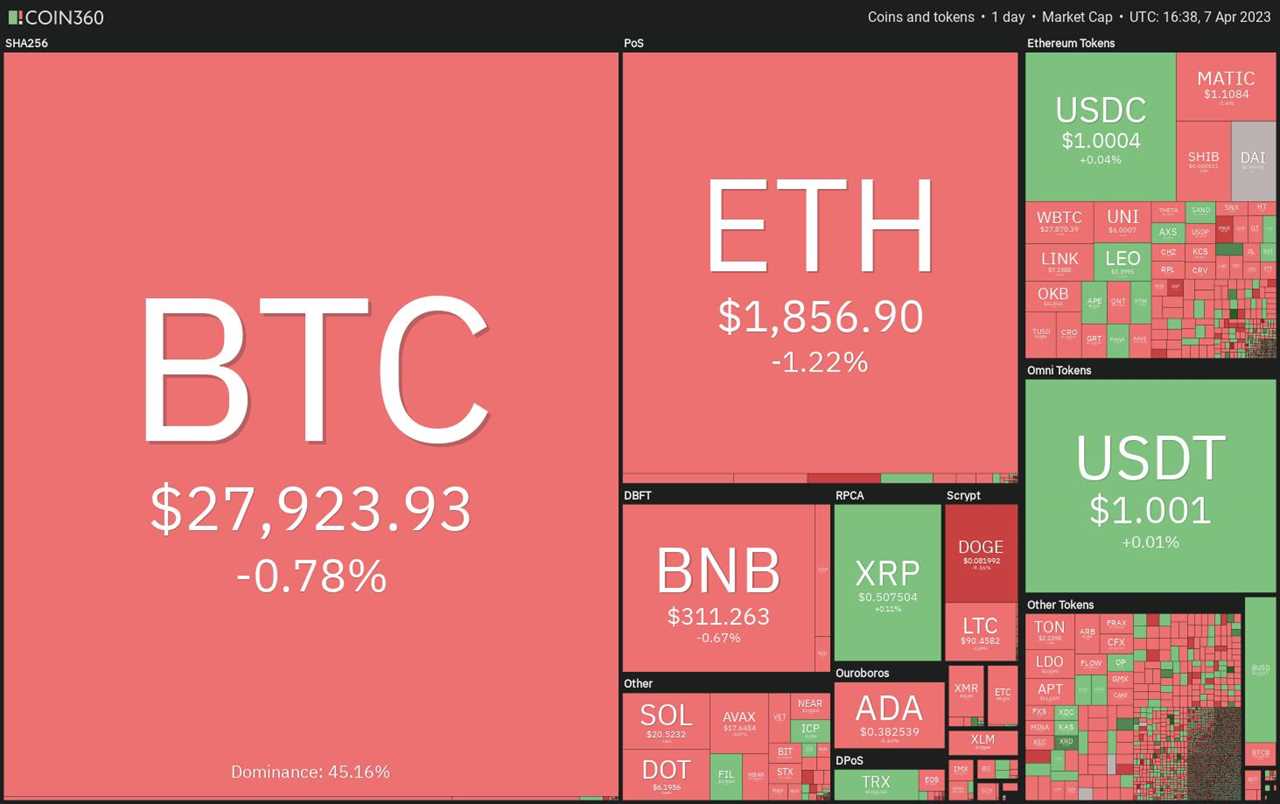

Bitcoin (BTC) has been trading below $29,000 for the past several days. The analyst community remains divided on the near-term prospects of Bitcoin. While some believe that Bitcoin could rise to $30,000, others are of the opinion that a local top has been made.

Bloomberg Intelligence senior macro strategist Mike McGlone said that cryptocurrencies, along with the stock market, crude oil and copper may find it difficult to sustain the recent bounce because bank liquidity levels remain tight.

On the other hand, SkyBridge Capital founder Anthony Scaramucci, while speaking with Yahoo Finance, said that Bitcoin’s bear market may be over, but he added that it was a guess. However, Scaramucci highlighted that Bitcoin has repeatedly outperformed other asset classes over the long term.

Will Bitcoin turn down from the current level or will bulls regroup and push the price above $30,000? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin has formed a symmetrical triangle near $29,000, which suggests uncertainty among the bulls and the bears about the next directional move.

The upsloping 20-day exponential moving average ($27,406) and the relative strength index (RSI) above 58 suggest that bulls have a slight edge. If the price rebounds off the support line, the buyers will attempt to thrust the BTC/USDT pair above the triangle.

If they manage to do that, the pair may start the next leg of the up-move. The pattern target of a breakout from the triangle is $31,280.

Conversely, a break below the support line will tilt the short-term advantage in favor of the bears. The pair may then plummet to the breakout level of $25,250. Buyers are expected to protect the level with all their might.

Ether price analysis

Ether’s (ETH) rally turned down from $1,943 on April 5, indicating that the bears are guarding the psychological level at $2,000 with vigor.

The first support is at $1,857. If this level gives way, the ETH/USDT pair could pullback to the 20-day EMA ($1,794). This remains the key level for the bulls to defend if they want to keep the up-move intact.

If the price rebounds off the 20-day EMA, the bulls will again try to overcome the obstacle at $2,000. If they do that, the pair may ascend to $2,200.

On the other hand, if the price breaks below the 20-day EMA, it may tempt short-term traders to book profits. The pair may then tumble to $1,743 and later to $1,680.

BNB price analysis

BNB (BNB) is turning down from the 20-day EMA ($314), indicating that the bears are fiercely defending the level.

The gradually downsloping 20-day EMA and the RSI just below the midpoint signal a minor advantage to the bears. If the $306 support cracks, the BNB/USDT pair could slide to $300 and then to the 200-day SMA ($291).

If bulls want to prevent the downward move, they will have to drive the price above the immediate resistance at $318. That could open the gates for a rise to the overhead resistance zone between $338 and $346.

XRP price analysis

XRP (XRP) has stayed above the 38.2% Fibonacci retracement level of $0.49 for the past few days, indicating that the bulls are buying on shallow dips.

The upsloping 20-day EMA ($0.47) and the RSI in the positive territory indicate that bulls have the upper hand. Buyers will next try to propel the price to the overhead resistance zone of $0.56 to $0.58. A close above this zone will signal the start of the next leg of the recovery.

Contrarily, if the price fails to break above the overhead zone, it will suggest that bears remain active at higher levels. Sellers will then try to tug the price below the 20-day EMA. If that happens, the pair may plunge to $0.43.

Cardano price analysis

The bears did not allow Cardano (ADA) to break above the neckline and complete the inverse head and shoulders (H&S) pattern.

The price has reached the 20-day EMA ($0.37), which is a crucial level for the bulls to defend. If the ADA/USDT pair rebounds off the 20-day EMA, the buyers will make one more attempt to overcome the barrier at the neckline. If they can pull it off, it will suggest the start of a new uptrend.

On the contrary, if the price falls below the 20-day EMA, it will suggest that the short-term bulls may be booking profits. The pair could then decline to the 200-day SMA ($0.35).

Dogecoin price analysis

Traders used Dogecoin’s (DOGE) rise on April 3 to lighten their positions. This shows that the sentiment remains negative and traders are selling on rallies.

The sharp pullback in the past four days suggests that the DOGE/USDT pair will continue to trade inside the large range of $0.07 to $0.11 for some more time. The price has reached the moving averages, which may act as a strong support. If the price turns up from the current level, the pair may recover to the 50% Fibonacci retracement level of $0.09.

Alternatively, if the price plummets below the moving averages, it will suggest a slight advantage to the bears. The pair may then slump to $0.07.

Polygon price analysis

Polygon (MATIC) has formed a symmetrical triangle pattern, indicating indecision among the bulls and the bears.

If the price rebounds off the support line of the triangle, it will suggest that the bulls are protecting this level. That could keep the pair inside the triangle for a while longer. If the price climbs above the 20-day EMA ($1.11), the bulls will again try to propel the MATIC/USDT pair to the resistance line of the triangle.

On the downside, a break and close below the support line of the triangle will indicate that the bears have overpowered the bulls. That could open the doors for a potential drop to the 200-day SMA ($0.98).

Related: XRP price eyes 30% upside after key resistance area breaks

Solana price analysis

Buyers could not sustain Solana (SOL) above the 20-day EMA ($20.81) in the past few days, indicating that demand dries up at higher levels.

The 20-day EMA is flattish and the RSI is just below the midpoint indicating that the SOL/USDT pair may stay between the downtrend line and $18.70 for some time. A break below $18.70 will indicate that bears have come out on top. The pair may then extend its decline to the vital support at $15.28.

Conversely, if the price turns up from the current level and breaks above the downtrend line, it will suggest that the bulls are back in the game. The pair may then ascend to $27.12.

Polkadot price analysis

Polkadot (DOT) has slipped below the 20-day EMA ($6.22), indicating that the bulls are losing their grip. The price could slide to the strong support at $5.70.

If the price rebounds off $5.70, the DOT/USDT pair may attempt a rally to the downtrend line and oscillate between these two levels for some time. A rally above the downtrend line will clear the path for a possible rally to the neckline of the developing inverse H&S pattern.

Alternatively, if the price breaks below $5.70, the advantage will tilt in favor of the sellers. The pair may then slump to $5.15. This is an important level to keep an eye on because if it cracks, the pair may tumble to $4.50.

Litecoin price analysis

The failure of the bulls to push Litecoin (LTC) above $96 has emboldened the bears who are trying to strengthen their position by dragging the price below the 20-day SMA ($90).

If they succeed, the next stop could be $85. This is an important level to watch out for because a break and close below it may result in a retest of the 200-day SMA ($75).

Another possibility is that the price turns up from the current level but fails to cross $85. In that case, the LTC/USDT pair may stay range-bound between $85 and $96 for a few days.

The 20-day EMA is sloping up gradually but the RSI has dropped near the midpoint, suggesting a consolidation in the near term. Buyers will have to clear the overhead hurdle at $96 to extend the recovery to $106.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Title: Price analysis 4/7: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

Sourced From: cointelegraph.com/news/price-analysis-4-7-btc-eth-bnb-xrp-ada-doge-matic-sol-dot-ltc

Published Date: Fri, 07 Apr 2023 19:45:00 +0100