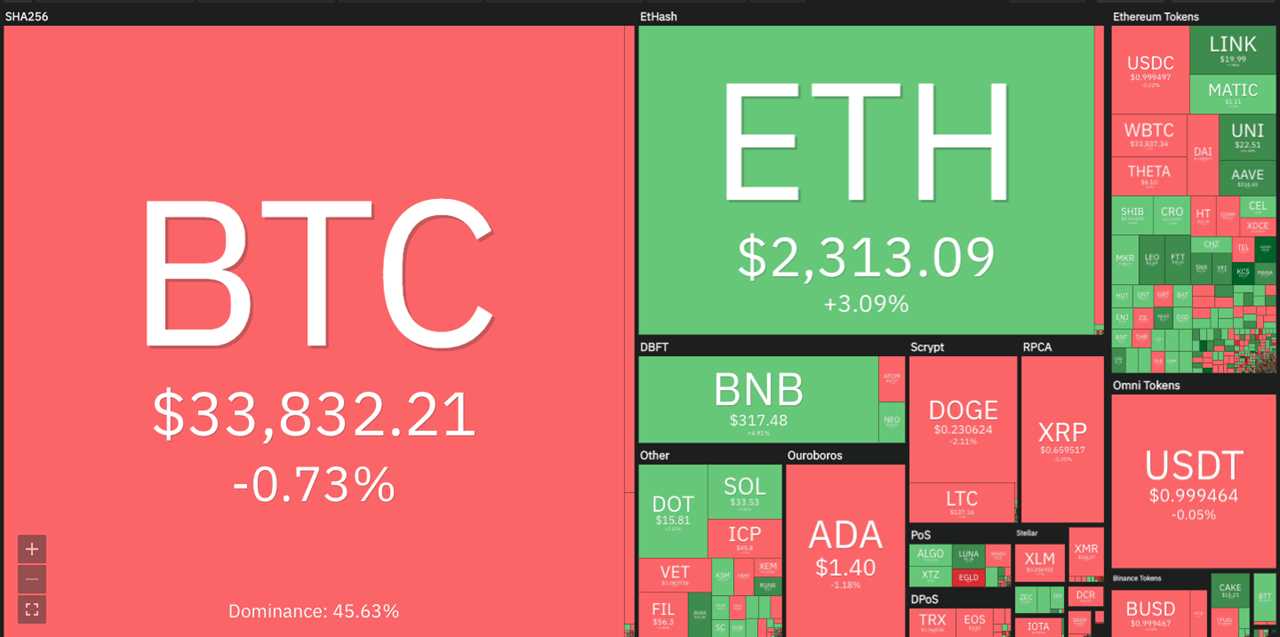

The weekend rally in cryptocurrencies was led by Bitcoin (BTC) but this move was not supported by huge trading volumes. According to on-chain analysts at CryptoQuant, the low trading volume suggests that “whales are staying low without much action.”

However, Bitcoin has successfully held the $30,000 support for two weeks, which suggests that accumulation is taking place at lower levels. The Crypto Fear and Greed Index rose to 29 on July 5, its highest level in about three weeks. This suggests that aggressive investors may have started bottom fishing.

If bulls successfully hold the $30,000 level in Bitcoin for a few more days, trading interest is likely to increase further. Institutional investors usually do not buy in a falling market and wait until prices stabilize. Once that happens, the volume is likely to pick up and a stronger recovery may be expected.

However, if support levels crack, the sentiment will sour further and institutions may prefer to remain on the sidelines until a bottom is confirmed. Let’s analyze the charts of the top-10 cryptocurrencies and spot the critical support levels on the downside.

BTC/USDT

The bulls pushed Bitcoin above the 20-day exponential moving average ($34,851) on July 4 but they could not clear the hurdle at the 50-day simple moving average ($36,338). This suggests that bears continue to sell on rallies.

If the price sustains below the 20-day EMA going forward, the bears will try to pull the BTC/USDT pair to the $31,000 support. The flat 20-day EMA and the relative strength index (RSI) just below the midpoint signal that there is a balance between supply and demand.

This balance will shift in favor of the bears if they can sink the price below $31,000. That could result in a drop to the $28,000 support. If this level cracks, the pair could witness panic selling.

Conversely, if the price rises from the current level or rebounds off $31,000, the bulls will make one more attempt to clear the overhead hurdle at $36,670. If they manage to do that, the pair may rally to the overhead resistance zone at $41,330 to $42,451.67.

ETH/USDT

Ether (ETH) is stuck between the moving averages. This shows that bears are attempting to defend the 50-day SMA ($2,410) and the bulls are trying to sustain the price above the 20-day EMA ($2,196).

However, this tight-range trading is unlikely to continue for long. If bulls push the price above the 50-day SMA, the ETH/USDT pair could rally to the downtrend line. This level may again act as a resistance but if crossed, the next stop could be $2,990.05.

Conversely, if bears sink the price below the 20-day EMA, the pair could drop to $2,000. This is an important support because a break below it will invalidate the short-term bullish view. The pair may then slide to the critical support at $1,728.74.

The flat 20-day EMA and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears.

BNB/USDT

Binance Coin (BNB) is facing stiff resistance at the 20-day EMA ($308) but the positive sign is that the bulls are not giving up much ground. This suggests that buyers anticipate the altcoin to make an upward dash.

If bulls thrust the price above the 20-day EMA, the BNB/USDT pair could rise to the 50-day SMA ($341). The bears may try to stall the recovery at this resistance but if the bulls can absorb the supply, the pair could start its journey to $433.

Contrary to this assumption, if the bulls fail to push the price above the 20-day EMA, short-term traders may close their positions. If the pair breaks below $264.26, a retest of the support at $211.70 may be on the cards.

ADA/USDT

Cardano (ADA) broke above the 20-day EMA ($1.39) on July 3 but the bulls could not drive the price above the 50-day SMA ($1.51). This suggests that bears are in no mood to relent and they continue to sell on rallies.

If the bears sink the price below the 20-day EMA, the traders who bought during the recent relief rally may bail out of their positions. This could pull the price down to $1.20. If the price rebounds off this level, the bulls will make one more attempt to clear the hurdle at the 50-day SMA.

If they succeed, the ADA/USDT pair could start its journey toward $1.94. Conversely, if bears sink the price below $1.20, the pair could retest the critical support at $1. A break below this level will be a huge negative and may start a new downtrend.

DOGE/USDT

Dogecoin (DOGE) had been trading near the 20-day EMA ($0.26) for the past few days but the bulls could not push the price above it. This suggests that bears aggressively defended this resistance.

The bulls seem to have given up and are closing their position today. If the bears sink the price below $0.21, the selling could intensify further and the DOGE/USDT pair may retest the critical support at $0.15.

The gradually downsloping moving averages and the RSI below 41 indicate advantage to the bears. The selling could pick up momentum below $0.15, which could result in a drop to $0.10.

This negative view will invalidate if the price rebounds off $0.21 and breaks above the 20-day EMA.

XRP/USDT

In a downtrend, the bears aggressively defend the 20-day EMA ($0.70) and that is what has happened in XRP. Even after repeated attempts in the past few days, the bulls could not propel the price above the 20-day EMA.

The downsloping moving averages and the RSI below 42 suggest that bears are in command. If bears sink the price below $0.63, XRP/USDT pair could drop to $0.58 and then to the critical support at $0.50.

This bearish view will be negated if the price rebounds off the support and rises above the 20-day EMA. Such a move will clear the path for a rally to the 50-day SMA where the bears may again pose a stiff challenge.

DOT/USDT

Polkadot (DOT) has been trading in a tight range between $13 and $16.93 for the past few days. A tight consolidation near the support is a negative sign as it shows that the bulls are not able to overcome the supply and push the price higher.

Both moving averages are sloping down and the RSI has turned down from 41, suggesting that bears are in control. If the sellers sink the price below $13, the DOT/USDT pair could witness sharp selling, which may pull the price down to $10 and then $7.50.

On the contrary, if the bulls again defend the $13 support, the pair could extend its stay inside the tight range for a few more days. A breakout and close above $16.93 will be the first indication that demand exceeds supply.

UNI/USDT

Uniswap (UNI) broke above the 20-day EMA ($19.53) on July 4 but the bulls are struggling to sustain the price above it. This suggests that bears are trying to trap the aggressive bulls.

However, the flattening 20-day EMA and the RSI just below the midpoint indicate that the selling pressure is reducing. If the bulls do not allow the price to sustain below the 20-day EMA, it will suggest that the sentiment has turned positive and the buyers are accumulating on dips.

That will increase the possibility of a break above the 50-day SMA ($22.65). If that happens, the UNI/USDT pair could start its northward march to $25 and then $27. Contrary to this assumption, if the price breaks below $16.93, the pair may drop to $15.

Related: Stablecoin growth could affect credit markets, rating agency warns

BCH/USDT

Even after repeated attempts in the past few days, the bulls have not been able to push Bitcoin Cash (BCH) above the overhead resistance at $538.11. This suggests that bears are unwilling to let go of their advantage.

The 20-day EMA ($526) has started to turn down and the RSI has slipped below 43, suggesting the path of least resistance is to the downside.

The sellers will now try to pull the price below the immediate support at $475.69. If they succeed, the BCH/USDT pair could drop to $428.43 and then to $370.

This negative view will be nullified if the price turns up from the current level or rebounds off the support and rises above $538.11. If that happens, the pair could extend its relief rally to $650.35 and then to $735.53.

LTC/USDT

The bulls could not push Litecoin (LTC) above the 20-day EMA ($144) on July 4, which suggests that bears are aggressively defending this resistance.

The price has turned down from the 20-day EMA today. If bears pull the price below $130.60, the LTC/USDT pair could retest the critical support at $118. If this level also breaks down, the pair will complete a descending triangle pattern, opening the doors for a down move to $100 and then $70.

This bearish view will be invalidated if the price turns up from the current level or rebounds off the support and breaks above the downtrend line of the triangle. Such a move could create an opening for an up-move to $200.

Market data is provided by HitBTC exchange.

Title: Price analysis 7/6: BTC, ETH, BNB, ADA, DOGE, XRP, DOT, UNI, BCH, LTC

Sourced From: cointelegraph.com/news/price-analysis-7-6-btc-eth-bnb-ada-doge-xrp-dot-uni-bch-ltc

Published Date: Tue, 06 Jul 2021 20:11:35 +0100