The Rise and Fall of Ardana Labs

In 2021, Ardana Labs promised to revolutionize the stablecoin space with its innovative platform for the Cardano network. The project, called "Ardana," aimed to allow investors to lock up crypto collateral and mint fiat-pegged stablecoins, including a U.S. dollar-based token called dUSD. With $10 million in funding raised from investors, Ardana seemed poised for success. However, the project abruptly shut down in November 2022 due to "funding and project timeline uncertainty."

New Evidence Raises Questions

While some attributed Ardana's collapse to the challenging market conditions of the "crypto winter" in 2022, a blockchain risk-management platform called Xerberus has uncovered evidence that suggests a different story. According to Xerberus, Ardana executives may have transferred 80% of the project's funds to a personal wallet and made risky crypto investments, resulting in a loss of approximately $4 million.

The Initial Hype and Prominent Backers

Ardana gained significant attention in the summer of 2021 when it announced partnerships with venture capital firms CFund, Three Arrows Capital (3AC), and Ascensive Assets. With $10 million in funding secured, investors had high hopes for Ardana's token, DANA. Additionally, Ardana revealed plans to collaborate with Near Protocol to create an asset bridge between Cardano and Near.

A Failed Launch and Closures

Despite the initial excitement, Ardana never launched its stablecoin platform or bridge. In November 2022, the project shut down, citing funding and project timeline issues. This closure coincided with the collapse of FTX and the bankruptcy of one of Ardana's backers, 3AC, making it seem like a natural outcome. However, Xerberus' analysis suggests that the real reason behind Ardana's failure may have been poor asset management practices by the project's officers.

Questionable Money Movements

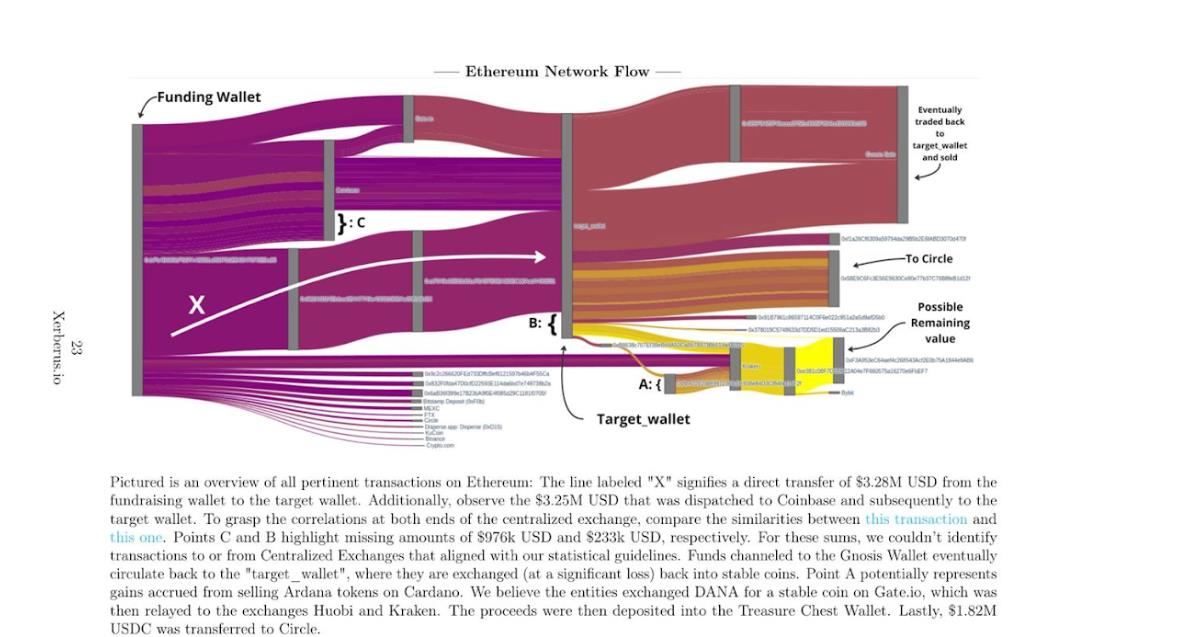

According to Xerberus, Ardana Labs collected funds from its initial coin offering (ICO) through an Ethereum wallet that later received millions of dollars worth of stablecoins. The funds were then moved through a series of intermediate steps before reaching a personal wallet of Ardana's founder, Ryan Motovu. There, the funds were used for a series of bad crypto investments, leading to significant losses.

CeFi Exchanges and the Missing Funds

Xerberus also claims that Ardana's team sent $4 million through centralized exchanges, including Kraken, Coinbase, and Gate.io, before transferring the funds to the personal wallet. While tracking these funds became more challenging after they entered the exchanges, Xerberus was able to identify many outgoing transactions that matched the amounts deposited. This evidence suggests that the same user made these transactions, hinting at Ardana's team involvement.

Remaining Funds and Development Costs

Despite the losses, Xerberus identified approximately $1.82 million worth of funds that were spent on development costs and team salaries. Additionally, the project still holds around $1.4 million worth of stablecoins in a wallet referred to as the "Treasure Chest" account.

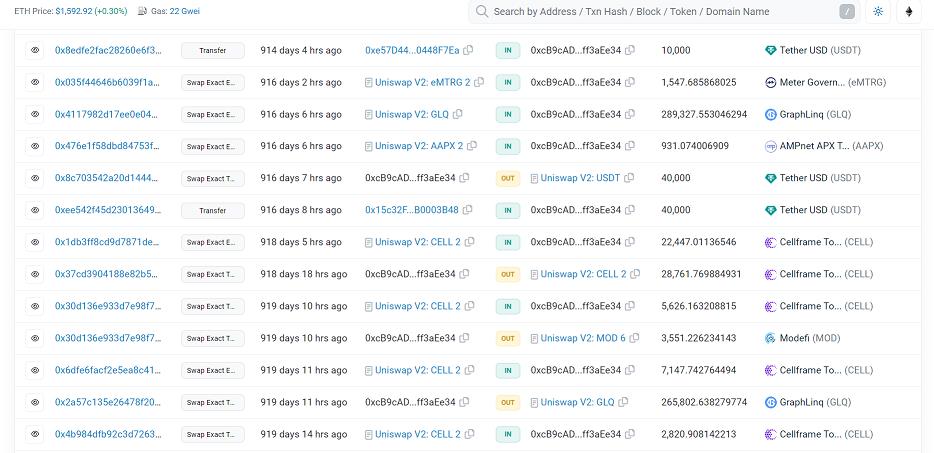

Nearly $4 Million Lost in Bad Trades

Xerberus' analysis reveals that almost $4 million was lost through bad trades made by the Target Wallet, where the funds were ultimately transferred. The wallet owner also used Safe multisignature accounts to make trades on decentralized exchanges like PancakeSwap, Uniswap, SushiSwap, and GMX, resulting in near-total losses.

The End of Ardana

In March 2022, Ardana's wallets began selling off assets on DEXs, continuing until November 2022 when the project officially announced its closure. The funds obtained from these sales still remain in the treasury wallet. Xerberus believes this investigation into Ardana will help fine-tune their risk model to make crypto markets safer for investors.

A Sober Reminder for Investors

The collapse of Ardana serves as a cautionary tale for investors who eagerly support Web3 startups without functioning products. Despite the potential for significant gains, such projects also carry the risk of catastrophic losses. Investors are advised to closely examine a project's on-chain behavior before considering any investments.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoin-price-drops-as-investor-confidence-wanes-amid-economic-concerns-and-etf-disappointments