Key Takeaways:

- Marathon Digital Holdings experienced a remarkable 670% year-on-year revenue gain in Q3 2023.

- Bitcoin production saw a nearly five-fold increase, contributing to the firm's financial success.

- Marathon's CEO attributes the positive results to progress made in strengthening the company's balance sheet.

- The firm plans to further increase its hashrate in the short to mid-term.

Bitcoin mining company Marathon Digital Holdings has announced an impressive 670% surge in revenue during the third quarter of 2023. This significant increase was largely driven by a nearly five-fold rise in Bitcoin production.

The firm's Q3 results filing revealed a quarterly profit of $64.1 million, showcasing its financial growth. Marathon Digital attributed this success to a 467% spike in Bitcoin production, with 37.9 BTC mined in Q3 2023 compared to 6.7 BTC in the same period last year. Additionally, Marathon's hashrate increased by 403% during this timeframe.

Marathon Digital's recent venture in Paraguay, a 27-megawatt hydro-powered mining facility, played a significant role in boosting its hashrate. This expansion, announced on November 8, has helped strengthen the company's balance sheet, according to Marathon's CEO and chairman Fred Thiel. Thiel also highlighted a successful note exchange in September that reduced the firm's long-term debt by 56%, resulting in over $100 million in cash savings for shareholders.

Looking ahead, Marathon Digital remains committed to increasing its hashrate in the short to mid-term. The company's current installed hashrate is 23.1 exahashes per second, and it aims to boost it to 26 EH/s and further increase by 30% in 2024.

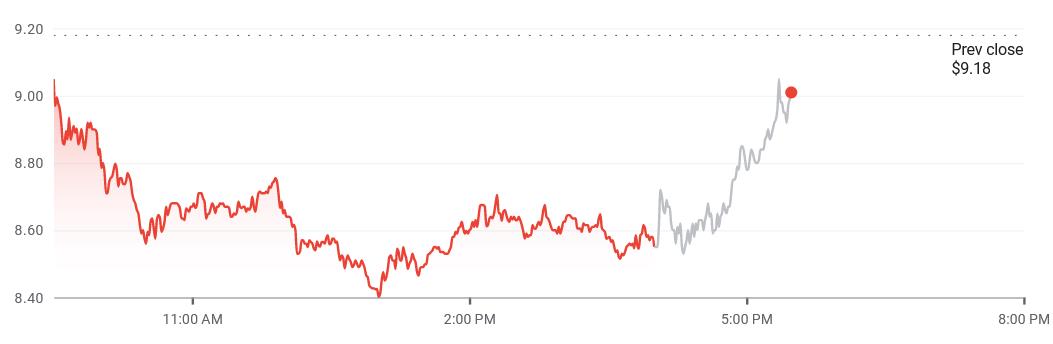

Following the release of Marathon's earnings statement, the company's share price initially dropped by 6.9% on November 8. However, it later rebounded by 4.3% in after-hours trading, according to Google Finance.