Bitcoin (BTC) is off to yet another fighting start on Monday, hitting $59,500 — is this the week we see $60,000?

After a promising but restrained weekend, BTC/USD is once again back to beating out resistance as major markets reopen.

Given the strength of underlying technicals and buyer demand, bulls may have cause for celebration in the next few days. Resistance, however, has kept them in check for weeks.

Cointelegraph presents five things which may help to shape Bitcoin price action.

Dollar down on oil pipeline attack

Stocks began on a familiar positive note in Asia as traders betted on existing highs continuing to hit.

A fresh all-time high for the S&P 500 index last week ensured a buoyant mood, with the coronavirus pandemic doing nothing to sour what have been historic returns for various markets.

Commodities were dictated by the ransomware attack in the United States, which pushed oil prices to three-year highs before the market calmed.

“This interruption of the distribution of refined gasoline and jet fuel underscores the vulnerability of our national critical infrastructure in cyberspace and the need for effective cybersecurity defenses,” Bloomberg quoted a governmental statement as saying.

The dollar suffered as the attack hit, with the U.S. dollar currency index (DXY) suddenly tanking in a move which boosted Bitcoin beyond $58,000.

On Monday, with the pipeline still closed, only a modest rebound was evident, allowing the potential for further DXY-based gains for BTC/USD.

As Cointelegraph often reports, DXY and Bitcoin tend to be inversely correlated, but this relationship has become more unpredictable this year.

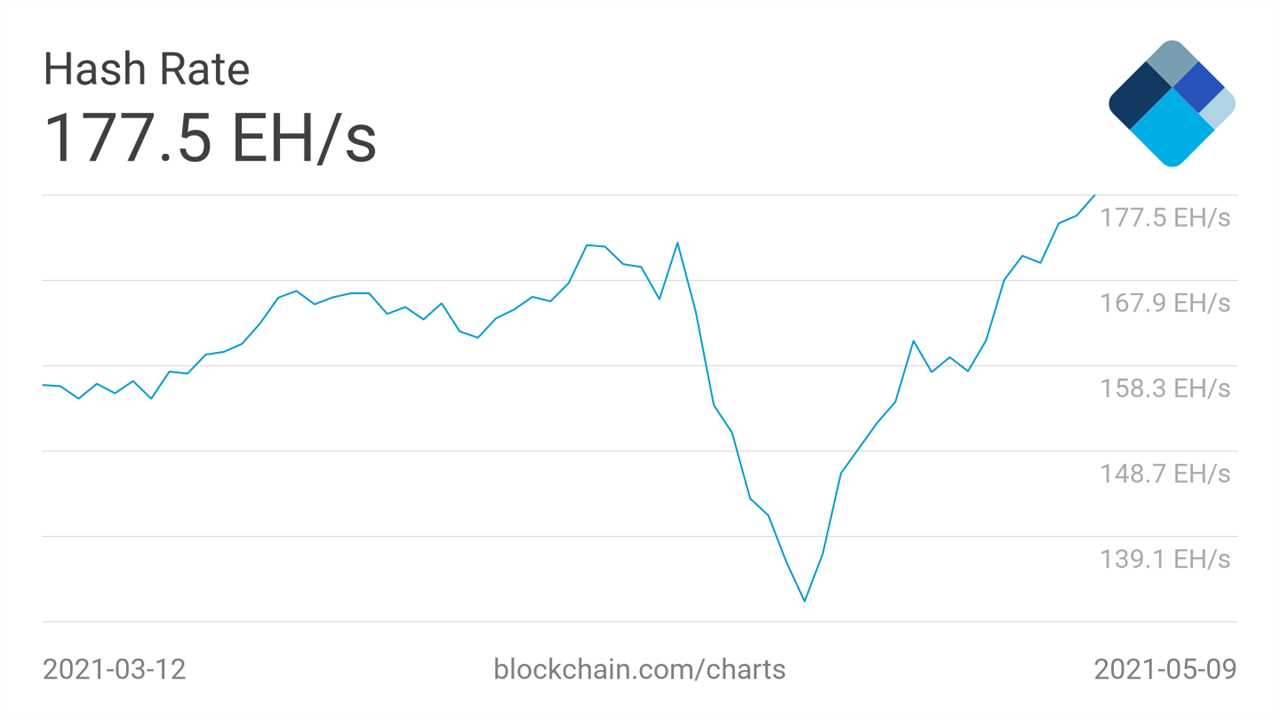

Record hash rate precedes major difficulty boost

It’s all systems go for Bitcoin — at least when it comes to network fundamentals.

Following the sudden hash rate dip last month — tied to miners being flooded in China — network strength and associated price performance have firmly recovered.

The process was already evident last week, with commentators noting that the negative impact of the event was practically behind Bitcoin already.

Now, however, forecasts reflect unprecedented interest and competition among miners, along with a firm commitment to the network’s future.

According to data from on-chain monitoring resource Blockchain, hash rate is now at new all-time highs, with its seven-day average going from 131 exahashes per second (EH/s) on April 25 to 177 EH/s as of Monday.

Difficulty, which automatically adjusted downwards to take account of the reduction in miners, is now also due for a major hike of its own when it adjusts again in around two days’ time.

At 13.5%, the projected difficulty increase is the largest since June last year.

If the old adage “price follows hash rate” proves itself to be as true today as previously, Bitcoin hodlers could feel the knock-on price benefits in the coming weeks.

BTC price on the verge of $60,000 takedown

On the topic of price benefits, traders this week are looking for a “springboard” effect in BTC spot price action which could lead to a breakout.

After climbing and reversing but broadly putting in higher highs and higher lows in recent days, Bitcoin is due to make a more committed statement.

On Monday, popular trader Crypto Ed said that a leg down from current levels near $59,000 should end around $800 lower before a resurgence takes out the pivotal $60,000 resistance zone.

“BTC plan for today: Smaller correction after 5 legs up. Looking for a bounce and continuation up towards 62k and 68k after that. Potential bounce area (green box) = 58100-58200,” he commented on Twitter alongside a projection chart.

The battle for final resistance near all-time highs of $64,500 has been raging for several weeks, with each attempt to overcome sellers ending in a price dip of various strengths.

A look at the order book structure on Binance, the biggest exchange globally by volume, showed that the $60,000 zone was still holding on Monday, backed up by incremented sell walls below the highs.

Buyer support, conversely, was only in evidence at $50,000, providing a wide potential trading range should BTC/USD drop again.

Ethereum blasts through $4,000

Bitcoin may have to wait for its ultimate push to take out the highs — altcoins are already running hot this week.

Led by Ethereum (ETH), Monday saw a return to form for the majority of the large-cap cryptocurrencies after mixed performance over the weekend.

ETH/USD, ever the surprise, shot past $4,000 on the day, showing no signs of slowing as it hit new all-time highs and confirmed traders’ forecasts of an attack on $5,000.

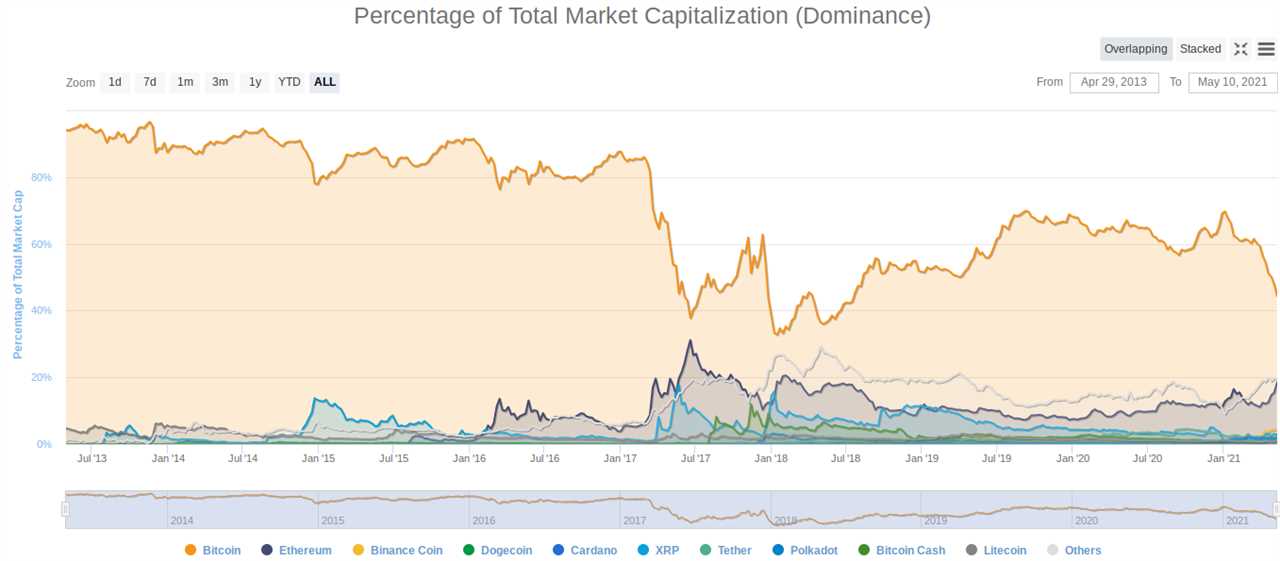

The largest altcoin’s gains were plain to see beyond simple price action. According to data from analytics resource CoinMarketCap, Ethereum’s overall share of the cryptocurrency market cap now stands at 19.1%.

That market cap passed $2.5 trillion on Monday, while Bitcoin’s share fell ever closer to 40%.

Crypto market value hits $2.5tn as #Ether hits record high >$4k. #Bitcoin’s price is currently ~$59k w/its dominance reaching 44%, lowest since 2018, while Ethereum’s dominance is at a record 18%. pic.twitter.com/vhI2I8QPPw

— Holger Zschaepitz (@Schuldensuehner) May 10, 2021

With ETH/USD up 31% in a week, other altcoins began to copy its success. Cadano (ADA) matched its gains, while Litecoin (LTC) and Bitcoin Cash (BCH) both reached almost 50% weekly returns.

High flyers from earlier were conversely much calmer, with Dogecoin (DOGE) and Ethereum Classic (ETC) both flat after reaching all-time highs of their own last week.

Strong hands increase their positions

Escaping the short-term narrative just for a moment meanwhile produces a familiar sensation that all is well in Bitcoin.

While altcoins boom on a trading frenzy, a slow but steady transfer of Bitcoin wealth from weak hands to strong is continuing, says popular statistician Willy Woo.

Analyzing data late last week, Woo stressed that this year’s bull run is different to the rest — because speculative hands are not lasting long and seasoned hodlers are buying up the slack at higher prices than ever.

“This cycle is different; the movement of coins to strong holders is unprecedented,” he summarized alongside the data from on-chain monitoring resource Glassnode.

As Cointelegraph reported, the trend has characterized various phases of 2021 when it comes to BTC price.

Title: Record fundamentals meet $4K Ethereum: 5 things to watch in Bitcoin this week

Sourced From: cointelegraph.com/news/record-fundamentals-meet-4k-ethereum-5-things-to-watch-in-bitcoin-this-week

Published Date: Mon, 10 May 2021 09:51:34 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/alipay-set-to-allow-users-test-chinas-digital-yuan