Bitcoin’s (BTC) fundamentals received a boost as the U.S. Senate passed the $1.9 trillion stimulus bill on March 7. If traders react to this bill in the same way as they had done to the first stimulus package in April 2020, then the crypto markets may witness a strong rally.

The stimulus package also intensifies the focus on the devaluation of the U.S. dollar. These concerns could lead some investors to park their money in hard assets or Bitcoin instead of keeping them in fiat currencies, according to veteran trader Peter Brandt.

In addition to investors, a growing number of listed companies are choosing to protect their fiat reserves by buying Bitcoin. After the high-profile purchases by MicroStrategy, Tesla, and Square, a Chinese listed company called Meitu revealed that it had acquired $40 million worth of Bitcoin and Ether.

If other companies across the world also follow this lead and invest a portion of their treasury reserves in Bitcoin, that could create a massive supply and demand imbalance, sending prices through the roof.

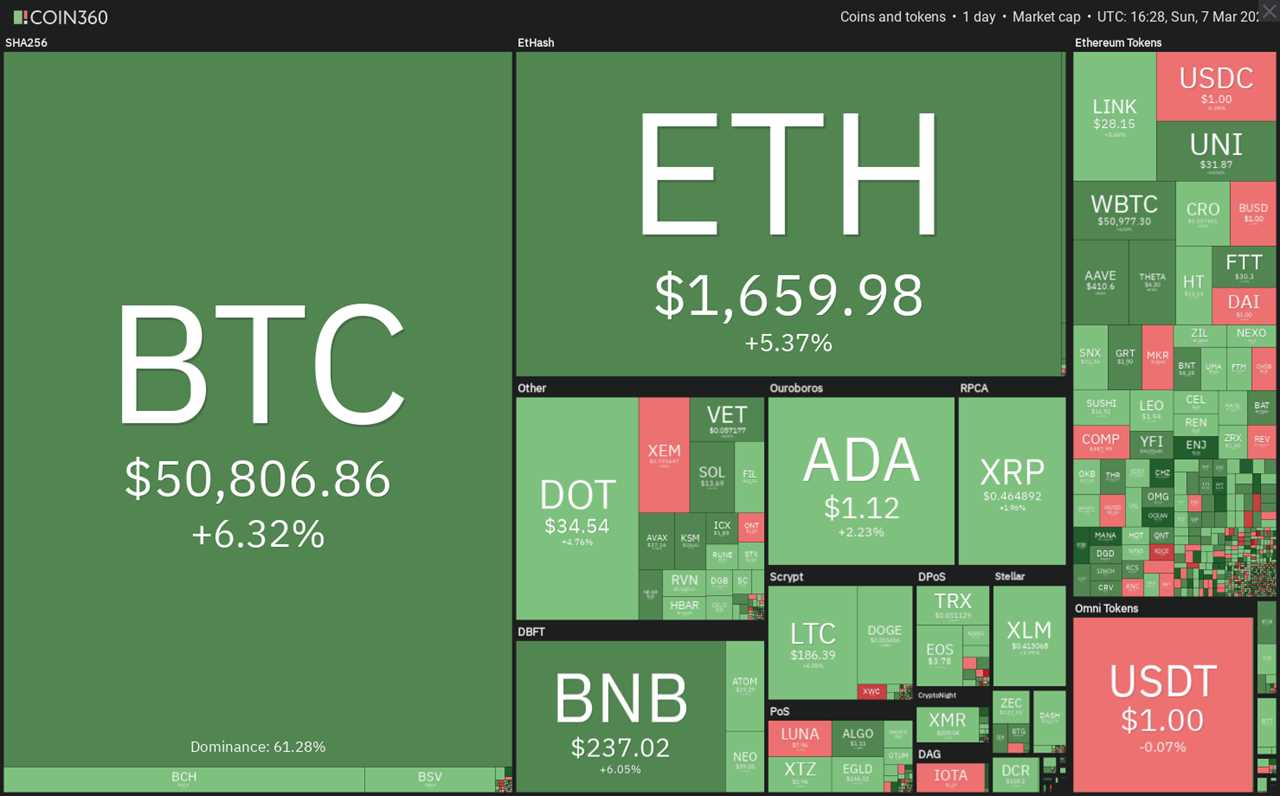

Let’s study the charts of the top-5 cryptocurrencies that may resume their uptrend in the short term.

BTC/USD

Bitcoin dipped below the 20-day exponential moving average ($48,484) on March 5 and March 6 but the long tail on each candlestick shows buyers are ready to jump in at lower levels. The bulls have currently pushed the price toward the $52,040 overhead resistance.

While the 20-day EMA is flat, the relative strength index (RSI) has started to turn up and it has risen above 58, indicating that the bulls are attempting to make a comeback.

If the buyers can propel the price above the resistance, the BTC/USD pair may retest the all-time high at $58,341. A breakout of this level could start the next leg of the uptrend, which may reach $72,112.

Contrary to this assumption, if the price turns down from the overhead resistance and breaks below $46,313, the pair may drop to the 50-day simple moving average at $42,861. This level is likely to act as a strong support.

If the pair rebounds off this support, the pair may spend a few more days in consolidation. But if the bears sink the price below $41,959.63, traders may rush to the exit, which could signal a possible change in trend.

The pair has formed an inverted head and shoulders pattern on the 4-hour chart that will complete on a breakout and close above $52,040. This bullish setup has a pattern target of $61,075.

The 20-EMA has started to turn up and the RSI has jumped above 62, indicating a minor advantage to the bulls.

This bullish view will invalidate if the price turns down from the current levels or the overhead resistance and breaks below $47,000. Such a move could open the doors for a decline to the next major support at $41,959.

UNI/USD

After consolidating near $29 for three days, Uniswap (UNI) has broken out of the overhead resistance today. If the bulls can sustain the price above $29, it will enhance the prospects of the resumption of the uptrend.

Both moving averages are sloping up and the RSI is in overbought territory, which indicates that bulls are in command. If the UNI/USD pair rises above $33, the next level to watch out for is $38 and then $46.

This bullish view will invalidate if the price turns down from the current levels and breaks below the 20-day EMA ($25.31). If that happens, the pair may drop to $22 and then to the 50-day SMA ($19.78).

The 4-hour chart shows that the bears are likely to defend the $32 overhead resistance aggressively. However, if the bulls do not allow the price to dip below the 20-EMA, it will signal strength. A breakout and close above the $32 to $33 zone may start the next leg of the up-move.

This bullish view will invalidate if the price turns down and breaks below the 20-EMA. Such a move will suggest that traders are booking profits on rallies. The pair could then drop to the 50-SMA.

THETA/USD

THETA is in a strong uptrend. Although the altcoin turned down on March 7, the long tail on the March 8 candlestick shows buying at lower levels. Corrections in a strong uptrend generally last for one to three days after which the main trend resumes.

The rising moving averages and the RSI near the overbought zone suggest the bulls are in control. If buyers can drive the price above $4.72, the THETA/USD pair may resume the uptrend and rally to $5.73.

On the contrary, if the price turns down from the $4.50 to $4.72 overhead resistance zone, the pair may drop to the 20-day EMA ($3.58). A strong rebound off this support will suggest the sentiment remains positive as the bulls are buying the dips.

If the bears sink the price below the 20-day EMA, a deeper correction to the 50-day SMA ($2.82) is possible. Such a move will indicate that the momentum has weakened and may delay the resumption of the up-move.

The 4-hour chart shows the 20-EMA is rising and the RSI is in the positive zone. If the bulls can push and sustain the price above the downtrend line, the pair may retest $4.72. A breakout of this resistance could start the next leg of the uptrend.

On the other hand, if the price continues to correct, it may find support at the 20-EMA. If that happens, the bulls will again try to propel the price above the downtrend line. However, a break below the 20-EMA may pull the price down to $3.85.

VET/USD

VeChain (VET) is currently stuck in a large range between $0.0345 and $0.060774. The price had reached the resistance of the range, but the long wick on today’s candlestick shows profit-booking near $0.060774.

However, the moving averages are sloping up and the RSI has also inched higher into the positive territory, suggesting that the path of least resistance is to the upside. If the bulls can push and sustain the price above $0.060774, the VET/USD pair may start the next leg of the uptrend.

The first target on the upside is $0.087048 and if this level is also crossed, the pair may rise to $0.10.

Contrary to this assumption, if the price turns down from the current level, the pair may drop to the 20-day EMA ($0.047). A bounce off this support will suggest that the uptrend remains intact, but a break below it may bring the range-bound action into play.

The 4-hour chart shows some profit-booking near $0.060, but the positive sign is that the bulls have not allowed the price to collapse. If the pair rebounds off the 20-EMA, the bulls will make one more attempt to thrust the price above the stiff overhead resistance.

If they can sustain the price above $0.060774, the next leg of the uptrend could begin. However, if the price dips below the 20-EMA, the selling could intensify and the price may drop to the next support at the 50-SMA.

LUNA/USD

Terra (LUNA) is currently consolidating in a large range between $5 and $8.50 for the past few days. Both moving averages are sloping up and the RSI is near the overbought territory, indicating the path of least resistance is to the upside.

The bulls pushed the price above the range on March 5, but could not build up on the breakout as the price turned down and slipped back below $8.50 on March 6. This suggests that demand dried up at higher levels.

However, if the bulls do not give up much ground, it will indicate that traders are waiting to buy the shallow dips. If that happens, the buyers may make one more attempt to start the next leg of the up-move. If they succeed, the LUNA/USD pair could rally to $12.

The long wicks on the candlesticks above $8.50 show profit-booking at higher levels and the bulls are currently attempting to defend the 20-EMA. If the price rebounds off the current levels, the buyers will again try to resume the uptrend by driving the pair above the $8.50 to $9 overhead resistance zone.

On the contrary, if the bears sink and sustain the price below the 20-EMA, the pair could dip to the 50-SMA. If the price bounces off this level, the pair may consolidate in the upper half of the range for some time. A drop below the 50-SMA will be a signal that the price may settle into the $5 to $6 range.

Title: Top 5 cryptocurrencies to watch this week: BTC, UNI, THETA, VET, LUNA

Sourced From: cointelegraph.com/news/top-5-cryptocurrencies-to-watch-this-week-btc-uni-theta-vet-luna

Published Date: Sun, 07 Mar 2021 19:36:15 +0000