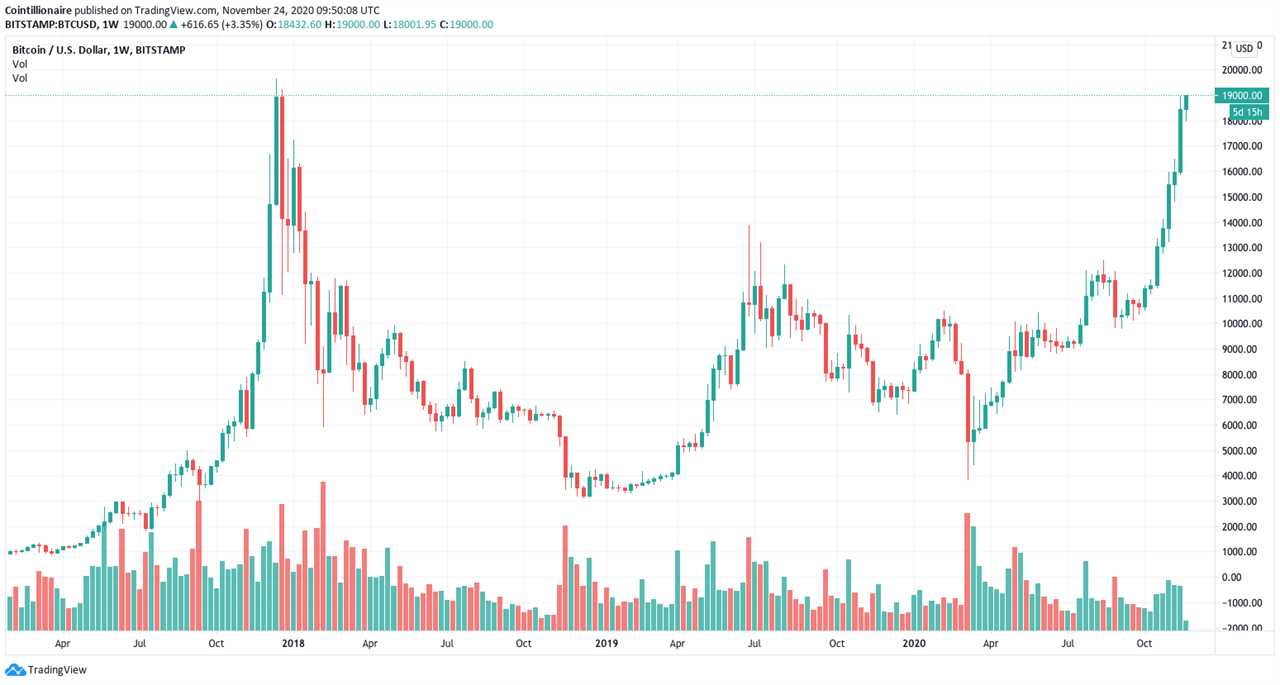

The price of Bitcoin (BTC) hit $19,000 on Nov. 24 for the first time since the historic rally in December 2017. Three key reasons are behind the dominant cryptocurrency’s strong momentum.

The main factors buoying BTC’s ongoing rally is whale accumulation, decreasing exchange supply and explosive volume trends.

Whales are still accumulating Bitcoin

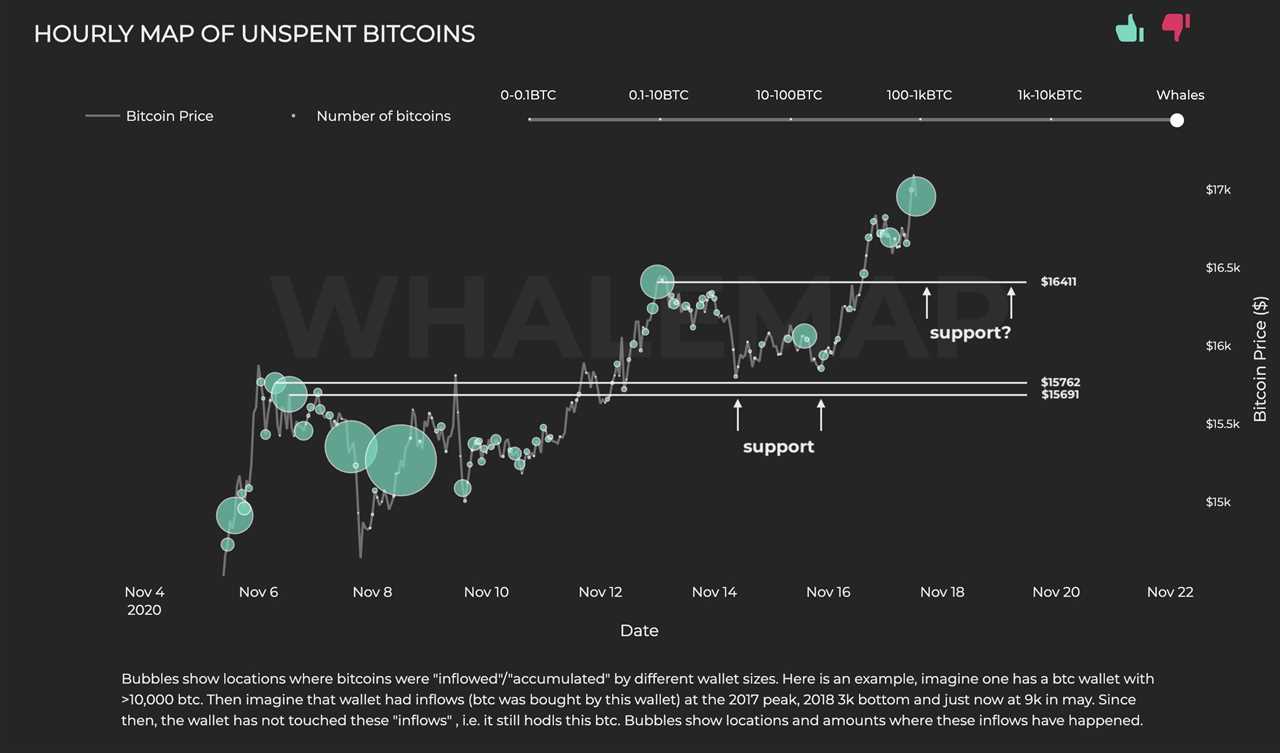

All throughout November, Cointelegraph reported that whale clusters were steadily forming as the price of Bitcoin rallied.

These clusters emerge when Bitcoin whales buy BTC at a certain price point and do not move them. Analysts have interpreted this as a signal that whales are accumulating and that they have no intention of selling in the near term.

The difference between the ongoing Bitcoin rally and previous price cycles is that the recent uptrend has proven to be more sustainable. In fact, each whale cluster shows that every major support level BTC reclaimed was accompanied by whale accumulation.

On Nov. 18, when Bitcoin dropped to as low as $17,200, analysts at Whalemap said that the new whale support is located at $16,411. They said:

“Bubbles indicate prices at which whales have purchased BTC that they are currently holding. Bubbles also visualize support levels. Last time we bounced from $15,762 and had a 15% price increase. Is the new bubble at $16,411 going to hold this time as well?”

Since then, Bitcoin has seen several more dips below $18,000 but has since recovered above $18,800, sustaining its strong momentum.

Furthermore, data from Santiment, an on-chain market analysis platform, shows a similar trend. Santiment researchers found that the number of BTC whales significantly increased in recent months. They explained:

“The amount of #Bitcoin whales with at least 10,000 coins (currently $185M or more) has ballooned to 114 the past couple days as prices soared above $18k. Additionally, the amount of holders with at least 1,000 $BTC ($18.5M) has hit an ATH of 2,449!”

Bitcoin's supply is drying up

One consistent trend throughout the 2020 bull cycle was the continuous drop in Bitcoin exchange reserves.

Investors and whales deposit BTC to exchanges when they want to sell BTC. Hence, the recent drop in exchange reserves means there are fewer sellers in the market.

A pseudonymous trader known as “Byzantine General” said that every time spot exchanges expand their BTC reserves, they get accumulated. He said:

“Everytime spot exchanges add to their $BTC reserves it gets depleted almost immediately. Don't you get it? There's literally not enough supply.”

Volume is surging

The volume of both institutional and spot exchanges has been increasing rapidly since September. Open interest on Bitcoin futures and options at CME surpassed $1 billion in November and Binance’s BTC/USDT pair has consistently delivered over $1.5 billion in daily volume.

Various data points also show that the spot market has been leading the rally, not derivatives or futures markets. This trend makes the rally more stable and reduces the risk of massive corrections.

When the futures market accounts for the majority of the volume during a Bitcoin uptrend, there is a large risk of cascading liquidations. This time, the spot market has been leading the rally, thus making it more sustainable.

Title: Why Bitcoin price just hit $19,000 for the first time in 3 years

Sourced From: cointelegraph.com/news/why-bitcoin-price-just-hit-19-000-for-the-first-time-in-3-years

Published Date: Tue, 24 Nov 2020 09:50:59 +0000