The CTO of crypto market data aggregator Glassnode, Rafael Schultze-Kraft, has described a slew of Bitcoin market indicators as “insanely bullish” and predicted prices are set to increase by more than 10 times.

On Dec. 9, Schulze-Kraft tweeted a thread providing the basis for his ultra-optimistic prediction, presenting six “of the most important on-chain market indicators that are currently hovering at the same levels they were at the start of 2017.”

1/ Where are we in the #Bitcoin market cycle?

— Rafael Schultze-Kraft (@n3ocortex) December 8, 2020

A look at some of the most important on-chain market indicators.

TLDR: Insanely bullish, most metrics are far from the top. If things develop anything like 2017, we could see more than 10x $BTC from here.

A THREAD pic.twitter.com/d1jU0h5fxA

Each of Schulze-Kraft’s predictions (or estimates) see Bitcoin breaking into six-figures, with all but one suggesting that BTC will exceed $200,000

For each of the indicators, Schultze-Kraft measured the gains produced when the metric moved from a similar position in 2017 until it posted an all-time high later that year. He then multiplied Bitcoin’s current price by the same percentage increase.

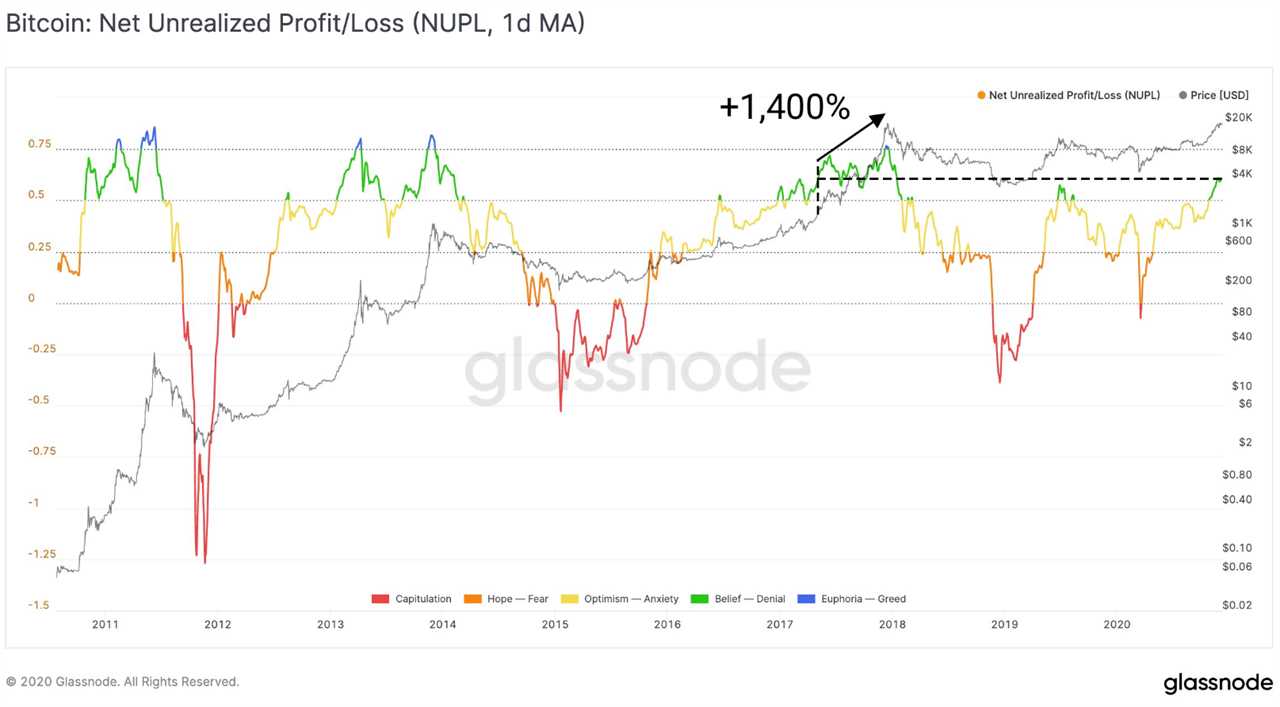

Schultze-Kraft noted that Bitcoin’s Net Unrealized Profit/Loss, or NUPL — “the difference between unrealized gains and losses based on when coins last moved on chain” — has climbed back up to 78% of its 2017 ATH.

Bitcoin’s price gained 1,400% to its peak, as NUPL ascended from a similar level to where it is today, in early 2017. If the same scenario played out, Kraft estimates that Bitcoin’s price could reach $286,000 this cycle.

BTC’s Market Cap to Thermocap ratio — which assesses Bitcoin’s price premium relative to miner expenditure — is currently sitting at just one-quarter of its 2017 high. In 2017, Bitcoin’s price gained 625% as the metric rose to its all-time highs, suggesting BTC could tag $138,000 in future.

Bitcoin’s MVRV Z-Score — which seeks to identify when Bitcoin is “over/undervalued relative to its "fair value’” — currently sits at 34% of its 2017 top, the ascent to which accompanied a 1,150% price gain. Should BTC rally with the same strength as in 2017, Kraft-Schulze estimates Bitcoin will be worth $240,000 each.

Kraft-Shulze identified that metrics looking at longer-term hodler behavior suggested even higher price targets.

Long-Term Holder MVRV, which is the average profit or loss of all BTC currently circulating, and Long-Term Holder SOPR — which is Bitcoin’s overall profit and loss according to when each coin last moved on-chain — are each sitting at just 13% of their record highs. With the price of Bitcoin having gained 1,340% and 1,620% alongside these metrics in 2017, Kraft-Schulze predicts crypto could tag $274,000 or $328,000 in future.

Reverse risk — which is used to “assess the confidence of long-term holders relative to [Bitcoin’s] price” — also suggests coming price highs of $240,000, with the metric currently at only 11% of its former high.

However, Kraft-Schulze urged his followers to “take these numbers with a grain of salt.”

“What this aims to show: These #BTC cycle indicators are still far away from their values that indicated a $BTC top in 2017.”

Glassnode’s Dec. 8 weekly on-chain data report found that Bitcoin is likely to retrace before rallying into new all-time highs as investors look to realize profits made during the run-up to the recent retest of $20,000, stating:

“Sideways or downwards price movement can be expected as they realize these profits.”

Despite warning of bearish pressure from short-term profit-takers, the report concludes that Bitcoin’s long-term outlook is bullish.

Title: ‘Insanely bullish’: Glassnode CTO predicts BTC price will 10X from here

Sourced From: cointelegraph.com/news/insanely-bullish-glassnode-cto-predicts-btc-price-will-10x-from-here

Published Date: Fri, 11 Dec 2020 04:20:30 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/theta-network-enhancements-usher-in-smart-contract-capabilities-