Stablecoin Issuer's Loans Grow in 2023

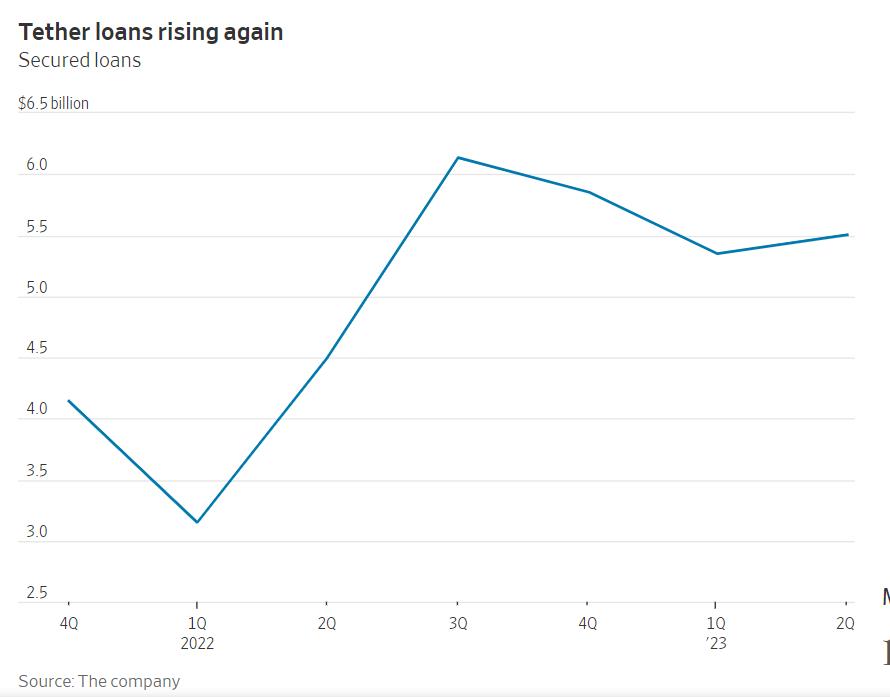

Despite announcing a plan to eliminate stablecoin loans in December 2022, Tether, the largest stablecoin issuer in the crypto market, has seen a rise in its lending activities in 2023.

Quarterly Report Reveals Loan Growth

In its latest quarterly report, Tether revealed that its assets included $5.5 billion of loans as of June 30, up from $5.3 billion the previous quarter.

Short-Term Loan Requests from Longstanding Clients

Tether explained that the recent increase in stablecoin lending was due to a few short-term loan requests from clients with whom the firm has cultivated longstanding relationships.

Controversy Surrounding Secured Loans

Secured loans, which allowed customers to borrow USDT from Tether in exchange for collateral, were always controversial due to a lack of transparency regarding the collateral and borrowers.

Tether Addresses Concerns

Tether addressed concerns about secured loans, calling them "FUD" or fear, uncertainty, and doubt, and claiming that the loans were overcollateralized.

Growing Market Dominance and Profit

Despite the controversy, Tether continues to dominate the market and has reported $3.3 billion in surplus reserves, a significant increase from $250 million in September last year.

Preserve this Moment in History

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.