Multichain wallet Exodus has released its financial results for the second quarter of 2023, revealing a 4% decrease in revenue compared to the same period last year. The company generated a total revenue of $12.4 million, with a net income of $1.9 million.

Exchange aggregation business drives revenue

Exodus reported that its exchange aggregation business was responsible for the majority of its revenue in Q2, amounting to $11.6 million. Fiat onboarding revenue also saw a significant increase of 220% from 2022, reaching $561,000. However, the volume of exchange provider transactions in Q2 experienced a decline of 12% compared to Q2 2022, totaling $591.5 million. The top assets traded during the quarter were Bitcoin (BTC), Tether (USDT), and Ether (ETH), accounting for 27%, 16%, and 12% of the volume, respectively.

Decline in monthly active users

Despite the company's decrease in revenue, Exodus saw a 6% decline in monthly active users during the second quarter. The number of monthly active users dropped from 817,972 last year to 772,839 in Q2 2023.

Cost reductions contribute to positive results

Exodus was able to strengthen its financial results through cost reductions. The company reported a 6% decrease in expenses, amounting to $7.1 million in Q2. The reduction in headcount and cloud infrastructure expenditures were factors contributing to the lower expenses. In terms of headcount, the Exodus team decreased from 290 full-time equivalents in June 2022 to approximately 195 as of June 2023.

Administrative and marketing expenses cut by 65%

To cope with the challenges of the bear market, Exodus significantly slashed its administrative and marketing allocations by 65% in the second quarter. This resulted in expenses of $4 million. The total general and administrative expenses represented 32.2% of company revenue, a substantial decrease from 87.1% in the same quarter of 2022.

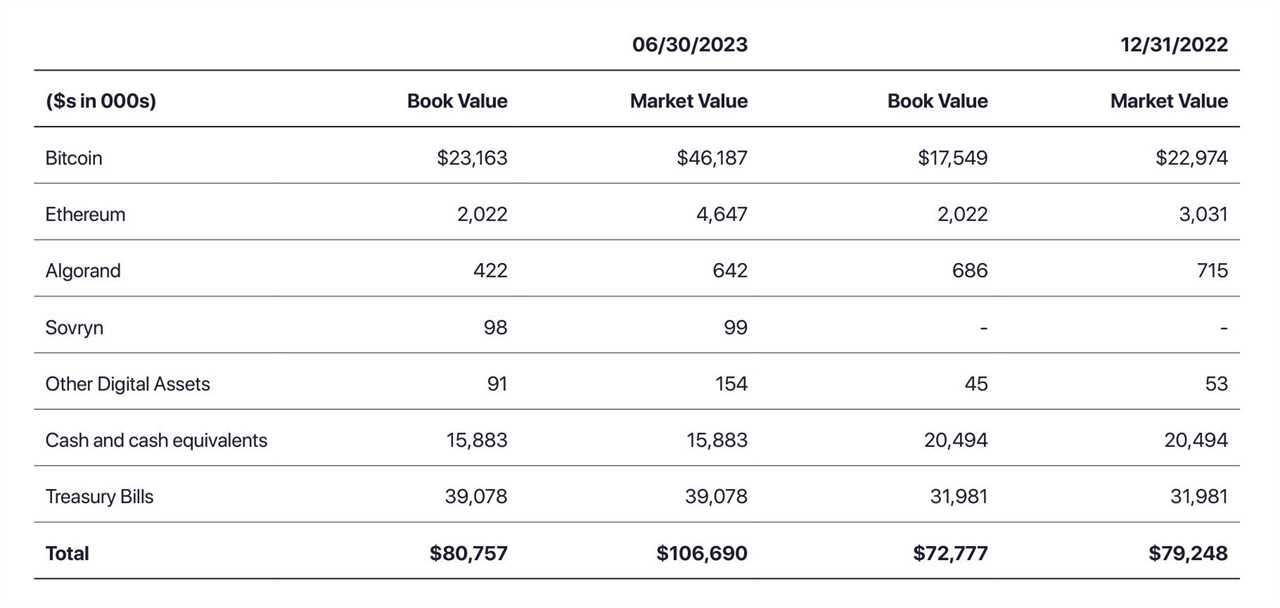

Strong treasury position

As of June 30, Exodus held $55 million in cash, cash equivalents, and U.S. Treasury Bills. In addition, the company reported holding $46.2 million worth of Bitcoin. Exodus claims to be one of the few public companies with over 1,000 Bitcoin in its corporate treasury.

New integrations and support

In the second quarter, Exodus made significant developments, including an integration with Robinhood Connect. This integration enables users to purchase and hold cryptocurrencies in Exodus through Robinhood's cash and buying power. Additionally, Exodus added full support for Arbitrum and Optimism, as well as Matic staking.

"Accordingly, the next step for Exodus is to provide our technology to other companies, often called Wallet-as-a-Service or Infrastructure-as-a-Service," said JP Richardson, CEO and co-founder of Exodus.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/frogthemed-memecoin-pepe-sees-15-price-drop-amid-fears-of-developer-rug-pull