A bull trend is formed when demand exceeds supply and a bear trend occurs when sellers overpower the buyers. When the bulls and bears hold their ground without budging, it results in the formation of a trading range.

Sometimes, this leads to the formation of a rectangle pattern, which can also be described as a consolidation zone or a congestion zone. Bearish and bullish rectangles are generally considered to be a continuation pattern but on many occasions, they act as a reversal pattern that signals the completion of a major top or bottom.

Before diving in to learn more about the bullish and bearish rectangle patterns, let’s first discuss how to identify them.

Basics of the rectangle pattern

A rectangle is formed when an asset forms at least two comparable tops and two bottoms that are almost at the same level. The two parallel lines can be used to join the high and the low points, forming the resistance and support lines of the rectangle.

The duration of the rectangle could range from a few weeks to several months and if this time is shorter than three weeks it is considered a flag. Typically, the longer an asset spends in consolidation, the larger is the eventual breakout or breakdown from it.

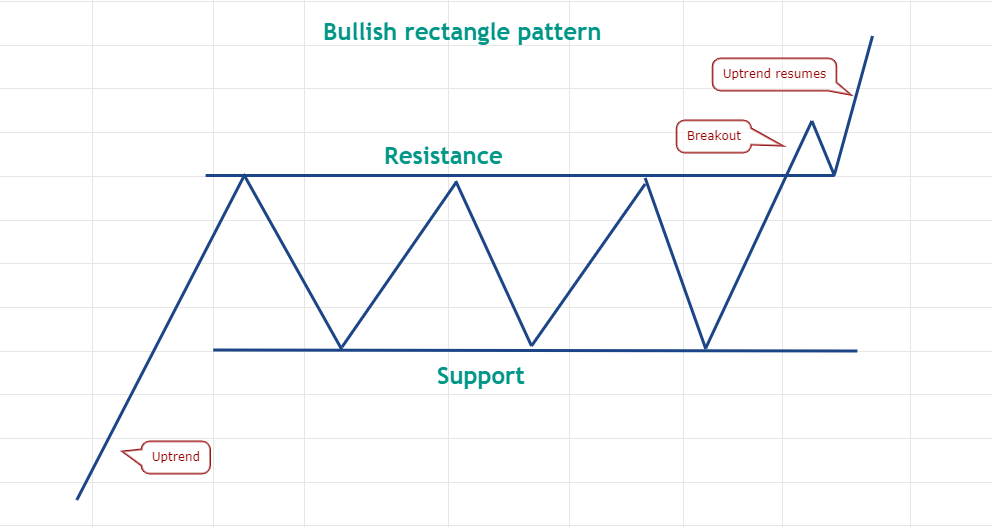

Bullish rectangle pattern

As shown above, the asset is in an uptrend but after the rally, some bulls took profits and this created the first reaction high. After the price corrects, several dip buyers jump in and arrest the decline, which forms the first trough.

As demand exceeds supply, the asset attempts to resume its up-move but when the price nears the previous reaction high, traders book profits again. Joining these two high points with a straight line forms the resistance of the rectangle. When the price turns down, buyers defend the earlier reaction low and this forms the support.

It is difficult to predict the direction of the breakout beforehand and the price could trade between the support and the resistance for a few weeks or even months. For this reason, it is better to wait for the price to escape the rectangle before turning bullish or bearish.

In the above example, the price breaks out of the resistance of the range as demand exceeds supply. This could result in the resumption of the uptrend.

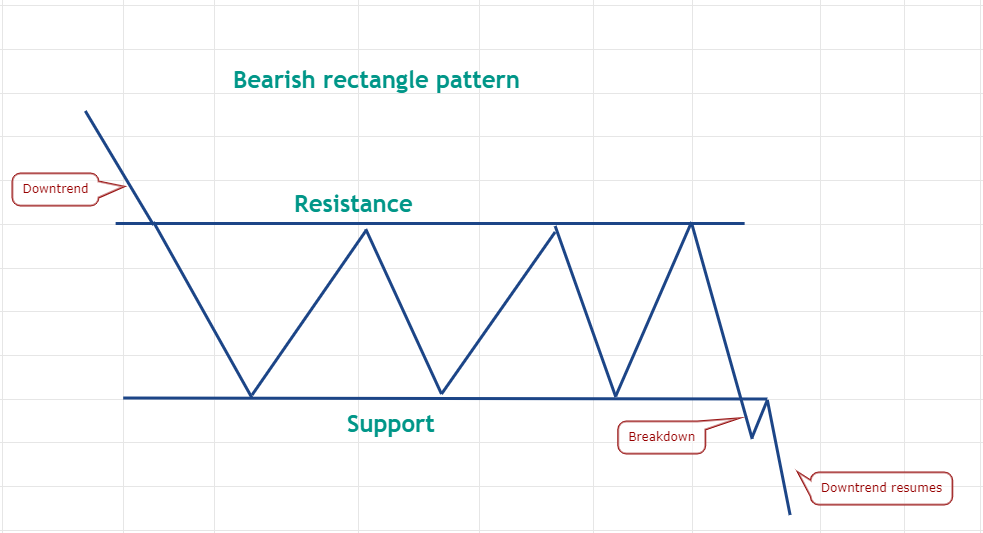

Bearish rectangle pattern

As shown in the above example, the asset is in a downtrend but when the price reaches a level deemed as undervalued by traders, dip buyers absorb the supply and form a reaction low. Bulls then attempt to reverse the direction but the sentiment is still negative and traders sell on rallies, forming the reaction high.

Traders again buy the dip when the price reaches the first reaction low but the bears stall the recovery near the earlier reaction high. Thereafter, the price gets stuck between the parallel lines, forming a rectangle.

The bearish rectangle pattern completes when the price breaks and closes below the support of the range. This generally results in the resumption of the downtrend.

A bullish continuation rectangle pattern

THETA had been in an uptrend before hitting resistance near $0.80 on Sep. 30, 2020. On the downside, buyers stepped in and arrested the correction near $0.55. Thereafter, the price remained stuck between these two levels until Dec. 15, 2020.

The THETA/USDT pair broke above the rectangle on Dec. 16, 2020, which indicated that the bulls had overpowered the bears. This signaled the resumption of the uptrend.

To arrive at the target objective of the breakout from the rectangle pattern, calculate the height of the rectangle. In the above case, the height is $0.25. Add this value to the breakout level, which is $0.80 in the above example. That gives the target objective at $1.05.

After a long consolidation, when the uptrend resumes, it may overshoot the target by a huge margin as is the case above. Traders can use the target as a reference point but the decision to close or hold the trade should be taken after considering the strength of the trend and signals from other indicators.

The same processes apply to bearish rectangles as shown below.

Litecoin (LTC) had been in a strong downtrend, dropping from $184.98 on May 6, 2018, to $73.22 on June 24, 2018. The buyers stepped in at this level and attempted to form a bottom but the bears were in no mood to relent. They stalled the recovery at $90 on July 3, 2018. Thereafter, the LTC/USDT pair remained range-bound between these two levels until Aug. 6, 2018.

The bears reasserted their supremacy and pulled the price below the rectangle on Aug. 7, 2018. This resumed the downtrend.

The target objective following the breakdown from a bearish rectangle is calculated by deducting the height of the rectangle from the breakdown point. In the above case, the height of the rectangle is $17. Deducting it from the breakdown level at $73 presents a target objective at $56.

The rectangle as a reversal pattern

Ether (ETH) topped out at $1,440 in January 2018 and started a strong downtrend, which reached $81.79 in December 2018. This level attracted strong buying from the bulls and the ETH/USDT pair made a sharp recovery. However, bears stalled the recovery near $300 in June 2019. Thereafter, the pair remained stuck between these two levels until July 24, 2020.

The bulls pushed the price above the rectangle on July 25, 2020, which suggested the start of a new uptrend. The bears tried to pull the price back below the breakout level at $300 but failed. This showed that the sentiment had turned positive and traders were buying the dips. The pair resumed its uptrend in November 2020.

Although the pattern target of the breakout from the rectangle was only $518.21, the pair rose to an all-time high at $4,372.72 in May.

Key takeaways

The rectangle pattern is a useful tool because it can act both as a continuation pattern and a reversal pattern. If the rectangle is large, traders may buy near the support and sell near the resistance.

To benefit from the rectangle and avoid getting whipsawed, traders can wait for the price to break and sustain above or below the pattern before establishing positions.

The target objective should only be used as a guide because when the price breaks out of a long rectangle it tends to overshoot the target objective by a huge margin.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Pro traders know it's time to range trade when this classic pattern shows up

Sourced From: cointelegraph.com/news/pro-traders-know-it-s-time-to-range-trade-when-this-classic-pattern-shows-up

Published Date: Tue, 17 Aug 2021 23:30:00 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/fidelitys-crypto-ambitions-are-bigger-than-expected-report