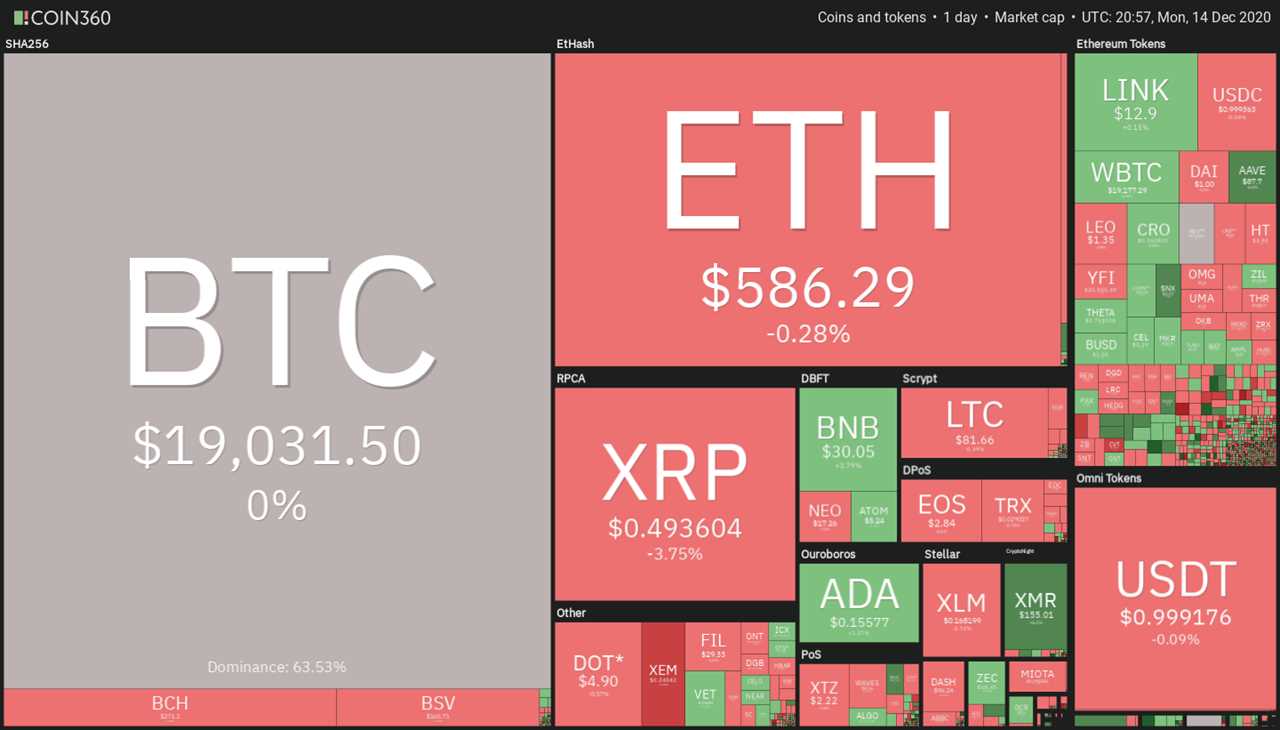

Strategists at JPMorgan said in a note that MassMutual’s $100 million Bitcoin (BTC) purchase shows that insurance firms and pension funds are now adopting Bitcoin. According to the analysts, typically this class of institutional investors is conservative in their style of investing so the recent allocation is quite significant.

However, the strategists said that even if the pension funds and the insurance companies in the U.S., Japan, the U.K., and the Euro area keep 1% of their assets in Bitcoin, that could amount to an additional inflow of about $600 billion into Bitcoin.

These investments by institutions may have increased the confidence of traditional investors on Wall Street who can now easily allocate a larger portion of their portfolio to Bitcoin.

CNBC Mad Money host Jim Cramer revealed in a recent interview that he purchased Bitcoin on dips under $18,000 and will continue to add on declines as he wants to “diversify into all sorts of asset classes.”

Another long-term bullish sign for Bitcoin is that the number of wallets containing a whole coin or more has risen to a new all-time high, according to on-chain analytics resource Glassnode. This shows that investors are not closing their positions at the all-time high but are buying more and withdrawing their Bitcoin from the exchanges to cold storage.

Now that several fundamental factors favor Bitcoin and altcoins resuming their uptrends, investors will be curious to see if BTC will at last snatch a new all-time high above $20,000.

Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USD

Bitcoin (BTC) broke below the 20-day exponential moving average ($18,492) on Dec. 11, but this proved to be a bear trap. The price quickly turned up and rose above the 20-day EMA on Dec. 12.

The long wick on the Dec. 13 candlestick and today’s Doji candlestick pattern shows that the bears are attempting to defend the $19,500 overhead resistance. However, the positive thing is that the bulls have not given up much ground.

The rising moving averages and the relative strength index (RSI) above 58 suggest that the path of least resistance is to the upside.

If the bulls can push the price above the $19,500 to the $20,000 overhead resistance zone, it will complete an ascending triangle pattern that has a target objective of $22,808.98.

Conversely, if the price again gets rejected at the current levels and the bears sink the BTC/USD pair below the trendline of the triangle, a drop to the 50-day simple moving average ($16,888) and then to $16,191.02 will be on the cards.

If the price rebounds off $16,191.02, the pair may enter a few days of range-bound action.

ETH/USD

Ether (ETH) broke out of the descending channel on Dec. 13, which is the first sign that the correction could be over. If the bulls buy the current dip to the 20-day EMA (564) and do not allow the price to sustain inside the channel, it will indicate strength.

The ETH/USD pair is in the early stages of forming an ascending triangle pattern that will complete on a breakout and close above $622.807. This bullish setup has a target objective of $763.614.

The gradually rising 20-day EMA and the RSI above 55 suggest that bulls have the upper hand.

This bullish view will fail if the pair breaks below the 20-day EMA and the ascending triangle. Such a move could drag the price down to the 50-day SMA ($501).

XRP/USD

The bulls could not sustain XRP above the 20-day EMA ($0.53), and the price dropped to $0.485419 on Dec. 12. The bulls bought the lows and are attempting to keep the altcoin above the $0.50 level.

However, the lack of a strong rebound suggests that bears are selling aggressively. If the price sustains below $0.4850, the XRP/USD pair could resume the correction and fall to the 50-day SMA at $0.41.

The gradually falling 20-day EMA and the RSI in the negative zone suggest that bears are attempting to take control. This negative view will invalidate if the price rebounds off the current levels and rises above the 20-day EMA.

LTC/USD

Litecoin (LTC) bounced off the 50-day SMA ($71) on Dec. 11, and the bulls pushed the price above the 20-day EMA ($78) on Dec. 13. This suggests accumulation at lower levels.

The LTC/USD pair could be in the early stages of forming a large symmetrical triangle, which usually acts as a continuation pattern. The bears could defend the resistance line of the triangle, while the bulls may buy on weakness to the support line.

A breakout of the triangle could resume the up-move, while a break below the triangle will signal that bears have the upper hand. The flat 20-day EMA and the RSI near the midpoint suggest a possible consolidation for a few days.

BCH/USD

Bitcoin Cash (BCH) recovered from $256.10 on Dec. 11 and reached $282.21 on Dec. 13. However, the bears defended this level aggressively and have pushed the price back below the 50-day SMA ($271).

Both moving averages are flat and the RSI is just below the midpoint, which suggests a few days of range-bound action. The price may move back and forth between $231 on the downside and $280 on the upside.

Contrary to this assumption, if the bulls can propel the price above $280, the BCH/USD pair may rise to $300 and then to $320. However, if the bears sink the price below $231, the pair may drop to $200.

LINK/USD

Chainlink (LINK) broke below the uptrend line on Dec. 11, but the bulls purchased at lower levels and pushed the price back above the uptrend line on Dec. 12. This attracted further buying, and the altcoin reached the $13.28 overhead resistance on Dec. 13.

However, the price has turned down from $13.28 and dipped back below the moving averages. This suggests that the bears are defending the overhead resistance.

Both moving averages have flattened out and the RSI is just below the midpoint, which suggests that the LINK/USD pair could remain range-bound for a few days. The price could seesaw between $13.28 and $11.43 for a few days.

A break below $11.43 could signal that bears have overpowered the bulls and that could result in a fall to $10. Conversely, a break above $13.28 will suggest advantage to the bulls.

ADA/USD

Cardano (ADA) broke above the downtrend and the 20-day EMA ($0.147) on Dec. 13. This suggests that the correction could be over. However, the bears are unlikely to give up easily.

The bears are currently trying to stall the recovery at $0.155. If the bears can sink the price below the 20-day EMA, the price can drop to $0.13. If the bulls again buy this dip, then the ADA/USD pair may remain range-bound between $0.13 and $0.155 for a few days.

However, the long tail on today’s candlestick suggests buying at lower levels. The gradually upsloping 20-day EMA and the RSI above 55 suggest that bulls have the upper hand. Above $0.155, the pair could rally to $0.175.

DOT/USD

The relief rally in Polkadot (DOT) has again hit a barrier at the downtrend line. This suggests that the sentiment is negative and the bears are trying to sell on minor rallies to the downtrend line.

The flattening 20-day EMA ($4.92) and the RSI just below the midpoint suggest a few days of range-bound action. The price may consolidate between $4.54 on the downside and $5.10 on the upside.

However, if the bears sink the price below $4.54, the down move could resume and the DOT/USD pair could drop to $4.20 and then $3.80. A break above $5.10 will be the first indication that bulls are attempting to gain an upper hand.

BNB/USD

Binance Coin (BNB) is currently stuck inside a large range between $32 and $25.6652. The crisscrossing moving averages and the RSI near the midpoint suggest that the range-bound action may extend for a few more days.

The BNB/USD pair has risen above the moving averages and the bulls will now try to push the price to the $32 overhead resistance. This level has previously acted as stiff resistance and the bears will again try to turn the price down from this level.

If they succeed, the pair may consolidate between $29 and $32 for a few days. On the other hand, if the bulls drive the price above the $32 to $33.3888 resistance, the next of the uptrend could begin.

XLM/USD

Stellar Lumens (XLM) broke above the downtrend line on Dec. 13, which suggests that the correction could be over. However, the bears are not ready to give up their advantage without putting up a fight.

The sellers are currently defending the $0.18 resistance. The flattish 20-day EMA ($0.16) and the RSI just above the midpoint suggest a balance between supply and demand. This could keep the XLM/USD pair range-bound between $0.18 and $0.14 for a few days.

If the bears sink the price below the 20-day EMA, the pair may drop to $0.14. A break below the range will tilt the advantage in favor of the bears while a break above $0.18 will open the doors for an up-move to $0.205.

Market data is provided by HitBTC exchange.

Title: Price analysis 12/14: BTC, ETH, XRP, LTC, BCH, LINK, ADA, DOT, BNB, XLM

Sourced From: cointelegraph.com/news/price-analysis-12-14-btc-eth-xrp-ltc-bch-link-ada-dot-bnb-xlm

Published Date: Mon, 14 Dec 2020 20:59:12 +0000