A few years back, Bitcoin’s (BTC) price was controlled by whales as the crypto market lacked depth and was relatively illiquid. If whales were selling in unison, no one wanted to venture out and buy. Similarly, the whale’s concerted buying easily boosted prices higher.

However, that is not the case anymore. With the arrival of institutional investors, it appears that the whales are gradually losing their ability to influence BT price.

According to on-chain data, Grayscale Investments purchased about twice the number of Bitcoin mined in November. The steady inflow of institutional funds has boosted Grayscale’s Bitcoin Assets Under Management to over $10.5 billion.

Some investors will wonder why institutions are buying Bitcoin when the price is near record highs but it should be noted that institutional investors usually buy with the long-term in mind. The fact that they are buying near record highs shows they believe Bitcoin’s price will be considerably higher in a few years.

Legendary investor Paul Tudor Jones said that the current crypto market capitalization of about $560 billion is minuscule compared to the $90 trillion equity market cap and “God knows how many trillions of fiat currency.” In the next two decades, Jones anticipates every one to be using “some type of digital currency.”

With such huge future potential, it's easy to believe that crypto prices will only move higher but this is a common misconception. Every bull phase witnesses violent corrections, and eventually crypto prices will pullback. These are the opportunities that savvy retail and institutional investors will be watching for.

Let’s analyze the charts of the top-10 cryptocurrencies to determine the critical support levels from where the price may rebound.

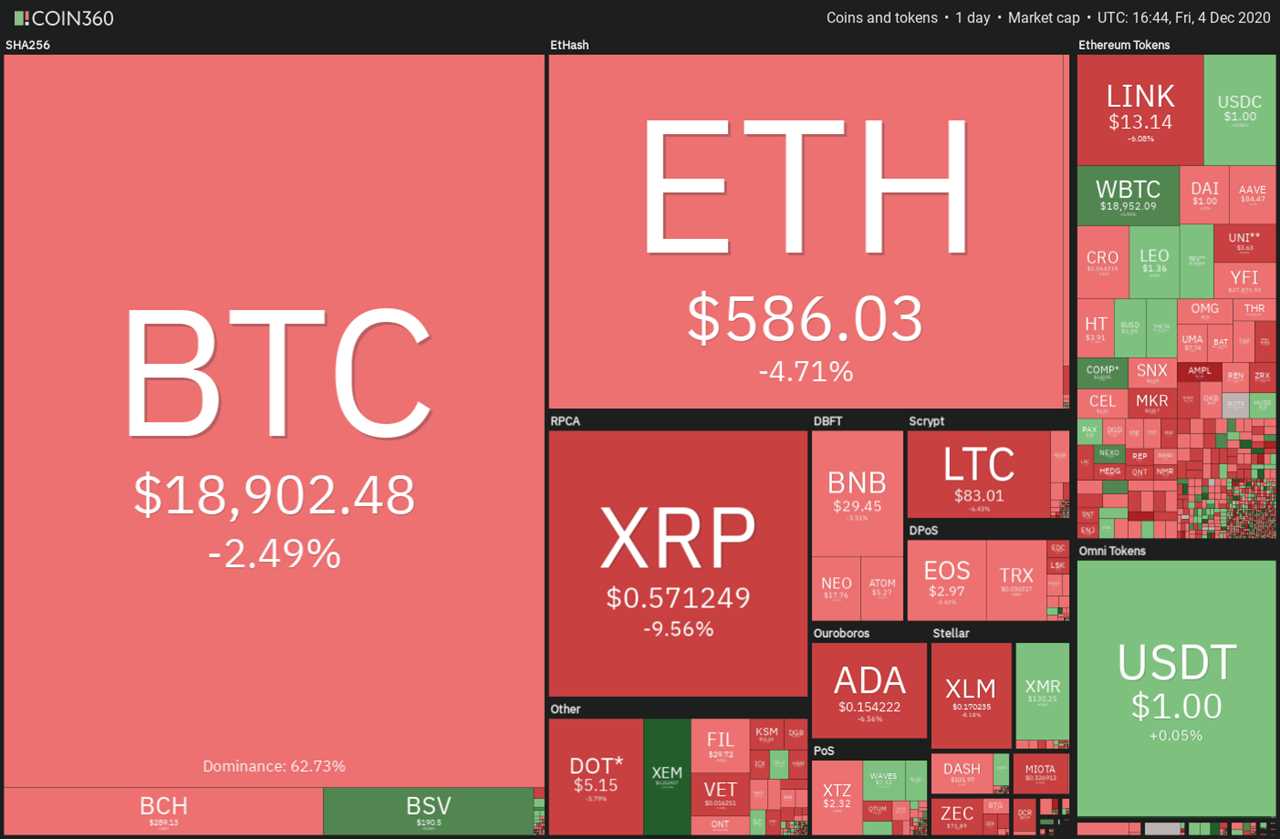

BTC/USD

Bitcoin (BTC) is in an uptrend and it is currently consolidating near the overhead resistance zone of $19,500 to $20,000. The bears are aggressively defending this zone but the positive sign is that the bulls have not given up much ground.

This shows that bulls are not closing their positions in a hurry and are buying on every minor dip. The upsloping moving averages suggest that bulls are in control.

The only bearish development on the chart is the negative divergence on the relative strength index (RSI). While this setup warrants caution, it gets invalidated in strong uptrends, hence a trade should not be taken on this setup alone.

If the bulls can push the price above $20,000, the next level to watch on the upside is $22,727 and then $25,000.

The first sign of weakness will be a break below the 20-day exponential moving average ($18,013) and the BTC/USD pair could start a deeper correction if the support at $17,200 cracks.

ETH/USD

Ether (ETH) has been consolidating near the $622.807 overhead resistance for the past few days. Usually, a tight consolidation near the resistance is a positive sign because it shows that the bulls are not booking profits aggressively as they expect the up-move to resume.

If bulls keep the price above $560, the possibility of a break above the $622.807 to $635.456 resistance zone increases. Above this level, the ETH/USD pair could resume the uptrend and rally to $800.

Contrary to this assumption, if the bulls fail to achieve the breakout even after repeated attempts, that may attract profit-booking by short-term traders and shorting by aggressive bears.

If the price dips below the 20-day EMA ($548), it will suggest that the bullish momentum has weakened. Below this level, the pair may plummet to $488.134.

XRP/USD

XRP is currently witnessing a correction in an uptrend. The altcoin has turned down from the downtrend line and if the bears sink the price below $0.574, the altcoin could drop to the 20-day EMA at $0.521.

In an uptrend, the bulls usually buy the dip to the 20-day EMA. If the price rebounds off the 20-day EMA, it will suggest that the sentiment remains bullish. The buyers will then try to propel the price above the downtrend line.

If they succeed, the XRP/USD pair could rally to $0.6794 and then to $0.780574. On the other hand, if the bears sink the price below the 20-day EMA, a deeper correction to $0.4365 is possible.

LTC/USD

Litecoin (LTC) is consolidating in an uptrend. The price had been stuck between the $84.3374 support and the $93.9282 resistance for the past two days, but the bears are currently attempting to sustain the price below the support.

If the bears manage to do that, the LTC/USD pair could drop to the 20-day EMA ($78). If the price rebounds off this level, the bulls will again try to propel the pair above $93.9282 and resume the uptrend.

On the contrary, if the bears sink the price below the 20-day EMA, the pair could slide to the next support at $68.9008, which is just above the 50-day SMA at $65.6947. If the bulls defend this support zone, a few days of range-bound action is possible.

BCH/USD

Bitcoin Cash (BCH) formed successive inside day candlestick patterns on Dec. 2 and 3, indicating indecision. The bulls tried to resume the up-move today but the long wick on the candlestick suggests aggressive selling by the bears at higher levels.

The bears tried to sink the price below the $280 support but the bulls are defending this level. Both moving averages are flattening out and the RSI is just above the midpoint, suggesting a balance between supply and demand.

A break below the $280 support could pull the price down to the 50-day SMA ($268) and then to $246.85. On the other hand, if the bulls sustain the price above $300, the BCH/USD pair may rise to $320 and then to $338.

LINK/USD

Chainlink (LINK) turned down from the downtrend line and the bears are currently attempting to sink the price back below the$13.28 support. If they succeed, the altcoin could drop to the 50-day SMA at $12.46.

The failure of the bulls to push the price above the downtrend line suggests that the bears are aggressively defending the higher levels. The 20-day EMA ($13.48) has flattened out and the RSI has dropped to the midpoint, indicating that bulls are losing their grip.

A break below the 50-day SMA could pull the price down to the uptrend line. A break below this support will tilt the advantage in favor of the bears.

This negative view will be invalidated if the price turns up from the current levels or rebounds off the 50-day SMA and rises above the downtrend line.

DOT/USD

Polkadot (DOT) again turned down from the $5.5899 overhead resistance on Dec. 3. This suggests that the bears are aggressively defending this level. The price has now dipped back to the 20-day EMA ($5.09).

If the price rebounds off the 20-day EMA, the bulls will once again try to propel the price above the $5.5899 overhead resistance. If they succeed, a rally to $6.0857 and then to $6.8619 may be on the cards.

On the contrary, if the bears sink the price below the 20-day EMA, the DOT/USD pair could drop to the 50-day SMA ($4.61) and remain range-bound for a few more days.

ADA/USD

Cardano (ADA) is currently correcting in an uptrend. If the bears sink the price below the $0.155 support, the altcoin could drop to the 20-day EMA ($0.144). The upsloping moving averages and the RSI in the positive territory suggest that bulls have the upper hand.

The bulls are likely to defend the 20-day EMA support, which is just above the 50% Fibonacci retracement level at ($0.141).

If the ADA/USD pair rebounds off the 20-day EMA and rises above the downtrend line, it will increase the possibility of resumption of the uptrend.

However, if the bears sink the price below the 20-day EMA, a deeper correction to the 61.8% Fibonacci retracement level at $0.131 is possible.

BNB/USD

Binance Coin (BNB) formed consecutive inside day candlestick patterns on Dec. 2 and 3. Today, the altcoin has formed a bearish engulfing candlestick, which shows that the bears have asserted their dominance.

If the bears sink the price below the moving averages, the BNB/USD pair could drop to the $25.6652 support. This is an important level that has held twice before. Therefore, the bulls are likely to buy a dip to this support once again.

The flat moving averages and the RSI near the midpoint suggest a balance between supply and demand. The bulls will have to push and sustain the price above the $32 overhead resistance to gain strength.

XLM/USD

Stellar Lumens (XLM) formed an inside day candlestick pattern on Dec. 2 and a Doji candlestick pattern on Dec. 3, both indicating indecision about the next directional move.

However, the uncertainty has resolved to the downside today. The XLM/USD pair has broken below the 38.2% Fibonacci retracement level at $0.17513 and it can now drop to the 50% Fibonacci retracement level at $0.15767, placed just above the 20-day EMA ($0.155).

Both moving averages are sloping up, hence, the bulls may buy the dip to the 20-day EMA. A strong bounce could take the price to the downtrend line but a weak rebound could increase the possibility of a fall to the 61.8% retracement level at $0.140.

Contrary to this assumption, if the price turns up and breaks above the downtrend line, a rally to $0.22 could be on the cards.

Market data is provided by HitBTC exchange.

Title: Price analysis 12/4: BTC, ETH, XRP, LTC, BCH, LINK, DOT, ADA, BNB, XLM

Sourced From: cointelegraph.com/news/price-analysis-12-4-btc-eth-xrp-ltc-bch-link-dot-ada-bnb-xlm

Published Date: Fri, 04 Dec 2020 20:00:00 +0000