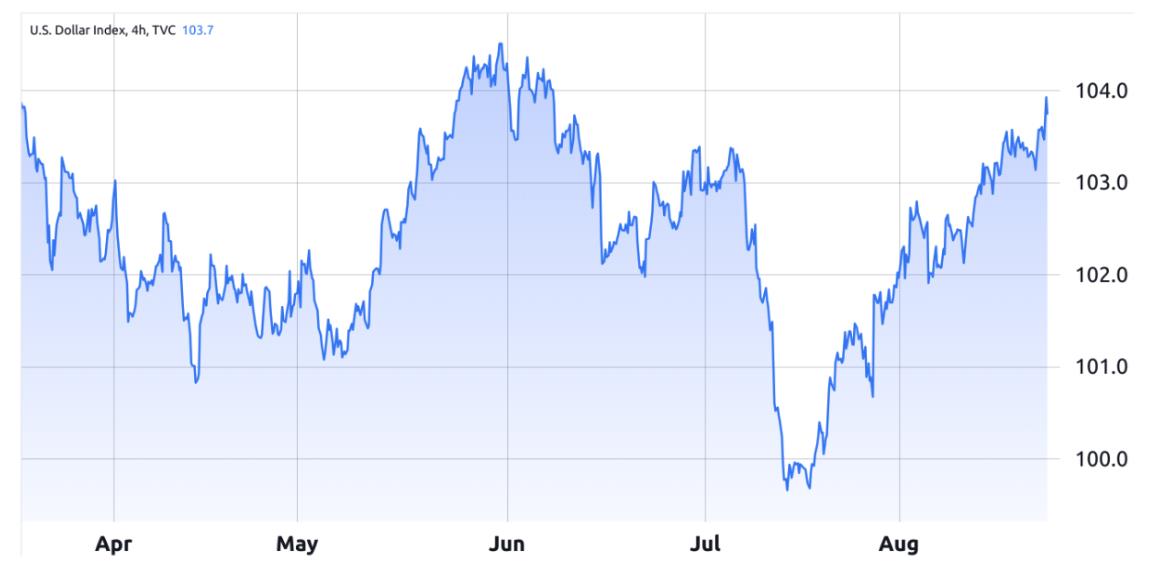

Despite the prospect of a deteriorating global economy, investors are showing a propensity to flock to the perceived safety of the U.S. dollar. This is evident in the movement of the DXY dollar index, which has surged from its July 17 low of 99.5 to its current level of 103.8, marking its highest point in more than two months.

The future of the crypto market

As the cryptocurrency market faces these multifaceted challenges, the ebb and flow of economic factors and regulatory developments will continue to shape its trajectory in the coming months. It's important to question whether the rally in mid-July, which saw the market capitalization rise from $1.0 trillion to $1.18 trillion, was justified in the first place instead of focusing solely on the recent 10% correction.

Please note that this article is for general information purposes and should not be taken as legal or investment advice. The views expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/kresus-launches-curated-marketplace-for-polygon-projects