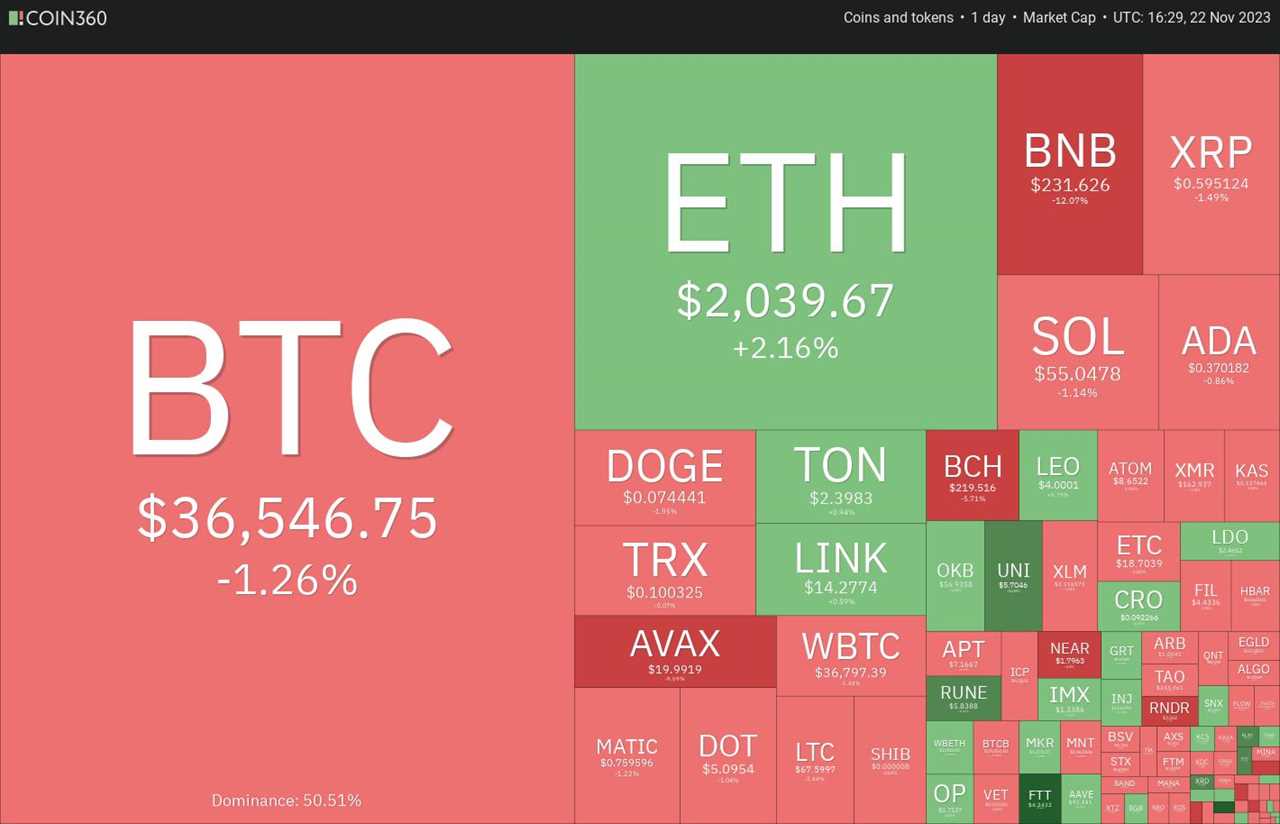

Bitcoin and altcoins find support after initial drop

Bitcoin and several major altcoins experienced a sharp decline following news of Binance's settlement with the US Department of Justice. However, traders stepped in to buy at lower levels, suggesting a positive sentiment in the market. The bulls are expected to face resistance from the bears, resulting in a range-bound action.

Bitcoin price analysis

Bitcoin fell below the 20-day exponential moving average ($35,948) but quickly bounced back above it. The cryptocurrency has been consolidating between $34,800 and $38,000, with the 20-day EMA sloping up, indicating a potential uptrend. If the price surpasses $38,000, it could rally to $40,000 and possibly even $48,000. On the other hand, a break below $34,800 may lead to further decline.

Ether price analysis

Ether slipped below the 20-day EMA ($1,957) but was bought aggressively by the bulls, pushing the price back up. The cryptocurrency is currently trying to break above the resistance line, which could trigger a rally to $2,137 and $2,200. However, a failure to hold the support at $1,880 may result in a deeper correction to the 50-day SMA ($1,791).

BNB price analysis

BNB experienced a wild ride, with a high of $272 and a low of $224. The bulls managed to prevent the price from breaking below the major support at $223, leading to a recovery. If the price sustains above the 20-day EMA ($240), BNB may consolidate between $223 and $265. However, a failure to hold above the 20-day EMA could pull the price back to $223 and potentially $203.

XRP price analysis

XRP fell to the 50-day SMA ($0.57) after turning down from the 20-day EMA ($0.61). The bulls are expected to defend the support at $0.56 to avoid a drop towards $0.46. If the price breaks above the 20-day EMA, it may range between $0.56 and $0.74 for a few days. A rise above $0.74 would indicate bullish strength.

Solana price analysis

Solana climbed above the critical overhead resistance of $0.59 but failed to maintain the higher levels. The bulls are defending the 20-day EMA ($51), with a potential challenge of the local high at $68 if they overcome the obstacle at $59. However, a turn down from $59 could signal bearish activity, potentially pulling the price below the vital support at $48.

Cardano price analysis

Cardano's repeated failures to stay above the breakout level of $0.38 triggered a correction. The cryptocurrency found strong support at the 20-day EMA ($0.35), indicating robust buying by the bulls. A break above $0.39 could lead to an increase in price towards $0.46. On the other hand, a drop below the 20-day EMA could push the price towards the 50-day SMA ($0.30).

Dogecoin price analysis

Dogecoin fell below the 20-day EMA ($0.07) but the bears struggled to sustain the lower levels. The bulls are attempting to push the price back above the 20-day EMA, signaling aggressive buying on dips. A clear break above the overhead hurdle at $0.08 could start a rally towards $0.10. However, if the bears sell rallies and keep the price below the 20-day EMA, a potential drop to the 50-day SMA ($0.07) and $0.06 support could occur.

Toncoin price analysis

Toncoin has been finding support at the 50-day SMA ($2.19), indicating positive sentiment and buying on dips. The cryptocurrency is currently range-bound, with both moving averages flat and the RSI just above the midpoint. If the price stays above $2.40, it may rise to $2.59. However, a break below the 20-day EMA could push the price towards the 50-day SMA, potentially leading to a downward move.

Chainlink price analysis

Chainlink turned down from the immediate resistance of $15.39 but rebounded above the 20-day EMA ($13.63), indicating demand at lower levels. If the price clears $15.39, it may retest the overhead resistance at $16.60. However, if the bears defend $15.39 and push the price below the 61.8% Fibonacci retracement level ($12.83), the cryptocurrency could drop to the 50-day SMA ($10.94).

Avalanche price analysis

Avalanche closed above the $10.52 to $22 range but couldn't maintain the higher levels. The 20-day EMA ($17.71) is sloping up, indicating bullish sentiment. If the price breaks above $22, it could start a new up-move towards $30. However, a turn down from $22 could lead to a break below the 20-day EMA and an extended period of range-bound trading.