On March 24, Tesla CEO Elon Musk announced that U.S. buyers are now able to purchase Tesla vehicles with Bitcoin (BTC). Musk also tweeted that Tesla will not convert BTC payments into fiat but will add to its existing treasury of about 48,000 Bitcoin.

Wedbush Securities analyst Dan Ives expects Bitcoin to account for less than 5% of Tesla transactions, but the percentage could move up as crypto adoption increases. The analyst said the move by Tesla could be a defining moment for Bitcoin from a transactional point of view.

This week, CNBC host Jim Cramer thanked Anthony Pompliano on the Pomp Podcast for convincing him to invest $500,000 in Bitcoin (BTC) in September 2020. Cramer said his Bitcoin investment has made him "a ton of money."

However, during the same period, Cramer said his gold investment “let him down.” Due to this, Cramer altered his age-old advice of allocating 10% of the portfolio to gold. He now recommends investors put 5% of their portfolio allocation in gold and 5% in Bitcoin.

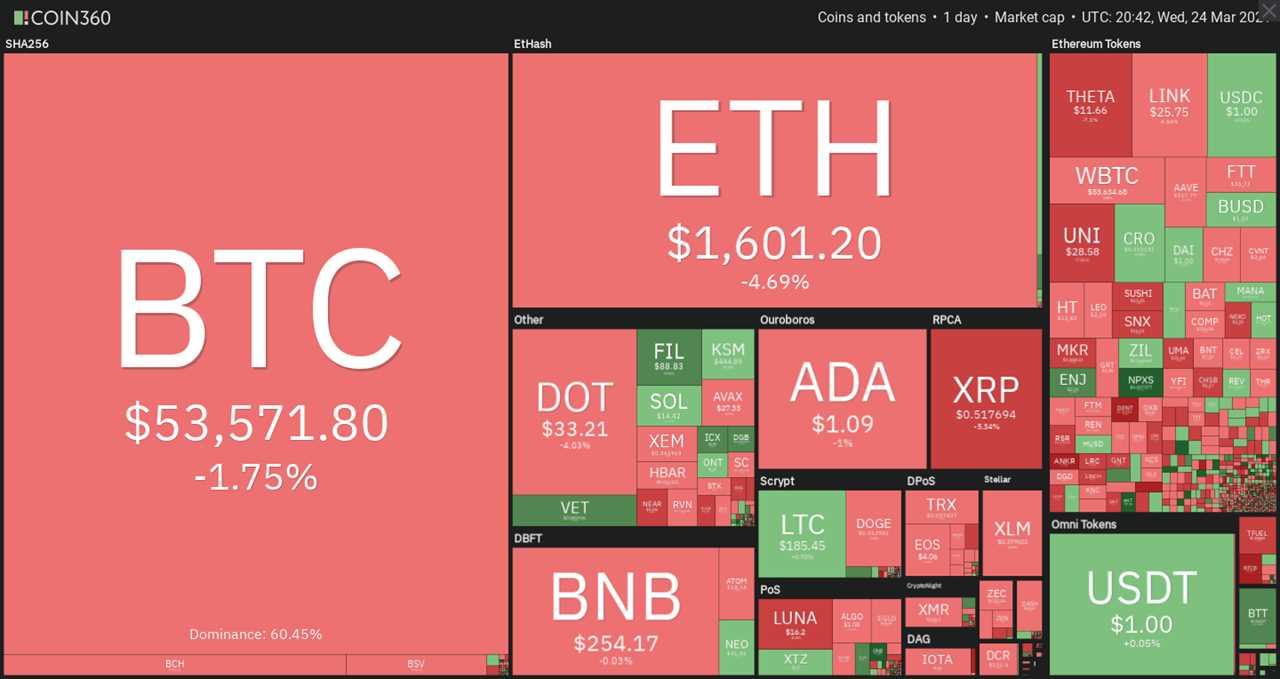

With positive news flow acting as a tailwind, could Bitcoin and major altcoins resume their uptrend? Let’s analyze the charts of the top-10 cryptocurrencies to find out.

BTC/USD

Bitcoin broke and closed below the pennant and the 20-day exponential moving average ($55,212) on March 22. However, the bears could not take advantage of the weakness and sink the price to the 50-day simple moving average ($50,752). This suggests a lack of sellers at lower levels.

The bulls have bought the dip aggressively and pushed the price back above the 20-day EMA today. The next hurdle is the downtrend line. If the buyers can drive the price above this resistance, the BTC/USD pair may retest the all-time high at $61,825.84.

A breakout and close above this level will open the doors for a rally to $72,112 and then $74,512.78.

However, the bears are unlikely to give up without a fight. They will try to stall the current relief rally at the downtrend line. If the price turns down from this resistance, the bears will once again try to sink the pair below the 50-day SMA. If they manage to do that, the pair could drop to $43,006.77.

ETH/USD

After failing to rebound off the 20-day EMA ($1,742) for a few days, Ether (ETH) succumbed to selling pressure and plummeted below the moving averages on March 22. The bulls are currently trying to push the price back above the moving averages.

If the buyers are successful in their endeavor, the ETH/USD pair may again try to reach the all-time high at $2,040.77. A breakout and close above this resistance could resume the uptrend, which has a target objective at $2,614.

On the contrary, if the price turns down from the moving averages, it will suggest that the sentiment has turned negative and traders are selling on rallies to the 20-day EMA.

If the price turns down and breaks below $1,647, the pair could extend its decline to $1,500 and then $1,289.

BNB/USD

Binance Coin (BNB) is trading inside a wide range between $189 and $309.50. The bulls are attempting to keep the price above the 20-day EMA ($254.66). If they can propel the price above $280, the altcoin may rally to $309.50. A breakout of this resistance could signal an advantage to the bulls.

On the other hand, if the price turns down from $280, it will suggest traders are booking profits on rallies. The bears will then try to capitalize on this weakness and sink the price below the 20-day EMA.

If they do that, the BNB/USD pair could gradually correct to $220 and then to $189. A break below this support could start a deeper correction.

Right now, the flat moving average and the RSI above 55 signal a balance between supply and demand, resulting in a few more days of consolidation.

ADA/USD

Cardano (ADA) broke below the 20-day EMA ($1.14) and the price dipped close to the $1.03 support on March 22. The bulls bought the dip and are currently attempting to push the price back above the 20-day EMA.

If they manage to do that, the ADA/USD pair may start its journey toward the resistance of the range at $1.48. The flat 20-day EMA and the RSI just above the midpoint also suggest a few days of consolidation.

Contrary to this assumption, if the price turns down from the current level and slides below $1.03, it could attract further selling from the bears. That could result in a drop to $0.80 and then $0.70.

DOT/USD

The failure to sustain Polkadot (DOT) above the resistance line of the symmetrical triangle on March 20 could have trapped the aggressive bulls, which led to a correction and the price dipped to the support line of the triangle on March 23.

The strong rebound off the support line shows the bulls are accumulating on dips. They will now once again try to propel the price above the triangle. If they can sustain the breakout, the DOT/USD pair could move up to $40.10 and then $42.28. A breakout and close above this resistance could start the next leg of the uptrend that could reach $55.

Conversely, if the price again turns down from the overhead resistance, the pair may extend its stay inside the range. The price has reached close to the apex of the triangle. Usually, when this happens, the setup is invalidated.

The flat 20-day EMA ($35.39) and the RSI just above the midpoint suggest a few days of range-bound action.

XRP/USD

The long wick on XRP’s March 22 and 23 candlestick suggests that traders are booking profits at higher levels. However, the positive thing is that the bulls continue to buy on every minor dip.

The upsloping moving averages and the RSI above 63 suggest that bulls have the upper hand. If they can push the price above $0.60, the XRP/USD pair may challenge the stiff resistance at $0.65. A breakout and close above this level could attract further buying, pushing the price to $0.78 and then $1.

This bullish view will invalidate if the price turns down and breaks below the moving averages. Such a move could pull the price down to $0.42.

UNI/USD

Uniswap (UNI) broke above the $35.20 overhead resistance on March 22 but the bulls could not sustain the breakout. The bulls again tried to clear the hurdle on March 23 but met with heavy selling pressure at higher levels. That dragged the price back into the $27.97 to $35.20 range.

The 20-day EMA ($30.41) is flattening out and the RSI is just above the midpoint, suggesting the range-bound action may extend for a few more days. The longer the time spent in a range, the stronger will be the eventual breakout from it.

A breakout and close above $35.20 could start the next leg of the uptrend that may drive the UNI/USD pair to $42.43 and then $46. On the contrary, a break and close below $27.97 may start a deeper correction to $20.74.

THETA/USD

THETA is in a strong uptrend but the long wick on the March 23 candlestick showed profit-booking at higher levels. However, that did not deter the bulls from pushing the altcoin to a new all-time high again today.

The failure to sustain the higher levels has formed a shooting star candlestick pattern today. This increases the possibility of a correction or a consolidation in the next few days. The RSI above 90 also shows the THETA/USD pair is overbought in the short term and may cool down.

The first support on the downside is the 38.2% Fibonacci retracement level at $10.31. If the pair rebounds off this support, it will suggest the trend remains strong as the bulls are not waiting for a deeper correction to buy. Conversely, a break below $10.31 could sink the pair to the 20-day EMA ($8).

LTC/USD

Litecoin (LTC) formed a Doji candlestick pattern on March 23, indicating indecision among the bulls and the bears. This uncertainty has resolved to the upside today and the bulls are attempting to push the price above the 20-day EMA ($196).

If they succeed, the price could rally to $208.10 and then to the resistance line of the symmetrical triangle. A breakout and close above this resistance will suggest that bulls may be back in command. The LTC/USD pair could then rally to $246.96 and then $300.

Alternatively, if the price turns down from the overhead resistance, the bears will once again try to sink the pair below the triangle. If they manage to do that, the selling could intensify, which may pull the price down to $152.94 and then $120.

LINK/USD

Chainlink (LINK) plunged below the moving averages and the trendline of the ascending triangle on March 22. However, the failure of the bears to capitalize on the weakness and sink the price to $24 indicates a lack of sellers at lower levels.

The bulls are attempting to push the price back above the moving averages, but they are likely to face stiff resistance from the bears.

If the price turns down from the moving averages and breaks the $26.20 support, the LINK/USD pair could drop to $24 and then to $20.11. The 20-day EMA ($28.63) has started to turn down and the RSI is in the negative territory, which suggests the bears are attempting to gain the upper hand.

Contrary to this assumption, if the bulls push the price above the moving averages, the pair could rally to $32. A breakout of this resistance could result in an up-move to $36.93.

Market data is provided by HitBTC exchange.

Title: Price analysis 3/24: BTC, ETH, BNB, ADA, DOT, XRP, UNI, THETA, LTC, LINK

Sourced From: cointelegraph.com/news/price-analysis-3-24-btc-eth-bnb-ada-dot-xrp-uni-theta-ltc-link

Published Date: Wed, 24 Mar 2021 21:01:43 +0000