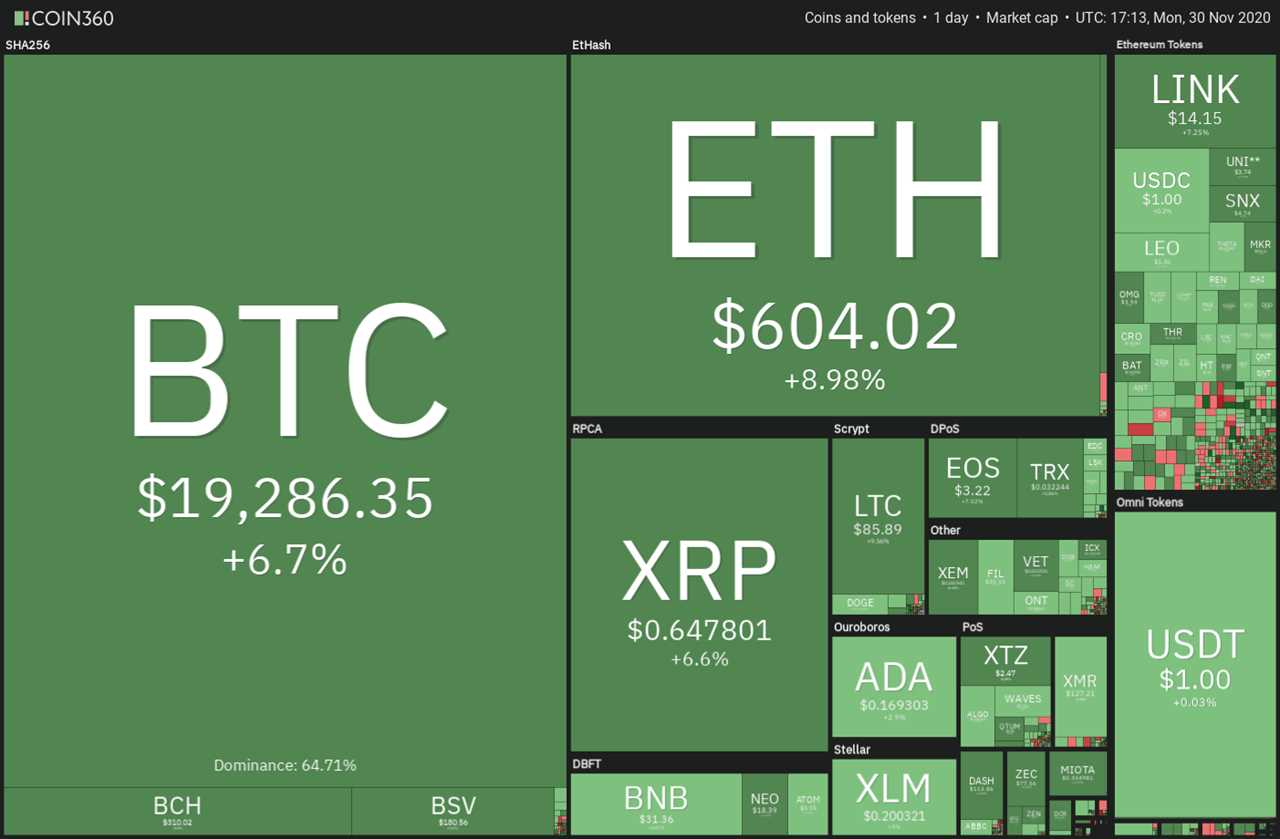

Bitcoin (BTC) price came within striking distance of hitting a new all-time high today. This shows that institutional and retail investors continue to buy on every dip and BTC is in a strong uptrend. Hence, traders should not urgently looking to call a top.

While Bitcoin has been creating new records, gold has corrected about 15% from its all-time high. This shows that traders are dumping their positions and this led to the largest weekly outflow in gold.

Analysts believe that some of the money flowing out of gold could enter Bitcoin as institutional interest continues to soar. A new high could also attract momentum traders who like to piggyback on a strong trend.

Traders are now wondering if Bitcoin's momentum will pull the whole crypto sector higher or if it will continue to hog the limelight at the expense of the altcoins?

Let’s analyze the top-10 cryptocurrencies to find out.

BTC/USD

Corrections in a strong uptrend usually last for one to three days and that is what happened with Bitcoin price. The pullback from the intraday high of $19,459.22 on Nov. 25 bottomed out at $16,191.02 on Nov. 26.

A shallow correction is generally a sign of strength. It shows that existing owners of the BTC/USD pair are in no hurry to book profits while traders who want to buy are not waiting for lower levels to enter.

The upsloping moving averages and the relative strength index near the overbought zone suggest that bulls are in command. The momentum picked up today and the bulls pushed the price above $19,459.22.

But the bears have not yet given up. They are trying to mount a stiff resistance in the $19,500 to $20,000 zone. If the price turns down sharply from this resistance, a drop to $17,200 is possible.

On the other hand, if the bulls can push the price above $20,000, the momentum could pick up further and a rally to $22,727 and then to $25,000 will be on the cards.

ETH/USD

Ether’s (ETH) strong rebound off the $488.134 support shows that the bulls are buying aggressively as they expect the next leg of the uptrend to resume.

If the bulls can push the price above $625, the ETH/USD pair could start its journey towards the next major resistance at $800. The upsloping moving averages and the RSI near the overbought territory suggest that bulls are in command.

Contrary to this assumption, if the price again turns down from $625, the pair may consolidate for a few days before resuming its up-move. A break below the 20-day exponential moving average ($523) will be the first sign of weakness.

XRP/USD

The pullback in XRP had been facing resistance at the 61.8% Fibonacci retracement level of $0.649138 for the past two days. Today, the bulls pushed the price above the resistance but failed to sustain the higher levels.

However, the upsloping moving averages and the RSI in the overbought territory suggest that bulls have the upper hand. If they can push the price above $0.649138, the XRP/USD pair could rally to $0.706942 and then to $0.780574.

This bullish view will be invalidated if the price turns down from either overhead resistance and plummets below the 20-day EMA ($0.47).

BCH/USD

Bitcoin Cash (BCH) rose above $280 on Nov. 29 and has picked up momentum today. However, the relief rally could face resistance at the 61.8% Fibonacci retracement level at $324.01.

If the price turns down from the overhead resistance, it will suggest that the bulls who are stuck at higher levels are bailing out of their positions. The bears will then try to sink the price to $280.

Contrary to this negative assumption, if the bulls can push the price above $324.01, the BCH/USD pair could move up to $344.98 and then to $371.70. The gradually rising moving averages and the RSI above 58 suggest that bulls have a minor advantage.

LINK/USD

Chainlink (LINK) bounced off the 50-day simple moving average ($12.25) on Nov. 26 and 27 and the bulls have pushed the price back above the overhead resistance at $13.28. The recovery is currently facing resistance at the 61.8% Fibonacci retracement level at $14.4433.

The flattish 20-day EMA ($13.40) and the RSI just above the midpoint does not give a clear advantage either to the bulls or the bears.

If the bears sink the price back below $13.28, it will suggest that sentiment has turned bearish and the traders are selling on rallies. A break and close below the 50-day SMA could start a deeper correction.

On the contrary, if the bulls push the price above $14.4433, the LINK/USD pair could rally to $15.2994 and then to $16.39. A break above this resistance could resume the uptrend.

LTC/USD

Litecoin (LTC) found support near the 61.8% Fibonacci retracement level of $64.8317 on Nov. 26 and 27. The rebound since then has been sharp but the bulls are currently facing resistance at $88.

However, the upsloping moving averages and the RSI in the positive territory suggest that bulls have the upper hand. If they can push the price above $88, a retest of $93.9282 will be on the cards. Above this level, the rally could extend to $100.

On the other hand, if the price turns down from the overhead resistance, the LTC/USD pair could remain range-bound for a few days. The pair will turn negative if the bears sink the price below $64.

ADA/USD

Cardano (ADA) surged back above the overhead resistance at $0.155 on Nov. 28, which shows aggressive buying at lower levels. However, the bulls are struggling to sustain the price above $0.17 for the past two days.

This shows that the bears are defending the zone between $0.17 and $0.1826315. If the bears can sink the price below $0.155, a drop to the 20-day EMA ($0.137) is possible.

However, if the bulls buy the dips to $0.155, it will suggest accumulation at this level. A consolidation near the overhead resistance is a positive sign as it shows that traders are not closing their positions in a hurry and are not waiting for deep corrections to buy.

If the bulls can propel the price above $0.1826315, the ADA/USD pair may start its journey to $0.2129 and then to $0.235.

DOT/USD

Polkadot (DOT) bounced off the 50-day SMA ($4.52), which shows that the bulls are defending this support. They will now try to push the price above the $5.5899 to $6.0857 resistance zone.

If they succeed, the DOT/USD pair could rally to $6.8619 and then to $7.64. The gradually upsloping moving averages and the RSI above 57 suggest that bulls are at a minor advantage.

However, if the price again turns down from the overhead resistance zone, the pair could remain stuck in the range for a few more days.

BNB/USD

Binance Coin (BNB) remains range-bound between $25.6652 and $32. The bounce off the Nov. 26 low suggests that bulls continue to buy near the support of the range. The price has now reached close to the resistance of the range at $32.

If the price turns down from $32, the BNB/USD pair may extend its stay inside the range. The moving averages are flat but the RSI has jumped into the positive territory, which suggests that the momentum favors the bulls.

If the buyers can push the price above $32, the BNB/USD pair could move up to $35.4338. A breakout of this resistance may result in a retest of the all-time high at $39.5941.

XLM/USD

Stellar Lumens (XLM) is facing resistance at the downtrend line but the positive thing is that the bulls have not given up much ground. This shows that the buyers are accumulating on every minor dip.

If the bulls can push the price above the downtrend line, the XLM/USD pair could rally to $0.231655. The bears may again mount a stiff resistance at this level and if the price turns down from the overhead resistance, a few days of range-bound action is possible.

If the bulls can drive the price above $0.231655, the next leg of the uptrend could begin. The next target to watch on the upside is $0.2933. Conversely, if the bears sink the price below $0.188, the pair may drop to $0.16.

Market data is provided by HitBTC exchange.

Title: Price analysis 11/30: BTC, ETH, XRP, BCH, LINK, LTC, ADA, DOT, BNB, XLM

Sourced From: cointelegraph.com/news/price-analysis-11-30-btc-eth-xrp-bch-link-ltc-ada-dot-bnb-xlm

Published Date: Mon, 30 Nov 2020 21:35:00 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/eth2-dev-talks-about-challenges-and-lessons-learned-ahead-of-mainnet-launch