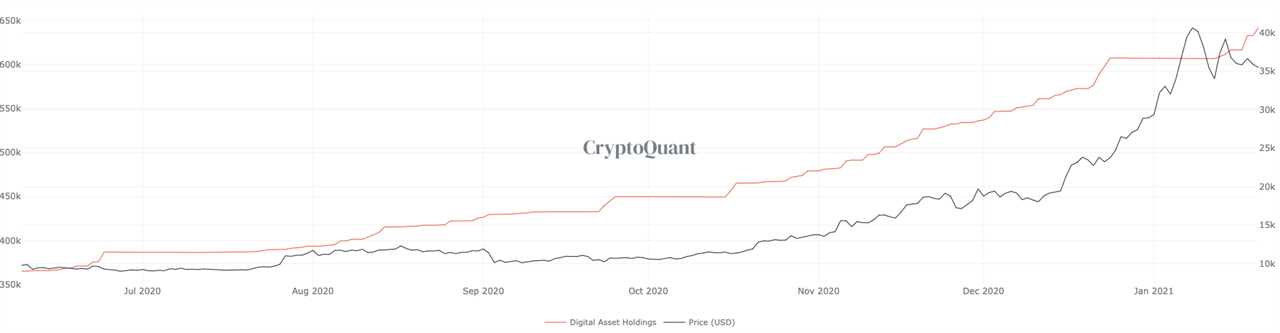

Bitcoin (BTC) has seen a massive surge in the past two months, in particular, as institutions jumped into the new asset class. The latest is Blackrock, announcing interest in trading in Bitcoin futures while Grayscale continues to scoop up BTC at an accelerating pace.

However, after a massive surge, the asset’s price has to come down for some tests of support as investors take profit. This is the beautiful cyclical nature of supply and demand.

BTC/USD is currently in a corrective phase since Bitcoin’s rally became overextended above $40,000. The primary question is how far the correction will go from here or whether the $30,000 level will be strong enough to fend off the bears.

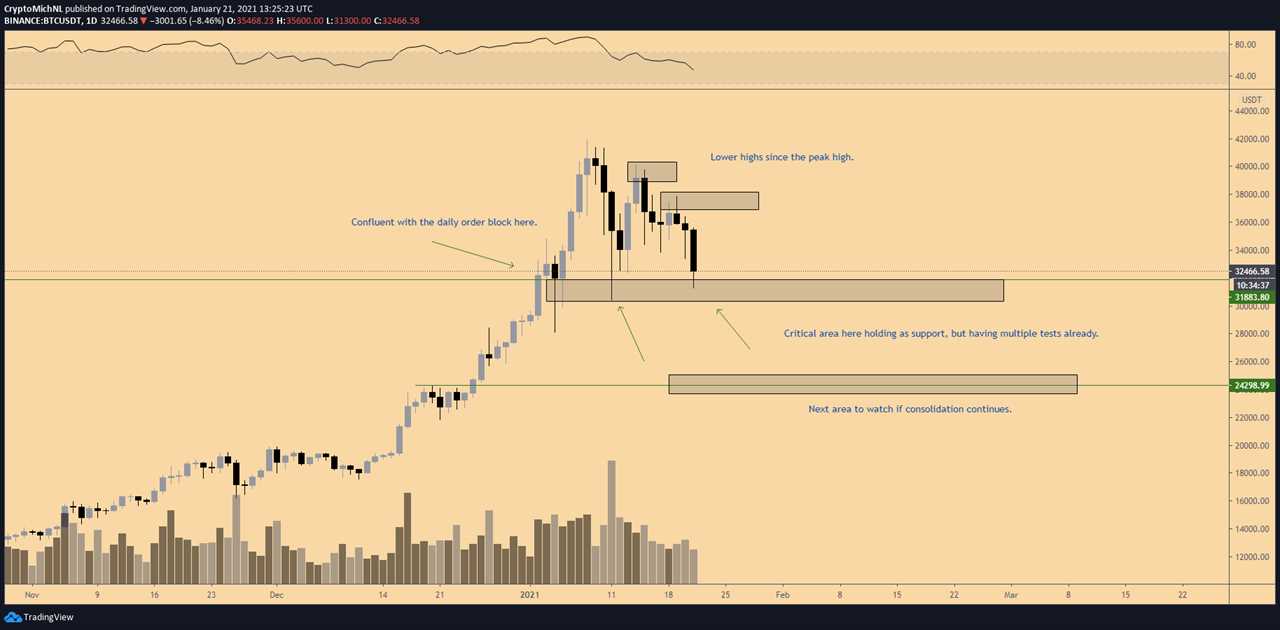

$30,000 must hold to stay bullish

The daily chart for Bitcoin shows a tremendous rally in recent months. However, some weaknesses are emerging since the recent high, after which the price corrected by roughly 30%.

One of these weaknesses is the continuing lower highs since the recent peak high at $42,000. These lower highs are confluent with weaker bounces from the support area.

In this case, the $30,000 area has held before. However, to the concern of the bulls, the bounces from this area are getting weaker.

If the $30,000 area doesn’t hold, a further correction toward $24,000 becomes likely, which would mean a retrace of 40% since the recent highs.

Corrections are quite common in a bull market

This weekly chart shows the previous bull cycle from 2015 to 2017 highlighting some corrective phases.

First and foremost, the 21-week MA (the orange line) is an important indicator for the bull cycle to continue. As long as the price of Bitcoin sustains above this 21-Week MA, the bull cycle is ongoing.

Traders and investors should be aware of the fact that nothing goes up in a straight line. Corrections are healthy and organic for the markets to occur and could be used as an opportunity to buy the dip.

The second important thing to note in this chart is the magnitude of the corrections. During the previous bull cycle, there were multiple corrections of 30-40%that were quickly bought up before the bull cycle continued.

It is worth noting that altcoins could see more downside as they are less liquid and hence, always more volatile than Bitcoin.

Therefore, the ultimate end of the correction could occur toward the 21-week MA. This indicator is currently moving around the previous all-time high at $20,000. However, it’s a lagging indicator, and corrections don’t happen within one week, meaning the 21-week MA would continue to go even higher in the meantime.

One possible scenario is the 21-week MA moving around the $24,000-26,000 in a few weeks from now. Such a correction would also be 30-40%.

Total market cap may retest previous all-time high

The total market capitalization chart is a great chart to watch during corrections.

While the likelihood that Bitcoin will retest its previous all-time high is very small. However, the likelihood that the total market capitalization will test its previous all-time high is significant.

This retest would put the 21-week MA of the total market cap chart around the level of $750 billion, an important confluence with the 2018 all-time high. Therefore, investors and traders should be watching the $750 billion zone as crucial support for a potential bounce in the cryptocurrency market.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: Is Bitcoin headed for a deeper correction? Watch these levels if $30K breaks

Sourced From: cointelegraph.com/news/is-bitcoin-headed-for-a-deeper-correction-watch-these-levels-if-30k-breaks

Published Date: Thu, 21 Jan 2021 14:30:00 +0000