Peter Brandt, a popular veteran trader and CEO of proprietary trading firm Factor LLC, recently gave his thoughts on Goldman Sachs potentially restarting its cryptocurrency desk.

Us old-timers have learned that whenever @GoldmanSachs enters a market niche it is time to guard your money. $BTC pic.twitter.com/tHfRkS4igb

— Peter Brandt (@PeterLBrandt) March 1, 2021

On Dec. 21, 2017, a similar Bloomberg piece stated that Goldman Sachs would set up a cryptocurrency trading desk, although the bank was “still trying to work out security issues.”

Although Brandt’s chart seems significant, one needs to understand that such speculation had been ongoing for a couple of months. Wall Street Journal already covered Goldman Sachs’ intention to do this on Oct. 2, 2017.

Even if we disregard the exact date, Goldman Sachs apparently ditched those plans to launch its Bitcoin (BTC) trading desk. But, more importantly, there aren’t many similarities between the 2017 bull run and the current market in terms of their structure.

Take notice of how BTC volume soared from a $2 billion average daily volume in November 2017 to $14.6 billion by year-end, a seven-fold increase. The incoming retail demand was so impressive that it caused Binance, Bitfinex, and Bittrex exchanges to reject new users temporarily.

Binance accounts were even sold by users directly to other users at the time when no new sign-ups were being accepted. In other words, there is currently no retail frenzy in Bitcoin similar to what happened in late 2017. In fact, the current bull cycle appears to be driven by institutions that are seemingly scooping up BTC on every dip.

Meanwhile, the $66 billion daily average traded volume seen on Feb. 22, 2021, as Bitcoin's market capitalization peaked at $1.09 trillion, has been relatively flat for the previous six weeks.

Therefore, an experienced technical analyst such as Brandt should have added the caveat that volume is the most relevant market participation indicator (which he frequently emphasizes in his other analysis).

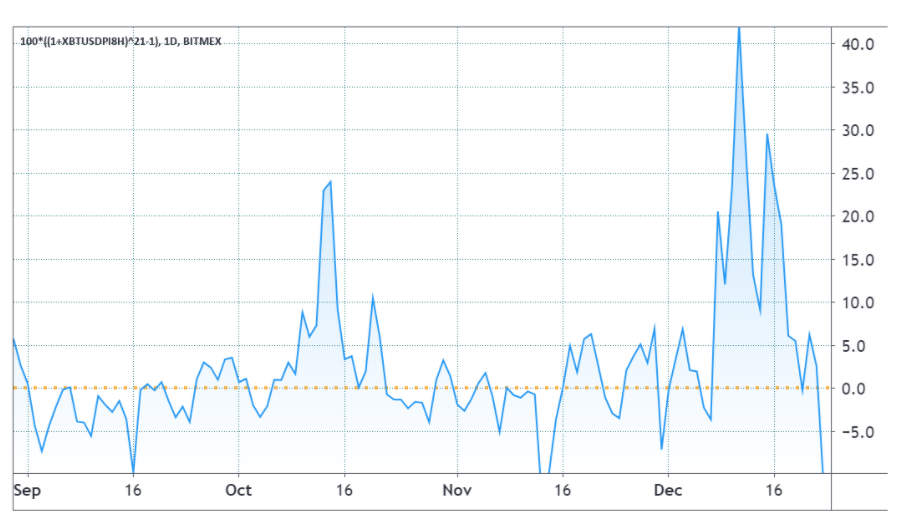

To settle this difference for good, one needs to understand the basics of futures markets. Derivatives exchanges charge either perpetual futures longs (buyers) or shorts (sellers) a fee every eight hours to keep a balanced risk exposure. This indicator, known as the funding rate, will turn positive when longs are the ones demanding more leverage.

As the above chart indicates, buyers were willing to pay up to 40% per week to leverage their long positions. This is entirely unsustainable and a sign of extreme optimism. Any market downturn would have caused cascading liquidations, with the BTC price accelerating to the downside.

Such exorbitant rates no longer exist, albeit the current 4% weekly funding rate has been the highest since June 2019. Nevertheless, scales of magnitude lower than late-2017 outrageous retail-driven long leverage frenzy.

Lastly, one should factor in that December 2017 marked the launch of CME and CBOE futures contracts. As Cointelegraph astutely put back then: “This unprecedented event could have a significant impact on the Bitcoin economy.” In retrospect, this seems to have been the peak euphoria signal the bears were waiting for. Thus, Goldman Sachs balking was likely the effect, not the cause.

But while Brandt has become well-known in the cryptocurrency space for anticipating the 80%+ correction after the 2017 Bitcoin price top, his track record has been less impressive in recent times.

So to sum up, there is zero evidence to support Peter Brandt’s theory besides a single event that happened once in the 11 years of Bitcoin trading. Not to mention that the 2017 Goldman Sachs cryptocurrency trading desk rumors had been going for a while.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: No, Goldman Sachs isn’t a bearish indicator for Bitcoin

Sourced From: cointelegraph.com/news/no-goldman-sachs-isn-t-a-bearish-indicator-for-bitcoin

Published Date: Tue, 02 Mar 2021 12:02:50 +0000