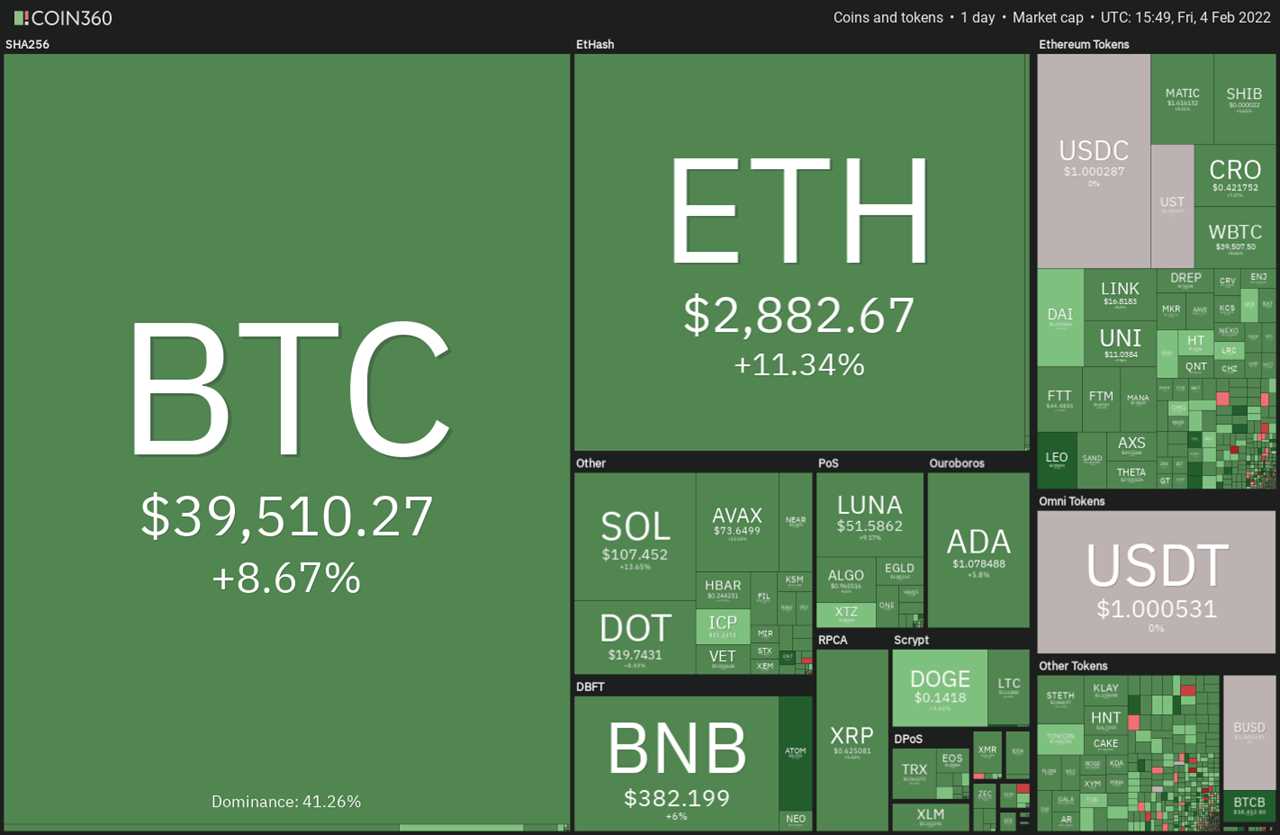

Bitcoin (BTC) and Ether (ETH) are attempting to build upon their recent recovery as the U.S. equity markets try to resume their relief rally, backed by strong results by Amazon. Bollinger Bands creator John Bollinger recently tweeted that Ether looked to be in a good spot to be added to his existing long positions.

The Purpose Bitcoin exchange-traded fund also witnessed its third-largest inflow on Feb. 1, according to Glassnode data. This suggests that traders may have started accumulating Bitcoin at lower levels.

Even though crypto markets are reeling under a bear phase, investor interest remains strong. Popular social media platform Stocktwits said that it has partnered with FTX.US to launch its crypto trading next quarter. The platform boasts 5 million monthly active users. This could result in several new investors starting their crypto investment journey.

Does the strong move in Bitcoin and select altcoins indicate the start of a new uptrend? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin bounced off the minor support at $36,155.01 and the bulls have pushed the price above the overhead resistance zone between the 20-day exponential moving average ($38,974) and $39,600.

If the price sustains above $39,600, buying could pick up momentum and the BTC/USDT pair could rally to the 50-day simple moving average ($43,021). The bulls will have to clear this hurdle to signal a possible change in trend.

Contrary to this assumption, if the price turns down from the current level, it will suggest that bears continue to sell on rallies. A break and close below $36,155.01 could clear the path for a retest of the Jan. 24 intraday low at $32,917.17.

ETH/USDT

Ether turned down from the 20-day EMA ($2,795) on Feb. 2 and dipped below the support at $2,652 on Feb. 3 but the long tail on the day’s candlestick suggests aggressive buying at lower levels.

The 20-day EMA has flattened out and the relative strength index (RSI) is just above the midpoint, indicating that bears are losing their grip. Sustained buying by the bulls has driven the ETH/USDT pair above the 20-day EMA.

If bulls sustain the price above the 20-day EMA, the pair could rise to the resistance line of the channel. A break above the 50-day SMA ($3,291) will indicate that bulls are back in the driver’s seat.

This bullish view will invalidate if the price turns down from the current level and plummets below $2,550. That could open the doors for a decline to the support line of the channel.

BNB/USDT

Binance Coin (BNB) rebounded off the minor support at $357.40, indicating that bulls are buying at lower levels. The bulls will now attempt to push the price above the 20-day EMA ($401).

If they manage to do that, the BNB/USDT pair could start its northward march toward the resistance line of the descending channel. A break and close above this resistance will signal a possible trend change.

Conversely, if the price turns down from the 20-day EMA, it will suggest that the sentiment remains negative and traders are selling on rallies. The bears will then try to pull the pair below $357.4 and challenge the strong support zone at $330 to $320.

ADA/USDT

Cardano (ADA) has been trading between the critical support at $1 and the 20-day EMA ($1.12) for the past few days. This tight-range trading is likely to result in a directional move soon.

A break and close above the 20-day EMA will be the first sign that the buyers are back in the reckoning. The ADA/USDT pair could then rise to the resistance line of the descending channel where the bears are likely to pose a stiff challenge. If the bulls overcome this hurdle, the pair could signal a trend change.

Contrary to this assumption, if the price turns down from the moving averages, it will suggest that traders are selling on rallies. The bears will then try to pull the pair below $1. If they manage to do that, the decline could extend to $0.80.

SOL/USDT

Solana (SOL) turned down from the 20-day EMA ($110) on Feb. 2 but the long tail on the Feb. 3 candlestick suggests buying at lower levels. The bulls will again endeavor to push the price above the breakdown level at $116.

If they succeed, the SOL/USDT pair could rally to the resistance line of the descending channel. A break and close above the channel will signal a possible change in trend. Alternatively, if the price turns down from the resistance line, the pair could continue to trade inside the descending channel.

On the downside, $80.83 is the critical support to watch out for because if it cracks, the selling could intensify further and the pair may plummet to the support line of the channel.

XRP/USDT

Ripple (XRP) continues its random price action between $0.54 and $0.65. If the price breaks above $0.65, it will suggest that the range-bound action may have been accumulation by the bulls.

The XRP/USDT pair could then move towards the 50-day SMA ($0.76) where the bears may mount a stiff resistance. A break and close above this resistance will be the first sign of a possible change in trend.

Conversely, if the price turns down from $0.65, the range-bound action could continue for a few more days. The bears will have to pull the price below the support at $0.54 to indicate the resumption of the downtrend. The pair may then retest the psychological support at $0.50.

LUNA/USDT

Terra’s LUNA token is trading between $43.44 on the downside and $54.20 on the upside. The 20-day EMA ($59) is sloping down and the RSI is in the negative zone, indicating that bears hold a slight edge.

If the price turns down from the overhead resistance at $54.20, the range-bound action may continue for a few more days. A break and close below the support at $43.44 could indicate the resumption of the downtrend. The LUNA/USDT pair could then drop to the critical support at $37.50.

Alternatively, if bulls drive the price above $54.20, the pair could rally to the 20-day EMA where the bears may face stiff resistance. The bulls will have to clear this hurdle to indicate a possible change in the short-term trend. The pair could then rally to the downtrend line of the channel.

Related: Bitcoin surges toward $39K as stocks volatility keeps Wall Street on edge

DOGE/USDT

Dogecoin (DOGE) continues its listless price action inside the range between $0.13 and $0.15. This indicates that both the bulls and bears are not waging large bets and are playing it safe.

The moving averages are sloping down and the RSI is in the negative territory, suggesting that bears hold a slight edge.

If the price turns down from the 20-day EMA ($0.14) the bears will attempt to resume the downtrend by pulling the DOGE/USDT pair below $0.13. If they succeed, the pair could decline toward the psychological support at $0.1.

The bulls will have to push and sustain the price above the 50-day SMA ($0.16) to signal that the bears are losing their grip. The pair could then rise to $0.19.

DOT/USDT

Polkadot (DOT) is trading between the 20-day EMA ($20.47) and the strong support at $16.81. The weak rebound off a strong support and the failure to break above the 20-day EMA indicates a lack of aggressive buying by the bulls.

Although the RSI has inched higher, it is still in the negative territory. The moving averages also continue to slope down, indicating that bears are in command. This suggests that the bears may again attempt to defend the 20-day EMA with vigor.

If the price turns down from the overhead resistance, the bears will try to pull the DOT/USDT pair below $16.81. If they succeed, the downtrend may resume. This negative view will invalidate in the short term if bulls push the price above the 20-day EMA. In that case, the pair could rise to the 50-day SMA ($24.34).

AVAX/USDT

Avalanche (AVAX) turned down from the 20-day EMA ($73.58) on Feb.2 but a positive sign is that the bulls held the support at the uptrend line. This indicates that the sentiment is improving and traders are buying on minor dips.

The bulls will now attempt to drive the price above the breakdown level at $75.50 where the bears are again expected to mount a stiff resistance. If the bulls overcome this barrier, the AVAX/USDT pair could start its journey toward the downtrend line.

Contrary to this assumption, if the price turns down from $75.50, it will suggest that bears continue to sell on rallies. That could keep the pair sandwiched between $75.50 and the uptrend line. A break below the uptrend line could open the doors for a decline to $60 and later to $51.04.

Market data is provided by HitBTC exchange.

Title: Price analysis 2/4: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Sourced From: cointelegraph.com/news/price-analysis-2-4-btc-eth-bnb-ada-sol-xrp-luna-doge-dot-avax

Published Date: Fri, 04 Feb 2022 19:13:42 +0000