The Halving: A Critical Juncture for Crypto Companies

As we approach Bitcoin's halving in April, companies within the crypto space are facing a crucial moment. This event, known for triggering significant market shifts, is surrounded by speculation and strategic planning. While there are opportunities to be seized, it is essential for businesses to adopt a balanced and long-term perspective rather than succumbing to market euphoria.

The Double-Edged Sword of Bitcoin Halving

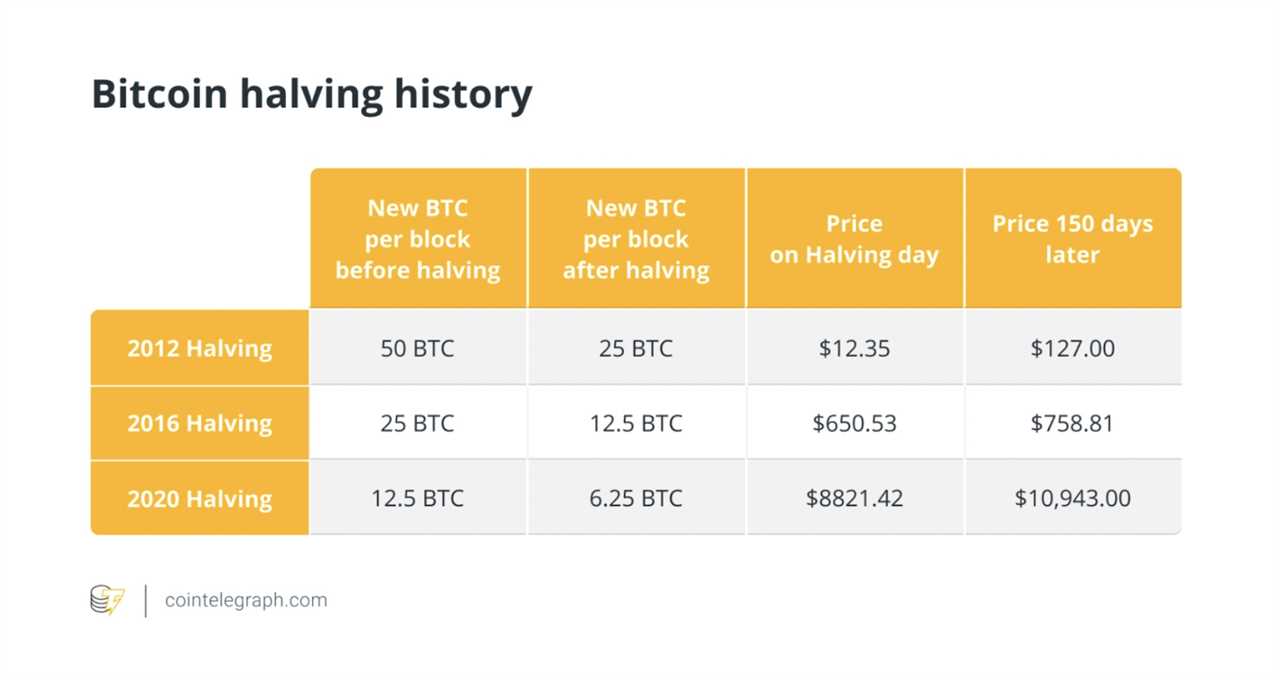

Bitcoin halving events, which reduce mining rewards by half, historically lead to substantial changes in the crypto landscape. These changes often result in increased market activity and heightened investor interest. However, basing an entire business strategy solely on the outcomes of the halving can be risky. Focusing on short-term gains may lead to missed opportunities or strategic errors that could jeopardize a company's future viability.

The Importance of Risk Management

The volatility and unpredictability of the crypto sector, exemplified by the recent developments in the layer-2 blockchain Avalanche, highlight the need for robust risk management strategies. Companies must be prepared for any eventuality and ensure their survival beyond the halving event. This calls for a focus on sustainable growth, solid financial planning, and a reluctance to overextend in pursuit of fleeting opportunities.

Diversifying Offerings and Building a Foundation

In response to the halving, crypto companies are increasingly focusing their efforts on product development and halting marketing initiatives. The goal is to diversify offerings and cater to an evolving customer base, expected to expand post-halving. This strategy aims to capitalize not only on the immediate upsurge in halving-related interest but also on building a foundation that can withstand market fluctuations.

Cybersecurity Preparations and Rushed Product Releases

One possible consequence of the halving is that companies may rush to release products without adequate cybersecurity preparations. The crypto industry, being a prime target for cyberattacks, demands careful attention to cybersecurity. Past incidents have shown the consequences of projects failing to learn from predecessors who fell victim to hackers.

Navigating the Complex Venture Capital Landscape

The landscape of venture capital in the crypto sector is complex. The AI hype and the recent crypto winter led to a drying up of funds. However, there is renewed interest from investors looking to capitalize on the halving event. This resurgence of investment must be approached with caution. Expansion and investment should be supported by a solid financial plan, especially in a market known for its volatility.

Managing Marketing and Public Perception

While generating awareness and excitement around the halving is important, overhyping the event can backfire. Setting realistic expectations is crucial for maintaining credibility and trust with the user base. The industry has experienced backlashes due to unmet, overambitious projections in the past.

The Changing Regulatory Landscape

Crypto companies should also consider the rapidly changing regulatory landscape. Global regulators, particularly in Europe, are increasingly scrutinizing the crypto space and discussing comprehensive crypto regulation. Stricter regulatory oversight aims to balance innovation with investor protection and financial stability. Companies must stay informed about these developments as new regulations could be implemented before the halving in April.

Innovation in Compliance as a Competitive Advantage

As regulations become more complex, crypto companies that proactively integrate compliance into their business models and technology infrastructures will likely have a competitive advantage. Investing in compliance and regulatory technology can provide efficiencies and help navigate the intricacies of varying jurisdictional requirements. The challenge for crypto companies is to innovate while adhering to these new rules, turning regulatory adherence into a strategic asset rather than a burden.

Preparing for the Post-Halving Crypto Landscape

Bitcoin's halving and the intensifying regulatory climate represent a pivotal moment for the crypto industry. Only the most adaptable and forward-thinking companies will survive this dual challenge. Taking a proactive approach, integrating innovative strategies that align with regulatory frameworks and harness the halving's potential, will differentiate the leaders in the post-halving, regulated crypto landscape. This shift from mere survival to strategic evolution is what will solidify their position in a rapidly maturing market.

This article is for general information purposes and should not be taken as legal or investment advice.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/openai-altmans-removal-triggers-cofounder-brockmans-exit