Introduction

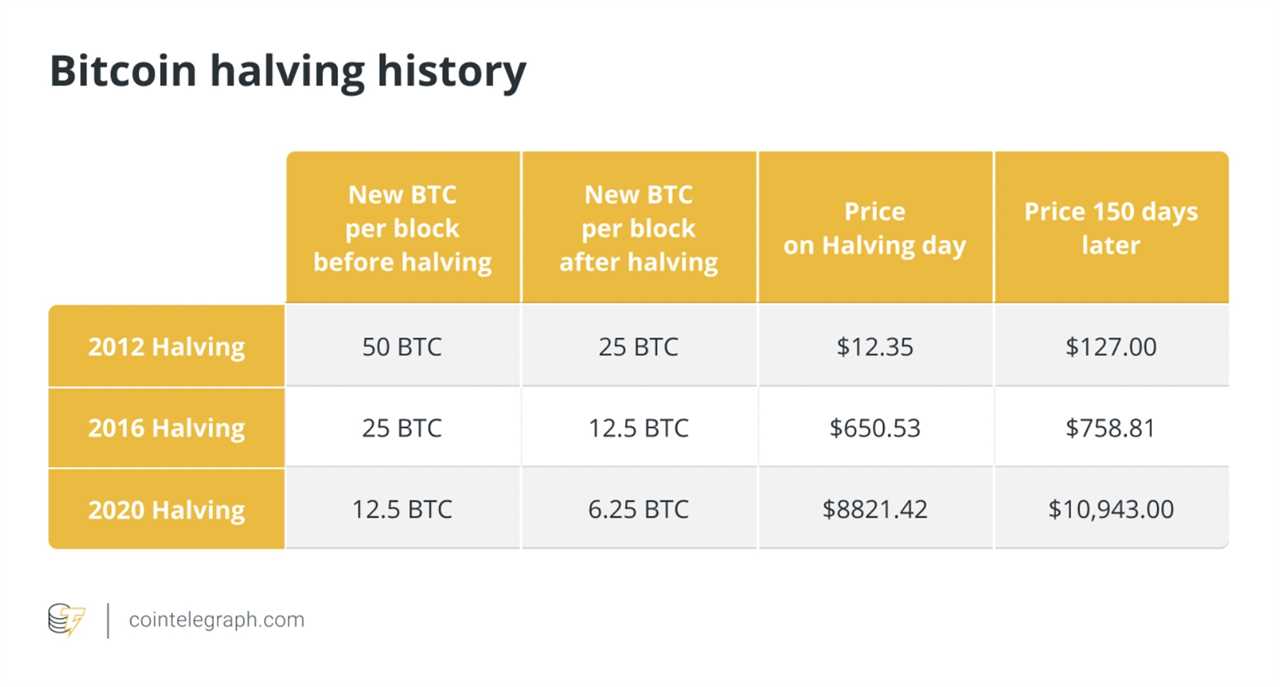

The next Bitcoin (BTC) halving is just seven months away, and crypto investors are eagerly anticipating its impact on the price. But for Bitcoin miners, this event poses a challenge to their profitability. With the production of new coins being cut in half, miners must adapt their strategies to ensure they can continue to thrive in the industry.

Changing mindsets

Bitcoin mining is a competitive process that requires miners to vie for block rewards. As the number of coins produced decreases, miners must prioritize energy efficiency and cost-effective hardware to stay competitive.

Bitcoin miners' survival rests on these three whales

Electricity costs play a crucial role in a miner's profitability. Miners are exploring contracts, relocating to countries with lower electricity prices, and considering power generation from stranded gas options to secure affordable electricity rates.

The efficiency of mining equipment is another important factor. Upgrading to more energy-efficient hardware can significantly reduce mining costs. Miners with efficient equipment and lower electricity costs will be the most profitable.

Accumulating excess capital in mined BTC during profitable periods can serve as a buffer against reduced block rewards. Miners can then sell their reserves during a post-halving rally at a higher profit margin to offset losses.

Exploring alternative revenue streams

The 2024 halving will put substantial pressure on miners and may lead to the closure of some mining operations. To mitigate the adverse effects, miners should explore alternative revenue streams.

One promising opportunity is Bitcoin Ordinals, a project driving transaction fees within the Bitcoin network to new highs. Ordinal "inscriptions" are unique assets attached to each satoshi, similar to nonfungible tokens (NFTs). Miners can benefit from the increasing demand for inscriptions, as it generates revenue from transactions.

By adopting these strategies and exploring new alternatives, miners can optimize their profitability and adapt to the post-halving landscape.

Note: This article is for general information purposes and is not intended as legal or investment advice. The views expressed here are the author's alone and may not reflect the opinions of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/philippine-sec-collaborates-with-us-and-asian-development-bank-to-crack-down-on-crypto-fraud