Bitcoin's (BTC) severe 26% drop from its $58,300 all-time high on Feb. 20 injected a bit of bearishness into the market but from a technical perspective, this was purely psychological as the digital asset held the $43,000 support with ease. This downside move caused indicators like the Crypto Fear & Greed Index to hit 38, its lowest level in five months.

Even though a $15,400 downside move might seem unusual, 25% and even larger corrections have happened on six separate occasions during the 2017 bull run. Moreover, when BTC first made an all-time high at $42,000 on Jan. 8, a 31.5% negative swing to $28,750 happened in the following two weeks.

As Bitcoin tried to establish a bottom, derivatives contracts eliminated any bullish signal and momentarily displayed worrisome data. For example, the open interest on futures dropped 22% after peaking at $19.1 billion on Feb. 21.

As depicted above, considering the end-of-month expiry impact, BTC futures open interest fell by 22%. Albeit significant, the remaining $14.9 billion is still 44% above the previous month's data.

Derivatives indicators held steady, indicating a healthy market

By measuring the futures contracts premium to the current spot levels, one can infer whether professional traders are leaning bullish or bearish. Typically, markets should display a slightly positive annualized rate, a situation known as contango.

Although the 1-month futures contracts premium toned down from the ultra-bullish 6% rate seen mid-February, it did manage to sustain levels above 1.2%. The annualized equivalent is a 70% peak compared to the current 17% rate. Therefore, the futures contract premium indicates that any excessive leverage from buyers has been eliminated, but we are nowhere near a bear market.

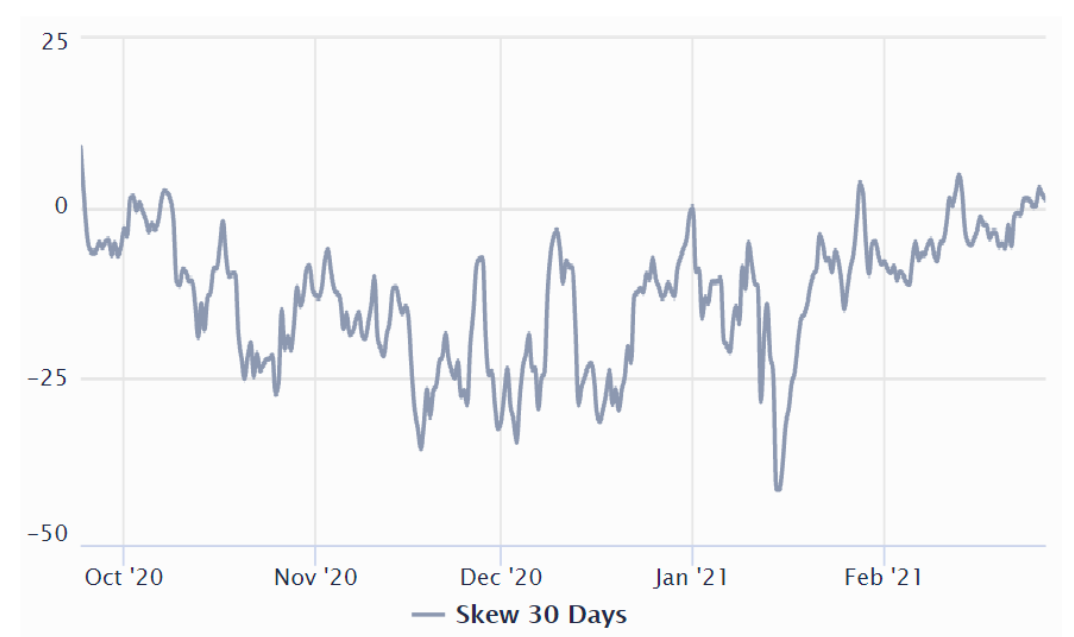

Meanwhile, the BTC option markets the 25% delta skew measures how the neutral-to-bullish calls are priced than equivalent bearish puts.

The indicator acts as an options traders' fear and greed gauge and was sitting at negative 5% until Feb. 21, meaning protection to the upside was more expensive. Over the past week, the 25% delta skew moved to a neutral zone that was last seen almost five months ago.

This further confirms the absence of desperation from market makers and top traders while shredding signs of the excessive optimism seen in January.

The absence of bearishness during a crash is a good signal

As institutional investors continue to flock to the space, Bitcoin’s volatility tends to have a lessened impact on derivatives markets. To illustrate this new situation, both BTC futures and options markets indicators were far from flashing any red flags despite the 26% price drop.

Bitcoin's positive newsflow and institutional investors interest is likely unharmed after the most recent retest of $43,000. Thus, as companies and mutual funds accumulate Bitcoin, instead framing dips as catastrophic, these moves should be interpreted as buying opportunities.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: Key Bitcoin price indicators signal bulls bought the $43K restest

Sourced From: cointelegraph.com/news/key-bitcoin-price-indicators-signal-bulls-bought-the-43k-restest

Published Date: Mon, 01 Mar 2021 21:08:20 +0000